E&P | NGI All News Access | NGI The Weekly Gas Market Report

EIA Sees Natural Gas Consumption Slightly Higher, 2014 Prices Lower

Colder winter temperatures late this year and into early 2014, versus record warm temperatures in 2012, will increase the amount of natural gas used for residential and commercial space heating, the U.S. Energy Information Administration (EIA) said Tuesday in the latest Short-Term Energy Report (STEO).

Domestic gas consumption should average 70.7 Bcf/d this year, up from 69.6 Bcf/d in 2012. Gas consumption in 2014 should be flat overall from 2012.

“However, the projected year-over-year increases in natural gas prices contribute to declines in natural gas used for electric power generation from 24.9 Bcf/d in 2012 to 22.3 Bcf/d in 2013 and 22.1 Bcf/d in 2014,” the STEO said.

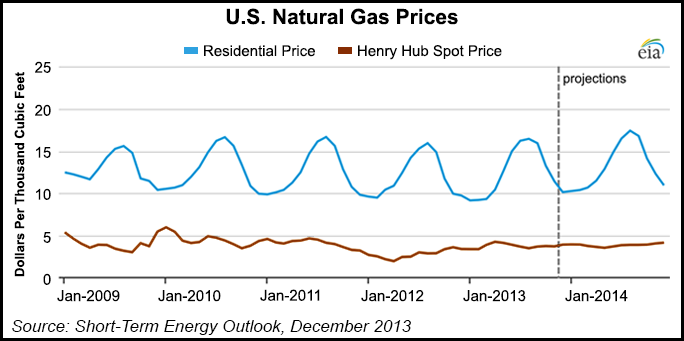

Henry Hub gas price averaged $3.64/MMBtu in November, down 4 cents from October. End-of-month wintry conditions, however, has sent prices soaring.

“Despite an overall month-over-month decline, prices in the final days of November rose above $3.80/MMBtu in response to colder weather,” said the report. Prices now are expected to average $3.69/MMBtu for the year, compared with $2.75 in 2012. The annual average for 2014 is forecast at $3.78, lower than the forecast a month ago.

In the November STEO, EIA called for Henry Hub prices to increase on average to $3.68/MMBtu this year and $3.84/MMBtu in 2014 (see Daily GPI, Nov. 13).

Gas futures priced for March 2014 delivery for the five-day period ending Dec. 5 averaged $3.98, according to EIA.

“Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for March 2014 contracts at $3.01/MMBtu and $5.26/MMBtu, respectively. At this time a year ago, the natural gas futures contract for March 2013 averaged $3.62/MMBtu, and the corresponding lower and upper limits of the 95% confidence interval were $2.62/MMBtu and $5.00/MMBtu.”

Working gas inventories at the end of November were estimated at 3.61 Tcf, 0.19 Tcf below the level at the same time in 2012 and 0.11 Tcf below the five-year average.

In the Monthly Natural Gas Gross Production Report issued on Monday, EIA said total domestic gas production in September was 82.16 Bcf/d, compared to 81.95 Bcf/d in August and 80.34 Bcf/d in September 2012 (see Daily GPI, Dec. 9). The biggest gains have been in the Appalachian Basin, where Marcellus Shale producers continue to break production records.

“This additional supply has encouraged greater use of natural gas in the Northeast, especially for power generation, and has also reduced net inflows of natural gas into the region from other regions such as the Gulf of Mexico, the Midwest, and eastern Canada,” the STEO said. “Both of the Northeast’s regional transmission organizations, the Independent System Operator of New England (ISO-NE) and the New York Independent System Operator (NYISO), have seen a dramatic shift since 2001 away from petroleum- and coal-fired generation to predominantly natural gas-fired output in 2012 and 2013.”

Gas pipeline gross imports, which have fallen over the past five years, are projected to fall by 0.5 Bcf/d in 2013 and remain flat in 2014, according to the STEO. Liquefied natural gas imports should remain “at minimal levels of around 0.3 Bcf/d in 2013 and 0.2 Bcf/d 2014.”

Gas working inventories fell by 162 Bcf to 3,614 Bcf during the week ending Nov. 29, “the largest weekly net withdrawal for the month of November since publication of weekly storage data began in 1994,” the STEO said.

“Colder-than-normal temperatures during the week resulted in increased heating demand, prompting larger-than-normal withdrawals in all three regions, including a particularly large withdrawal in the Producing Region. Stocks are now 200 Bcf less than year-ago levels and 104 Bcf less than the five-year average.”

Estimated U.S. crude oil production averaged 8.0 million b/d in November, the highest monthly level since November 1988. Officials expect domestic crude output will average 7.5 million b/d in 2013 and 8.5 million b/d in 2014.

The discount of the West Texas Intermediate (WTI) crude oil spot price to Brent, which averaged more than $20/bbl in February and fell below $4.00/bbl in July, recovered to an average of $9.00/bbl in October and $14.00/bbl in November, the STEO said.

“In addition, the spot discount of Light Louisiana Sweet (LLS), a key Gulf Coast light sweet crude oil, to Brent increased from an average of $3.00/bbl in September to almost $11.00/bbl in November.

“The opening of a large LLS discount to Brent and the increasing convergence of LLS and WTI prices result from pipeline expansions and reversals that have reduced bottlenecks in the Midcontinent, continuing growth in domestic light oil production, and a seasonal decline in crude oil runs at U.S. Gulf Coast refineries.”

The WTI discount to Brent is forecast to average $12.00/bbl in 4Q2013 and $9.00/bbl in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |