E&P | NGI All News Access | Permian Basin

QEP Buying in Permian in Ongoing Oil/Liquids Pursuit

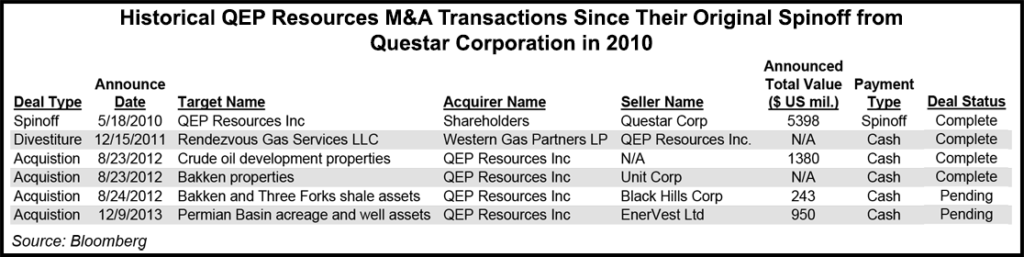

QEP Resources Inc. subsidiary QEP Energy Co. is acquiring oil and gas properties in the Permian Basin for $950 million from EnerVest Ltd. and plans to sell noncore Midcontinent assets as it becomes more oil- and natural gas liquids-focused, the company said Monday.

The acquired properties, which give QEP “entry into a world-class light oil play” are in the Midland sub-basin, primarily in the West Texas counties of Martin and Andrews, which have been among the state’s top oil-producing counties (see Shale Daily, Oct. 31). The company is paying less than four times estimated 2015 adjusted earnings before interest, taxes, depreciation and amortization, QEP said.

“This acquisition is part of our continuing strategy to become more focused on crude oil and natural gas liquids,” said QEP CEO Chuck Stanley. “Our new ventures team has been actively focused on expanding our footprint in the world-class crude oil provinces of North America, first in the Williston Basin and now in the Permian Basin.

“We have evaluated numerous potential opportunities in the Permian, but until now, none have met our acquisition criteria. This acquisition allows us to leverage our competitive strength of drilling horizontal development wells in multi-pay, stacked reservoirs, and provides a 10-year inventory of crude oil drilling locations.”

During a conference call Monday to discuss the transaction, Stanley said the company’s business development and new ventures staff have been scouting deals in the Permian but until this one had not found one large enough to give QEP a decent foothold in the play. Stanley said there would likely be bolt-on acquisitions in the future but did not provide further details.

QEP is acquiring 26,519 net acres with an average working interest of 94%, a 75% net revenue interest and 264 vertical producing wells with nearby horizontal activity by industry peers. Current net production from the acquired properties is 6,700 boe/d, of which 68% is crude oil. Net proved reserves are estimated to be 47 million boe. Estimated net recoverable resources are 300 million boe. According to QEP, there are nine potential horizontal development targets over a 3,000 foot vertical section. There is the potential for more than 200 vertical and up to 775 horizontal drilling locations, QEP said.

Stanley told analysts the company plans to grow production from the acquired assets by 400% to more than 33,000 boe/d by 2018.

The Permian Basin has been a prime destination for E&P companies seeking wetter production as natural gas prices remain unattractive relative to those for oil. Last month, Tudor, Pickering, Holt & Co. said nearly 100 additional rigs will be moved to the U.S. onshore through 2014, with about half directed at the Permian (see Shale Daily, Nov. 19). As the march to the Permian continues, a midstream buildout is also under way (see Shale Daily, Dec. 2).

The acquisition will be funded with QEP’s revolving credit facility and cash with closing expected by the end of January. An “aggressive derivatives program” will put a floor under the value of the transaction, Stanley said.

QEP also said Monday that it expects to sell non-core E&P assets in the Midcontinent during the first half of 2014. These sales will be in the Granite Wash and/or Cana Woodford. Stanley declined when asked to say how much the sales might fetch.

Pro forma for these transactions, QEP spending will be focused on the oil-rich Williston and Permian basins, and the company’s liquids-rich gas assets in the Pinedale Anticline and the Lower Mesaverde play in the Uinta Basin. The company also has “dry gas optionality” in the Haynesville Shale for when natural gas prices improve.

“Along with the planned separation of QEP Field Services Co. [see Daily GPI, Dec. 2], the acquisition and the anticipated asset sales will continue the company’s transformation into a liquids-focused, pure-play E&P company with assets located in premier basins across North America,” Stanley said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |