ConocoPhillips to Direct Most 2014 Spending to North America

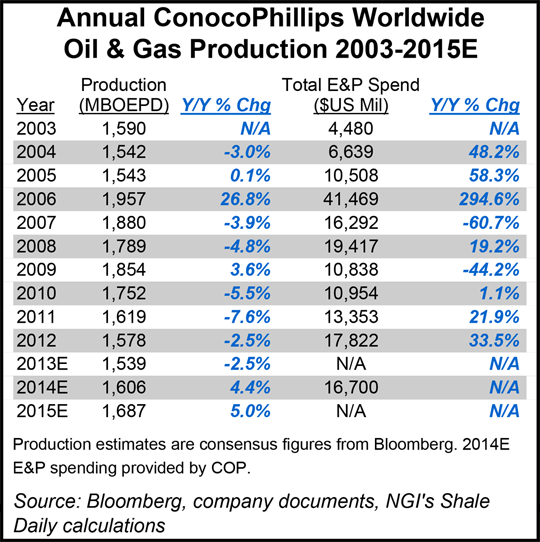

ConocoPhillips, the largest U.S. exploration and production (E&P) operator, plans to spend $16.7 billion for its operations in 2014, with more than half of the investments (55%) allocated to North America, and in particular, the Eagle Ford and Bakken shales, and the Permian Basin.

“Increased exploration and appraisal activity” is planned in several North American unconventional plays next year, including the Permian Basin, Niobrara formation and the Duvernay plan in Canada.

More capital also is slated for Alaska operations compared with 2013 to reflect “higher activity resulting from improved fiscal terms from the passage of the More Alaska Production Act (SB 21)” (see Daily GPI,April 16). It also plans to ramp up operated conventional exploration drilling programs in the deepwater Gulf of Mexico (GOM) and overseas.

The Houston-based explorer said it’s on track to achieve annual average production in 2014 of about 1.6 million boe/d, with growth in the Lower 48 states and Canada.

“2014 is an important year for ConocoPhillips,” said CEO Ryan Lance. “Since becoming an independent E&P company, we have set out to deliver a unique value proposition of 3-5% volume and margin growth with a compelling dividend.”

Since the beginning of 2012, the company has sold more than $12 billion of noncore assets, Lance said.

Next year’s capital budget includes funding for base maintenance, development drilling programs, major projects, and exploration and appraisal spending, as well as corporate expenditures.

About 39% of the budget would be for “high-margin” drilling programs, with nearly all of the money targeted for North America. Those development programs “should account for 600,000 boe/d of production by 2017,” which would offset normal field declines from producing assets.

“Approximately two-thirds of development drilling program funds will be spent in the Lower 48, primarily targeting development in the liquids-rich, unconventional plays in the Eagle Ford, Bakken and Niobrara, as well as conventional and unconventional plays in the Permian. The remaining one-third is targeted toward other conventional and unconventional opportunities, mainly in Alaska, Canada, Norway and Western Australia.

Canadian activity is centered around oilsands growth at Surmont Phase 2, with first production expected in 2015. Expansions also are planned at Foster Creek and Christina Lake.

About 13% of the 2014 capital budget would be set aside for exploration and appraisal program, with 60% of the amount targeting conventional exploration and 50% unconventional opportunities. More details on the 2014 outlook are planned to be released during the 4Q2013 earnings conference call scheduled for Jan. 30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |