NGI Archives | NGI All News Access

Plump Gains Characterize Short Trading Week

The NGI weekly spot gas average posted a stellar overall 24 cent gain to $3.93 for trading Nov. 25 and Nov. 26. All locations posted double-digit gains with the exception of three points on Iroquois Pipeline, which each shed less than a dime. Regionally the Northeast was a land of extremes tallying the week’s biggest winners and losers. Of the actively traded points Algonquin Citygates made it to the top adding 88 cents to $7.84 and deliveries to Iroquois Zone 2 eased 9 cents to $4.58. Regionally the Northeast outdistanced all section of the country with a 34 cent rise. California trailed the pack with “only” an 18 cent gain.

With many regions of the country receiving their first real doses of winter temperatures, cash prices were buoyed. South Texas and South Louisiana both rose 19 cents to $3.77 and $3.82, respectively, and the Midwest was up 22 cents to $3.98.

Rocky Mountain points added 23 cents to $3.83 and East Texas gained 24 cents to $3.83 as well. The Midcontinent rose 29 cents to $3.86.

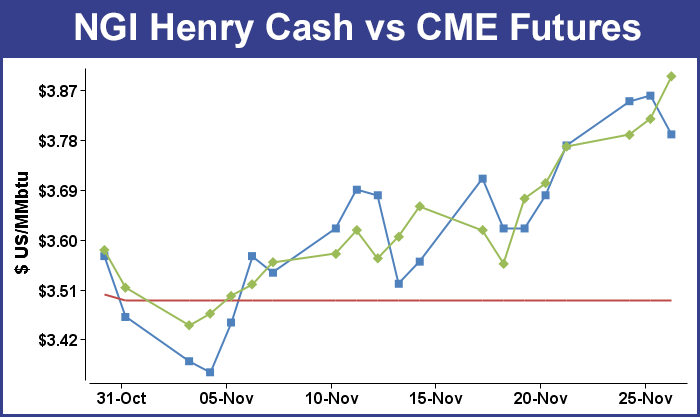

For the short trading week, January futures rose 5.3 cents to $3.895.

Traders Wednesday were treated to a surprise in the form of the market’s reaction to the weekly Energy Information Administration (EIA) storage report. The EIA reported a withdrawal of 13 Bcf for the week ending Nov. 22, about what traders were expecting, but prices advanced nonetheless. At the close of trading January had risen 3.1 cents to $3.895.

“I don’t know why the market rallied off the number. It was -13 and the market was looking for -12,” said a New York floor trader. “A difference of 1 Bcf makes the market move?” he queried. “It wasn’t really a bullish number.”

Tim Evans of Citi Futures Perspective viewed the report as “constructive” and “a larger draw than it might have been and no offset to the larger net withdrawals anticipated for the weeks ahead as colder temperatures boost heating demand.”

While coming in smaller than the five-year average withdrawal of 15 Bcf, the actual 13 Bcf decline was much larger than last year’s date-adjusted 2 Bcf withdrawal.

Inventories now stand at 3,776 Bcf and are 100 Bcf less than last year and 17 Bcf above the five-year average. In the East Region 14 Bcf was withdrawn and in the West Region 6 Bcf was pulled. Inventories in the Producing Region rose by 7 Bcf.

Recent gains notwithstanding, futures traders Wednesday were not convinced that the market can hold $4. “As long as this dynamic of y over y deficit contraction continues, a significant or sustainable price selloff could prove elusive,” said Jim Ritterbusch of Ritterbusch and Associates. “Nonetheless, we see the market beginning to approach the red zone on the upside as we are having difficulty constructing a sustainable $4 pricing environment within the newly prompt January contract.”

In Tuesday’s trading gas for Wednesday delivery on average fell a penny. However, if one is willing to assume that market dynamics in the transportation-challenged Iroquois-Algonquin corridor distort the broader national market, removing those prices shows a 6-cent decline overall.

Prices at eastern locations hammered out some double-digit gains, but in the Great Lakes and Upper Midwest prices were off anywhere from a nickel to a dime or more. Gulf points were generally lower by a few pennies, but Rockies prices were off by double digits. At the close of futures trading, December expired 2.9 cents higher at $3.818 and January had risen 2.2 cents to $3.864.

Gas prices at Northeast locations posted dollar-plus gains in spite of forecasts calling for 60 degree readings. AccuWeather.com forecast that Tuesday’s high in Boston of 43 would jump to 64 Wednesday but quickly subside to 35 on Thursday and Friday. The seasonal high in Boston is 48. New York City’s 41 high Tuesday was expected to jump to 60 Wednesday and drop to 34 Thursday and 35 Friday. The normal late-November high in New York is 49.

The National Weather Service in New York City predicted an active weather pattern for the next several days. “[L]ow pressure over the Southeast states late this afternoon [Tuesday] will intensify and move up the coast tonight…passing over the area on Wednesday and then heading into eastern Canada Wednesday night. High pressure will then build in from Thursday through Saturday…and move off the New England coast on Sunday. A coastal front will develop on Sunday and remain into Monday. Low pressure will develop on the front and move along the coast on Tuesday.”

In spite of warm temperatures, transportation in the area remained tight. According to Genscape, “AGT [Algonquin Gas Transmission] has restricted interruptible and 100% of secondary out-of-path nominations that exceed entitlements sourced upstream of its Stony Point Compressor Station for delivery downstream of Stony Point, [the] Cromwell Compressor Station for delivery to points east of Cromwell, and Southeast Compressor Station for delivery to points east of Southeast.”

Deliveries to Algonquin Citygates soared $3.50 to $9.59, and at Iroquois Waddington next-day gas rose 44 cents to $4.65. Gas on Tennessee Zone 6 200 L vaulted $2.50 to $8.44.

On Dominion, gas for Wednesday fell 4 cents to $3.48, and deliveries to Transco Leidy added 7 cents to $3.38. On Tetco M-3 gas for Wednesday delivery jumped 24 cents to $4.12, and gas bound for New York City on Transco Zone 6 added 47 cents to $4.53.

Midwest marketers had to pay up to get clients’ storage ready. “Looking forward, December is looking cold and we had to pay on Consumers what the daily index is coming in at, $3.95 and $3.96,” said a Michigan buyer.

The buyer said his firm hadn’t withdrawn any gas from storage for clients in November thinking “it could get worse.”

Gas for Wednesday on Alliance fell 11 cents to $3.89, and at the Chicago Citygates gas was quoted at $3.95, down 12 cents. On Consumers, gas was seen at $3.92, down 6 cents, and on Michcon Wednesday packages came in at $3.90, down 3 cents. Gas at Dawn changed hands at $3.99, unchanged.

Weather bulls can look forward to some frosty temperatures longer term. In its Tuesday morning 11- to 15-day forecast, WSI Corp. of Andover, MA, predicted a massive infusion of colder than normal temperatures extending from Oregon to South Texas to New York state. “Temperatures have trended colder over the interior Northwest and Plains, yet warmer over the East and Southwest when compared to the previous forecast,” it said.

“Confidence is considered above average standards as models show excellent large-scale agreement through the end of the period. Risk is to the warmer side over the East and CAISO [California], whereas cold risks continue to be locked in over the Northwest, Rockies and Plains under a highly anomalous arctic air mass.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |