Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota Bakken Oil Price Point May Be Coming

Ultimately the market will decide, but some industry stakeholders in North Dakota think the time may be fast approaching for the establishment of a Bakken crude oil price point, according to recent testimony to a state interim legislative committee examining the state’s energy future.

While winning a contract with state lawmakers to study North Dakota’s future energy development Niles Hushka, CEO of a Bismarck-based engineering and planning company, predicted that the state will become a crude oil hub at a location called Johnsons Corner in northeast McKenzie County in the heart of the Bakken-Three Forks Shale play.

Hushka made the comments Oct. 31 as he was presenting his company’s bid for a contract it eventually won from the state legislature’s Interim Energy Development and Transmission Committee. His firm, Kadrmas Lee & Jackson, is going to focus on industry practices, production estimates and various impacts on energy growth and production in the state, which now is the second-biggest U.S. oil producer.

North Dakota Petroleum Council President Ron Ness told NGI’s Shale Daily that while there hasn’t been a clear Bakken brand price posting in the past, there is starting to be signs this is going to happen, beyond the prediction of Hushka.

“It is a big enough market of equally valued barrels now that it could develop its own posting,” Ness said. “I think the time is right for the Bakken to have its own posting, but essentially that comes from one of the brokerage houses or the traders themselves when they begin buying and selling contracts on the Bakken barrels and not [the commonly used] WTI.

“It is a function of how the buyers and the traders choose to brand that barrel they are buying/selling. It would be the average price of a barrel of Bakken crude for a given day.”

Johnsons Corner is near the intersection of two major state highways, 13 miles east of Watford City, and is a terminal and storage center with a number of crude oil pipelines. Some of the pipelines have access to rail facilities. Thus, the crude can head to all three coasts and the Midcontinent markets from this area.

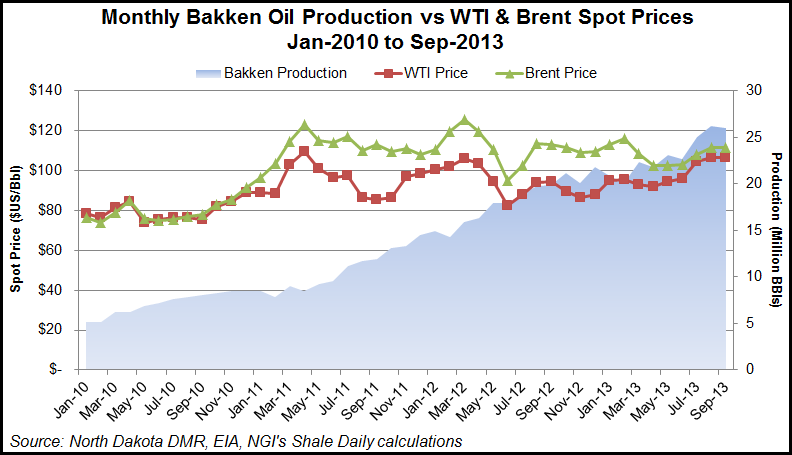

As Bakken production nears 1 million b/d (see Shale Daily,Oct. 1), Hushka said when the state can demonstrate it can sustain that level and above of production, he believes that the Bakken will begin to be traded as its own index.

Hushka thinks that Bakken crude will not continue to be sold at a discount at Midcontinent markets, but instead should be trading about 6-8% above Brent prices because of its quality. He think the lighter, lower sulfur Bakken crude supplies are superior.

“If it historically follows the original model, we’ll see Bakken traded on its own.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |