NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

More E&Ps Expected to Go Public in 2014

After the immense success of Denver-based Antero Resources’ initial public offering (IPO) in October, and with impressive well results in the Appalachian and Permian Basins continuing to stoke the equity market’s interest in the exploration and production sector, analysts expect more IPOs from small independents in the year ahead.

A large part of the focus is on those companies operating in the Utica Shale and Permian Basin, wrote Gabriele Sorbara, an energy analyst at Topeka Capital Markets, in a research note to investors released Monday.

Between 2012 and 2013, Antero became a pure-play operator in Appalachia, with about 329,000 net acres in the Marcellus, 102,000 in the Utica and about 170,000 in the Upper Devonian. With its output up in those plays and its solid core acreage position in the region, investors sent the stock soaring in its first day of trading, gaining 18% that day and trading between $54.38 and $55.68 since the IPO on Oct. 10 — well above the range of $38-$42 the stock launched at (see Daily GPI, Oct. 11).

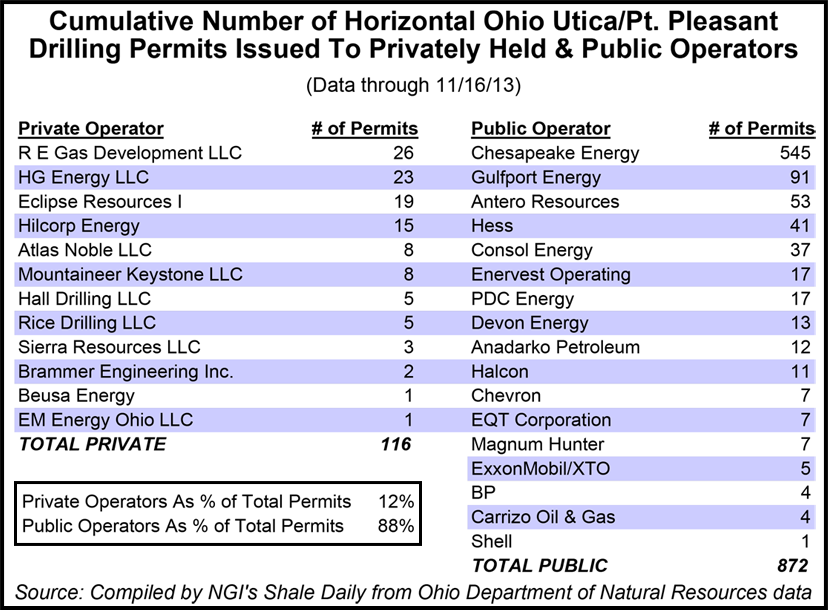

Sorbara believes Eclipse Resources and Rice Energy could be the next to go public, given their core acreage in the Utica. He estimates that Eclipse holds about 90,000 net acres in Ohio, where state records show the company holds 19 permits and has three wells drilled. What’s more, Eclipse has a position in Harrison and Monroe counties — an area of intense speculation where operators believe they’ve found the play’s sweet spot.

Though little is known about the overall value of the State College, PA.-based company or what kind of debt it has on its books, the outlook improved for Eclipse in June, when it acquired the Oxford Oil Co., which had 13.8 Bcfe of proved and developing reserves across 184,000 net acres in Ohio at the time of the acquisition.

Rough estimates for constructing and completing a well in the Utica and Marcellus shale formations have been widely pegged at between $8 million and $12 million. The cost for a drilling program in the plays could easily reach billions of dollars and operators will increasingly need more capital if they expect to build their programs in the basin.

“These are capital-intensive projects that require a lot of financing in the long run,” Sorbara said. “These companies have to tap the equity markets because they just can’t raise that kind of money as a private company. Eclipse and Rice will be a fraction of what Antero was, but we believe these kind of offerings will continue to garner a lot of interest because some of these companies hold prime acreage in the core of the plays.”

Sorbara believes Canonsburg, PA.-based Rice Energy holds about 50,000 net acres in the Utica, where state records show the company has just five drilling permits in Belmont and Guernsey counties.

Rice has been much more active in Pennsylvania’s Marcellus, where it has 97 drilling permits, almost all of which are in Washington County in a liquids-rich area of the play in the southwestern part of Pennsylvania.

When it comes time for any potential IPO, Sorbara added that it won’t be so much about a company’s acreage position as it will be about its overall value.

Antero has a market capitalization of about $14 billion. The company had 15 rigs operating in West Virginia last month, with Marcellus output there averaging 555 MMcfe/d. In the Utica, Antero had four rigs operating that were producing an average of 85 MMcfe/d.

The Ohio Department of Natural Resources has issued 53 horizontal Utica/Point Pleasant drilling permits to Antero, fewer than only Chesapeake Energy (545) and Gulfport Energy (91 permits).

Tom Picino, fund manager at Diamante Capital Partners, a small hedge fund with just under $10 million in investments in Ohio, said the region’s oil and gas industry is peaking his interest. He added that it will continue to be a hot sector and agreed with Sorbara in saying that these sorts of IPOs will continue to attract investors.

His fund recently completed a $15 million deal to establish a limited partnership that will buy the mineral rights to 2,500 acres in the Utica.

Along with Antero, Houston-based Plains All American Pipeline LP, had one of the best IPOs the market has witnessed this year, raising $2.82 billion in October(see Daily GPI, Oct. 17).

In the Permian Basin, Sorbara believes Endeavor Energy Resources, currently producing 41 Mboe/d, and Parsley Energy, with more than 75,000 acres there, could be next on deck for an IPO.

“I think there’s going to be a lot of interest in this area of the market for years to come,” Picino said. “It’s a very exciting industry.”

Asked if he would consider investing in an E&P IPO in the future, Picino said “absolutely, I consider every possible opportunity, it’s how you become successful.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |