Marcellus | E&P | NGI All News Access | Utica Shale

EIA: Southeast Gas Biggest Loser in Northeast Market

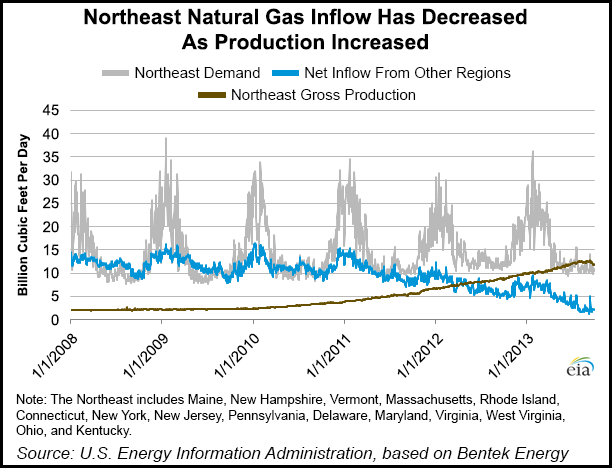

Net inflows of natural gas to the Northeast from all outside sources during the first nine months of 2013 decreased by 60% from the comparable 2008 period, displaced by internal production, according to a report Tuesday by the U.S. Energy Information Administration (EIA).

Gas from outside sources — the Southeast, including the Gulf of Mexico, Canada and Liquefied natural gas (LNG) imports — was backed out by northeastern production, which has climbed from 2.1 Bcf/d in 2008 to 12.3 Bcf/d in 2013.

The biggest volume loser was the Southeast, which went from 7.9 Bcf/d sold into the Northeast to 3.5 Bcf/d (a 56% decrease).

The EIA said flows on four pipelines — Columbia Gulf Transmission (CGT), Tennessee Gas Pipeline (TGP), Texas Eastern Transmission (Tetco) and Transcontinental Gas (Transco) — have been displaced by production in the Appalachian Basin, especially in the Marcellus Shale, “where increased production has occurred alongside expansions in capacity to move gas to northeastern consumers.

“Southeastern natural gas still accounts for three-fourths of the total flow to the Northeast, although total Southeast inflows may continue to decrease withadditional expansions in Marcellus takeaway capacity to the Northeast added at the beginning of this month [see Shale Daily, Nov 1].”

The EIA said natural gas net inflow from eastern Canada fell 82% between 2008 and 2013, from 2.5 Bcf/d to 0.4 Bcf/d. At the same time (LNG) imports went from 0.5 Bcf/d to 0.2 Bcf/d, a 54% decrease, and the Midcontinent supplies went from 1.2 Bcf/d to 0.6 Bcf/d, a 48% decrease.

“Lower production at Sable Island and higher demand for natural gas in eastern Canada contributed to the decrease of natural gas imported into the Northeast from eastern Canada,” EIA said. “Moreover, earlier this year, the Northeast began exportinggreater volumes of natural gas to eastern Canada by pipeline fromTGP’s border crossing in Niagara, NY, followingexpansions completed on TGP last year (see Shale Daily,Oct 31, 2012). The United States also began exporting compressed natural gas (CNG) to Canada this year by truck from Calais, ME.”

The EIA said that beginning last April, there have been days when the Northeast was a net exporter of gas to eastern Canada.

EIA’s description of the Northeast includes the heavily producing states of Ohio, Pennsylvania and West Virginia, and also Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |