NGI Data | NGI All News Access

Week’s Cash and Futures Trading Winds Down With Gains All Around

For the week ending Nov. 15 the NGI National Spot Gas Average posted a healthy 13 cent gain to average $3.58 with only one Rockies point and a handful of Northeast locations failing to make it to the positive side of the trading ledger. Of all the market points the Northeast was home to the week’s biggest winner and also the biggest loser.

Of the actively traded locations the Millenium East Pool saw the week’s biggest drop, 17 cents, to $2.98 and modestly traded Dracut saw its weekly gain of $2.72 to $7.12 reach the top of the leader board. Regionally the Northeast rose the most adding 22 cents to $3.55 and Rockies showed the least improvement tacking on 6 cents to $3.49.

California rose a modest 7 cents to average $3.74, the Midwest was up 8 cents to $3.70, and the Midcontinent added a dime to $3.53.

Both South Texas and East Texas gained 12 cents to $3.50 and $3.52, respectively and South Louisiana was higher by 15 cents to $3.57.

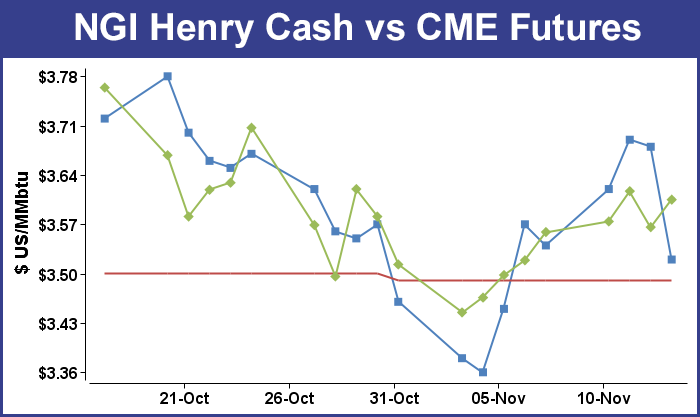

December futures rose 10.1 cents for the week to $3.660, despite traders digesting another natural gas storage injection Thursday morning for the week ending Nov. 8. The Energy Information Administration (EIA) reported Thursday morning a build in natural gas inventories about the level the market was expecting, an increase of 20 Bcf.

In Friday’s trading physical gas for weekend and Monday delivery on average was unchanged, and although most points showed gains of a nickel or more, forecasts of mild temperatures in New England and at eastern points prompted double-digit declines and offset what otherwise was broad market strength. Midwest, Gulf, and California firmness was countered by soft prices along the Eastern Seaboard. At the close of futures trading December was up 5.5 cents to $3.660 and January gained 5.3 cents to $3.708.

Industry observers have been confounded as much as anyone by the ever-changing weather forecasts. “If it gets cold we could be talking 20 Bcf a week or 3 Bcf a day additional demand with a swing in the temperatures. You’ve got to get Chicago and New York. That’s where it counts,” said a Denver producer. “I think the gas market is priced about right.”

Top traders suggest a sidelines approach to the market for now. “Although this market was initially nonplused by the seemingly neutral storage report, the bulls won out in the end by pushing Dec futures back up to the $3.60 area,” said Jim Ritterbusch of Ritterbusch and Associates. “Short term temperature views still appear mixed from our vantage point and incapable of forcing a test of either side of our projected $3.40-3.70 trading range. Consequently, we are maintaining a neutral trading posture in anticipation of further choppy, sideways price action until temperature forecasts become more skewed in one direction or another.”

He added that “With supply back to within 80 Bcf of last year’s lofty levels, we are still having difficulty building a case for nearby futures north of $3.70 without major assistance from a sustained much below normal cold spell. Finally, we’re maintaining a preference for bull spreads within the 2014 portion of the curve.”

Addison Armstrong of Tradition Energy sees “[T]raders eye[ing] forecasts indicating below-normal temperatures and increased heating demands across much of the East in the latter part of this month and expectations of the first storage withdrawal of season next week. But record production levels and the nearly 3.85 Tcf of gas in ground should continue to provide resistance to the market in the coming weeks.”

Natural gas futures rallied and then retreated after the EIA reported Thursday morning that 20 Bcf was injected for the week ending Nov. 8.

December futures were down on the day on weather developments before the report’s release. Once the report was unveiled, December futures rallied to the high of the day, making it to unchanged at $3.566 before settling back. By 10:45 EST, December was at $3.535, down 3.1 cents from Wednesday’s settlement. By the close, however, December had managed to climb into positive territory finishing 3.9 cents higher on the day at $3.605.

Traders’ expectations were almost identical to the reported build ahead of the report. Analysts at IAF Advisors forecast an increase of 19 Bcf, and a Reuters poll of 23 traders and analysts showed an average 21 Bcf build. Industry consultant Bentek Energy was spot on with a prediction of 20 Bcf.

More injections may be on tap. “We are going to get mild again in the East. We’ll be in the mid-60s by Monday,” said a New York floor trader. “The bottom line is there is a big number in the ground no matter what year you are looking at. There is plenty of gas.”

Prices firmed across the Midwest Friday as cold weather was anticipated to rip through the area. “A new sweep of cold air will race across the Midwest this weekend and will reach the East and South later on Monday,” said AccuWeather.com meteorologist Alex Sosnowski. “While the air coming in next week will not be as cold as last week, it will shave temperatures by 20 to 30 degrees Fahrenheit off weekend highs in the 60s and 70s in the Midwest. The colder air will follow a dose of rain and gusty, locally damaging winds across the Midwest this weekend and the Appalachians and East Coast Sunday night into Monday.”

“The core of the Arctic air will stay north over the Canada border over the Plains and generally north of the Great Lakes and the St. Lawrence Valley farther east. However, it will get cold enough for a round of lake-effect snow. The combination of wind, chilly air and other factors will make for wind chill temperatures 10 to 20 degrees lower than the actual temperature from the Upper Midwest and Northeast, southward along the Atlantic coast to part of the Deep South.”

Chicago’s Friday high of 50 was expected to rise to 59 Saturday before plunging to 43 on Monday, according to AccuWeather.com data. Milwaukee’s Friday high of 54 was anticipated to hold Saturday before dropping to 40 Monday. The seasonal high in Chicago is 50 and Milwaukee 46. Detroit’s Friday high of 51 was expected to rise to 55 on Saturday before retreating to 46 on Monday. The normal high in Detroit in mid November is 49.

Gas for the weekend and Monday delivery on Alliance was quoted at $3.61, up 6 cents, and deliveries to the Chicago Citygates rose 7 cents as well to $3.53. At Northern Natural Ventura packages were seen at $3.57, nine cents higher, and at Demarcation weekend and Monday gas came in at $3.55, up 10 cents.

Major price drops were seen at points in New England and the East as above normal temperatures were expected throughout the area. AccuWeather.com predicted that Boston’s Friday high of 61 was forecast to dip to 59 Saturday but surge to 64 on Monday, 12 degrees above normal. New York City’s Friday max of 56 was predicted to reach 58 on Saturday and 68 on Monday. The seasonal high in New York is 54. Philadelphia’s 59 Friday high was predicted to ease to 58 Saturday before also jumping to 68 on Monday. The normal mid-November high in Philadelphia is 56.

Monday power prices were mixed at eastern points. IntercontinentalExchange reported that peak power Monday at the New York Independent System Operator’s eastern delivery point (Zone G) fell $3.75 to $40.00/MWh, but Monday power at the New England Power Pool’s Massachusetts Hub rose 32 cents to $39.33/MWh.

Gas for weekend and Monday delivery at the Algonquin Citygates fell 51 cents to $3.51 and deliveries to Iroquois Waddington were off by 7 cents to $3.67. On Tennessee Zone 6 200 L gas was seen at $3.56, down 29 cents.

On Dominion gas changed hands at $2.91, down 15 cents and packages delivered to Tetco M-3 were seen at $3.11, down 24 cents. Gas on its way to New York City via Transco Zone 6 skidded 33 cents to $3.10.

Gulf locations were higher by a few pennies. Gas on ANR SE rose 3 cents to $3.45 and parcels at the Henry Hub gained 4 cents to $3.56. Gas at Transco Zone 3 was quoted at $3.51, up 4 cents and deliveries to Columbia Gulf Mainline added 4 cents to $3.47.

With the 20 Bcf packed away inventories now stand at 3,834 Bcf and are 80 Bcf less than last year’s record-setting build and 58 Bcf above the five-year average. In the East Region, 10 Bcf was injected and in the West Region 2 Bcf was withdrawn. Inventories in the Producing Region increased by 12 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |