NGI Archives | NGI All News Access

Berkshire Takes $3.45B Stake in ExxonMobil

Berkshire Hathaway Inc. disclosed Thursday that it owns 40.1 million shares of ExxonMobil Corp. currently worth an estimated $3.45 billion.

The purchase by legendary investor Warren Buffett, reported in a Securities and Exchange Commission (SEC) filing, represents 0.9% of the super major’s shares. The SEC requires large investors to disclose their holdings every quarter.

“We appreciate the confidence investors have in ExxonMobil when they decide to invest in the company,” said an ExxonMobil spokesman.

Berkshire owns interests in many North American exploration and utility businesses, including MidAmerican Energy, which earlier this year agreed to buy NV Energy Inc. for $5.6 billion (see Daily GPI, May 30). The investment firm last disclosed owning ExxonMobil shares two years ago.

“When Warren Buffett gives his seal of approval to any company, that is never a bad thing,” said Raymond James & Associates Inc.’s Pavel Molchanov. ExxonMobil is rated a “strong buy” by the analyst. “Buffett is a classic value investor, and Exxon has been an underloved stock in a bull market.

“Exxon is an amazing cash generating machine, which should generate $16 billion of free cash flow this year.”

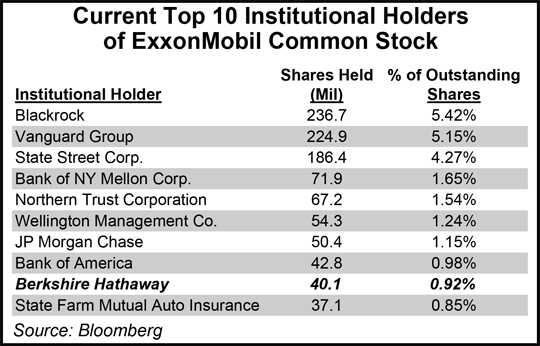

The largest institutional holders in ExxonMobil common stock are Blackrock (236.7 million shares), Vanguard Group (224.9 million shares) and State Street Corp. (186.5 million shares), according to Bloomberg.

During 3Q20113, Berkshire reduced its stake in ConocoPhillips by 44%, the SEC filing indicated. ConocoPhillips’ shares have risen more than 27% since the start of this year while ExxonMobil’s stock is up close to 8%. Berkshire also indicated it has taken stakes in Calgary’s Suncor Energy Co., a big oilsands operator.

Berkshire also holds controlling stakes in BNSF Railway Co., whose business has soared as U.S. onshore crude shipments expand, and is testing a natural gas locomotive (see Daily GPI, March 8). Those locomotives, if they prove to be worthwhile, could add to the gas market for ExxonMobil, the top natural gas producer in North America.

At the end of September Berskshire had almost $105 billion of equities. The top four holdings — American Express Co., Coca-Cola Co., International Business Machines Corp. and Wells Fargo & Co. — totaled more than half at $58.4 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |