Markets | NGI All News Access | NGI Data

Physical Gas Vaults Higher; Futures, Not So Much

Physical natural gas for delivery Friday bounded higher by an average of 11 cents in Thursday’s trading.

Gains were deep and widespread with only a handful of points in the Rockies and elsewhere reporting minor declines. New England and the East led the charge higher as weather forecasts turned sharply cooler with high temperature readings expected to drop as much as 20 to 30 degrees.

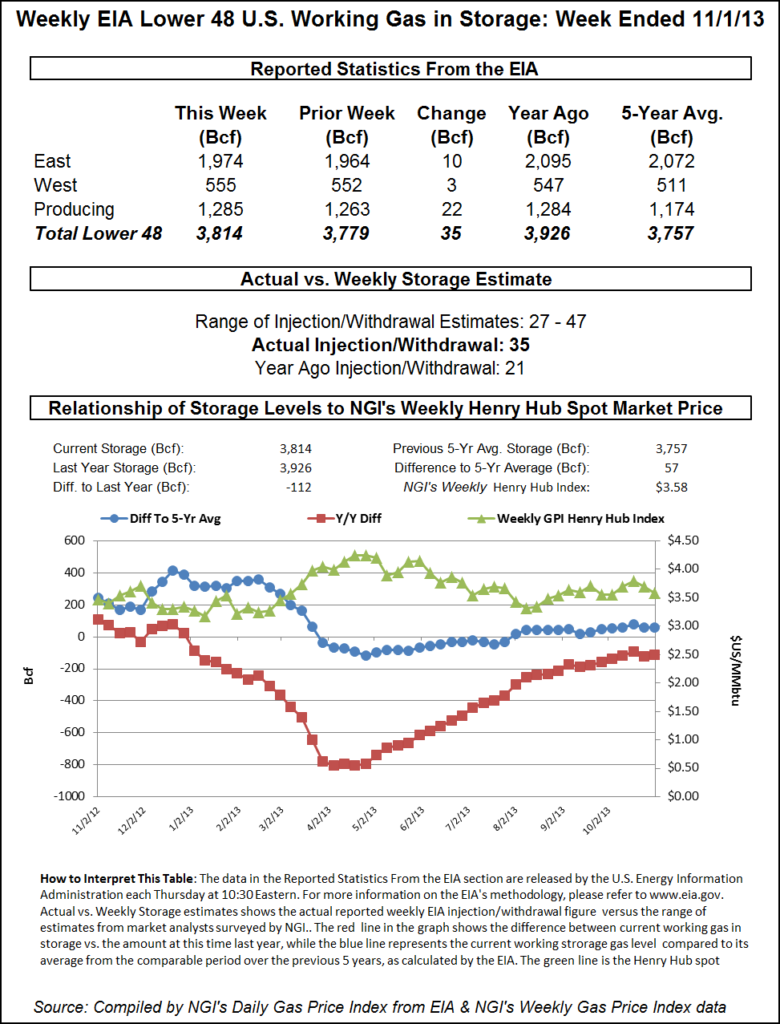

The Energy Information Administration (EIA) reported an increase in gas storage of 35 Bcf, about what the market was expecting. Futures prices were higher on the day, but following the release of the storage data they slipped off session highs. At the close, December was 2.1 cents higher at $3.519 and January had risen 0.9 cent to $3.575. December crude oil dropped 60 cents to $94.20/bbl.

The weather outlook for New England and the East has turned on a dime. “Temperatures in the East will slide downhill into Friday, and the chill will hang around this weekend,” said AccuWeather.com meteorologist Alex Sosnowski. “After a front brings clouds and a few hours of rain to the Atlantic Seaboard and Appalachians on Thursday, blustery and colder conditions are in store for the region Friday. Recent temperatures in the 60s will soon be erased by highs in the upper 30s, 40s and low 50s.

“Winds will not be quite as strong as last week’s damaging gusts, but west to northwest blusters will average 15 to 30 mph with gusts around 40 mph in most areas. When combined with air temperatures, wind and other atmospheric conditions, wind chill temperatures will be in the 20s and lower 30s at times. The air will be cold enough to produce a few bands of lake-effect snow or mixed rain and snow downwind of lakes Erie, Huron and Ontario, [and] over the weekend, the wind is forecast to ease a bit but will be far from silent.”

AccuWeather.com forecast that Thursday’s high in Boston of 66 degrees would slide to 52 Friday before easing further on Saturday to 49. The normal early November high in Boston is 54. New York City’s Thursday high of 64 was seen dropping to 51 on Friday and 50 on Saturday. The seasonal high in New York is 57. Washington, DC’s balmy 63 high on Thursday is anticipated to fall to 53 on Friday before recovering to 55 on Saturday. The normal high in Washington is 61 this time of year.

Power loads and next-day power prices in New England were expected to rise. New England ISO forecast that Thursday’s peak load of 16,700 MW would rise to 16,750 MW Friday. IntercontinentalExchange reported that next-day power prices at the New England Power Pool’s Massachusetts Hub rose $3.90 to $39.88/MWh. Friday peak power at the PJM West Interconnect added $2.63 to $39.42/MWh.

Gas at the Algonquin Citygates for Friday delivery surged 86 cents to $4.49, and gas into Iroquois Waddington gained 14 cents to $3.81. On Tennessee Zone 6 200 L, next-day packages were seen at $4.40, up 67 cents.

In the Marcellus and Mid-Atlantic, next-day gas posted stout gains as well. On Dominion, Friday deliveries changed hands at $3.28, up 16 cents, and on Tetco M-3 packages came in at $3.51, up 26 cents. Gas on its way to New York City via Transco Zone 6 gained 31 cents to $3.60.

Transco Leidy deliveries added 24 cents to $3.14, and parcels on Tennessee Zone 4 Marcellus added 29 cents to $2.92.

Gulf points were also firm. Friday deliveries on ANR SE added 11 cents to $3.50, and gas on Columbia Gulf Mainline was higher by 12 cents to $3.52. On Tennessee 500 L, gas changed hands at $3.52, up 12 cents, and at the Henry Hub, Friday packages were seen at $3.57, also up 12 cents. Deliveries on Transco Zone 3 rose by 13 cents to $3.55.

Other market centers were mostly higher. Chicago Citygates were seen 8 cents higher at $3.74, and gas at the Houston Ship Channel rose 11 cents to $3.50. Deliveries to Opal were off 4 cents at $3.44, and next-day gas at the PG&E Citygates added 6 cents to $3.82.

Although the traditional storage injection season ends with October, analysts are thinking that there still seems to be plenty of production around and mild enough weather to ensure at least a couple of more weeks of builds. Estimates for Thursday’s storage report by the EIA were just barely above historical averages.

Last year, 27 Bcf was injected, and the five-year average is for 36 Bcf to go into storage for the last week of October. The actual build of 35 Bcf was right in line with what the industry was thinking. Kyle Cooper of IAF Advisors calculated a 35 Bcf increase, and a Reuters poll of 23 industry followers also revealed an average 35 Bcf with a range of 27-47 Bcf. Bentek Energy’s flow model was expecting storage to have increased 39 Bcf.

Utilizing Bentek’s estimate, ending inventories at the traditional end of the injection season would come in at 3,818 Bcf. “However, with production posting a new all-time high on Nov. 3 at 66.9 Bcf/d, injection season could continue into much of November, closing the gap between current inventory levels and the all-time high posted in 2012 of 3,929 Bcf,” Bentek said. “Demand in the East Region followed the opposite pattern from the previous week as below-normal temperatures moved out of the region as the storage week progressed, which created an upward trend in injections during the week. Deliveries to LDCs and municipalities in the East rose 1.0 Bcf/d from the previous week, suggesting some of the demand estimates in the East were lagged slightly as residential/commercial estimates rose 0.4 Bcf/d week over week.”

While Bentek’s 39 Bcf estimate may have been on the high side of the consensus, others were looking for a bias lower. The Energy Metro Desk survey of 40 participants had an on-target average of 35 Bcf. “For all intents and purposes, we shouldn’t see a surprise this week out of EIA, but we still see the bias pointing to a number lower than our consensus. We’re anticipating three more builds this season before the switch moves to the draw side,” said John Sodergreen, editor.

“Do we still think a new record will be made this year? Not so much, but it will be close for sure. The weather picture looks more fickle than usual, so we’re told there is still a chance for a new end-of-season tally — high. And given that many eastern LDCs are following a predetermined, end-of-October end to the traditional fill season — regardless of what the thermometer might suggest — injections will be much curtailed going forward.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |