Canadian-Japanese Duo Proposes Floating LNG Export Terminal in BC

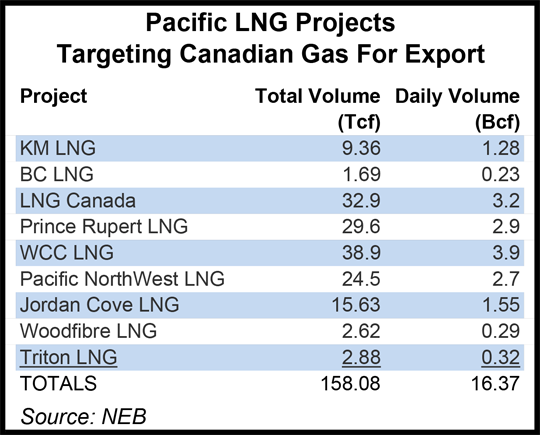

Another 2.88 Tcf has been added to Canadian hopes for overseas sales of liquefied natural gas (LNG) over the next quarter-century, swelling the industry total to 158.08 Tcf.

AltaGas Ltd. of Calgary and Idemitsu Kosan Co. of Japan stepped forward as joint sponsors of Triton LNG LP, the ninth Pacific Coast terminal project seeking an export license from the National Energy Board (NEB).

The Triton package calls for a floating liquefaction and storage (FLSO) vessel to load LNG tankers at an annual rate of 115 Bcf, or 315 MMcf/d, for 25 years. With the project still in a preliminary engineering stage, no costs were disclosed. The FLSO could park at either of the two ports on the northern Pacific Coast of British Columbia, Kitimat or Prince Rupert, says Triton’s application to the NEB.

Only one commercial arrangement for a single aspect of the plan has been secured to date. Triton has made a 20-year “reservation agreement” to take deliveries of 325 MMcf from the BC pipeline of Pacific Northern Gas, which has provincial environmental approval for capacity additions.

The NEB filing says tanker loadings could begin “as early as 2017,” but it also requests a 10-year sunset clause to keep the export license valid in case Triton needs until the 2020s to land overseas sales contracts with LNG buyers.

Gas supply sources are likewise not yet identified, except to predict that growing shale production will be available from the Western Canadian Sedimentary Basin and pipeline grids spanning BC, Alberta and Saskatchewan.

Triton’s Canadian partner, AltaGas, is a gas, power and utilities infrastructure enterprise, not a producer. The Japanese partner, Idemitsu, is a refined products, petrochemicals and lubricants manufacturer, not an LNG consumer.

None of the nine projects in the BC lineup have announced firm overseas sales deals and 10-year sunset clauses have become a Canadian industry standard for LNG export licenses.

In reply to written questions by NEB staff processing export license applications, keeping sales options open for a decade has been described as a must by the biggest entry in the BC project lineup, the WCC LNG partnership of ExxonMobil and 70%-owned Canadian affiliate Imperial Oil.

The long sunset clause is “based on a reasonable estimate of the cumulative time required to undertake the work to achieve various milestones that must be reached prior to the first export of LNG,” said the WCC partners. “Such milestones include continued stakeholder engagement [with interest groups such as northern aboriginal communities and civic authorities], obtaining all regulatory authorizations, completing necessary commercial arrangements, and undertaking the design, engineering and construction.”

WCC pointedly refrains from stoking high expectations for LNG projects to fuel swift gains in royalties from provincial government-owned northern shale gas resources, tax revenues and job creation. Visions of rapid development helped propel the BC Liberal government to re-election in May as a pillar of its campaign platform.

The Exxon Mobil-Imperial team told the NEB that 10-year export license sunset clauses grow out of sobering lessons taught by international energy markets. The long development timing “estimate is based on the worldwide experience of the project proponents in carrying out projects of a similar scope and scale and provides for a reasonable degree of flexibility,” said WCC LNG.

Additional BC schemes are expected to step forward with NEB filings as they mature enough to satisfy board requirements for applications.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |