Markets | NGI All News Access | NGI Data

Firm Marcellus Unable to Offset Weak East, Northeast; Futures Slide

Physical gas prices for Friday delivery tumbled an average 9 cents Thursday as traders were eager to get deals done ahead of weekly government inventory statistics.

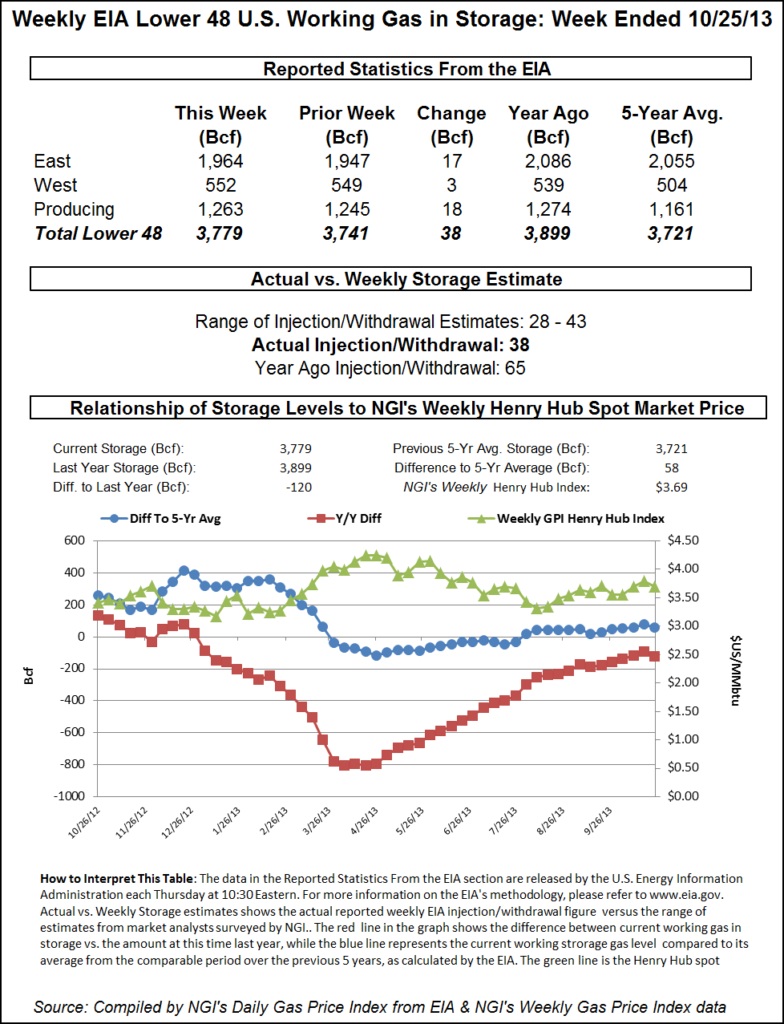

East and Northeast locations were down by solid double digits. Gains at Marcellus points along with firm quotes at SoCal Border and Gulf locations were unable to offset the broader selling. The Energy Information Administration (EIA) reported a build of 38 Bcf for the week ended Oct. 25, about 2 to 3 Bcf greater than market expectations, and futures eased. At the close, December had fallen 3.9 cents to $3.581 and the January contract was off 4.8 cents to $3.663. December crude oil dropped 39 cents to $96.38/bbl.

A Midwest marketer said, “people were getting set up for winter and then discovered they had no load for [Friday]. They were selling like crazy before the storage number came out. They were set up to cover the end of the month, and weather is not here to start the month so they were putting more pressure on the sales side. People were hitting bids early to get rid of their gas. No one wants to be long or short when that [EIA] number comes out.”

The marketer said trading in and around the Chicago Citygates had recently worked out well. “Some weather came through [Chicago Citygates] and shot it up 25 to 30 cents above the Hub [index]. Nicor has finished their work, and I haven’t had any issues getting gas into any of the gates,” the marketer said.

Gas for delivery Friday on Alliance slipped 4 cents to $3.70, and at the Chicago Citygates next-day packages were flat at $3.73. On Northern Natural Ventura, gas was seen at $3.64, down 5 cents, and at Demarcation gas changed hands at $3.62, down 8 cents.

In the New York-New England area, next-day gas prices plunged as lower next-day power loads and prices squashed any incentive for power producers to bid for gas. ISO-New England reported a falling trend in power demand. Wednesday’s peak load was 16,823 MW, and Thursday’s peak was expected to reach 16,700 MW. Friday’s peak load was forecast at 16,090 MW.

Next-day power prices behaved accordingly. IntercontinentalExchange reported that Friday peak power at the New England Power Pool’s Massachusetts Hub was $35.20/MWh, down $3.87. Peak power into the New York Independent System Operator’s Zone A trading point (western New York) settled at $37.00/MWh, off by $4.19.

Gas at the Algonquin Citygates plummeted 79 cents to $3.47, and deliveries into Iroquois Waddington fell 18 cents to $3.72. On Tennessee Zone 6 200 L, Friday parcels sank 52 cents to $3.71.

Next-day power in the Mid-Atlantic also weakened. IntercontinentalExchange reported that peak power for Friday delivery at the PJM Interconnect shed $2.97 to $35.20/MWh.

Gas on Dominion gave up 24 cents to $3.08, and deliveries on Tetco M-3 lost 37 cents to $3.17. Gas bound for New York City on Transco Zone 6 fell 38 cents to $3.25.

One of the few bright spots in eastern trading were Marcellus points. Gas delivered to Tennessee Zone 4 Marcellus jumped 37 cents to $2.52, and on Transco-Leidy Friday gas came in at $2.72, up by 10 cents.

The 10:30 a.m. EDT storage report was somewhat above market expectations. Traders were expecting a build in the 34 to 36 Bcf range, and the actual figure of 38 Bcf sent prices scooting to the low of the day. “$3.60 was initial [technical] support and now I’m thinking $3.56 is the new support zone. If the number would have come in a lot higher, we would have seen more action,” said a New York floor trader.

“The gain was less than the date-adjusted 65 Bcf build from last year and the 57-Bcf five-year average, but a below average injection should have already been discounted into the price,” said Tim Evans of Citi Futures Perspective. “Since the outcome wasn’t surprising, the report may have simply removed the risk of a surprise from the market for another week, freeing up trade flow.”

Prior to Thursday’s trading, futures seemed reluctant to probe below $3.60, but observers ultimately expected fundamental factors to weigh on prices. “Near-term forecasts for above-average temperatures and limited heating demands, the ramping-up of nuclear power plants as maintenance and refueling season ends, and the near-record production levels of gas are likely to exert downward pressure on the markets in the coming weeks. Weather forecasts are little-changed, with above-normal temperatures expected across the East in the coming weeks,” said Addison Armstrong of Tradition Energy.

Tradition Energy calculated a 33 Bcf build, and most estimates were well outside last year and the five-year average. Last year, 66 Bcf was injected, and the five-year pace is 57 Bcf. United ICAP was looking for a 35 Bcf increase, and a Reuters poll of 24 market pundits revealed an average 32 Bcf with a range of 28-43 Bcf. Bentek Energy’s flow model was anticipating a relatively thin 32 Bcf gain.

Bentek said cold weather prompted a significant decline from last week’s 87 Bcf build. “Significant increases in residential/commercial demand slashed storage injections from the previous week as heating load increased 6.2 Bcf/d, with 4.8 Bcf/d accounted for in the East Region,” Bentek said. “The increased demand was driven by below-normal weather in the East Region as population-weighted average temperatures in the Midwest reached sub-40 degrees for three of the seven days during the storage week ended Oct. 25. This cut total sample injections within the region by 20 Bcf from the previous week and increased sample deliveries to LDCs by 3.9 Bcf/d week-over-week.”

Analysts at Energy Metro Desk hinted that there is still room in the weeks to come for a record ending storage inventory. “We see an outside chance for a low-baller surprise this week out of EIA, which would be right in the 30-32 Bcf neighborhood,” said John Sodergreen, editor. “Still, S/D [supply-demand] models seem to be tracking higher, pointing directly to our consensus [36 Bcf]. Bottom line, it will be a build, as will the next two reports, at least; likely the next three reports. And if one more can be squeezed out, we’ll have a new record, for sure.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |