Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Midstreamers Trying to Keep Pace With Marcellus, Utica Production

Midstream companies are adding infrastructure and working to give producers options in the Marcellus and Utica shales, but some are concerned that construction isn’t keeping pace with production, a scenario that could lead to the bottom falling out on natural gas prices, something already seen.

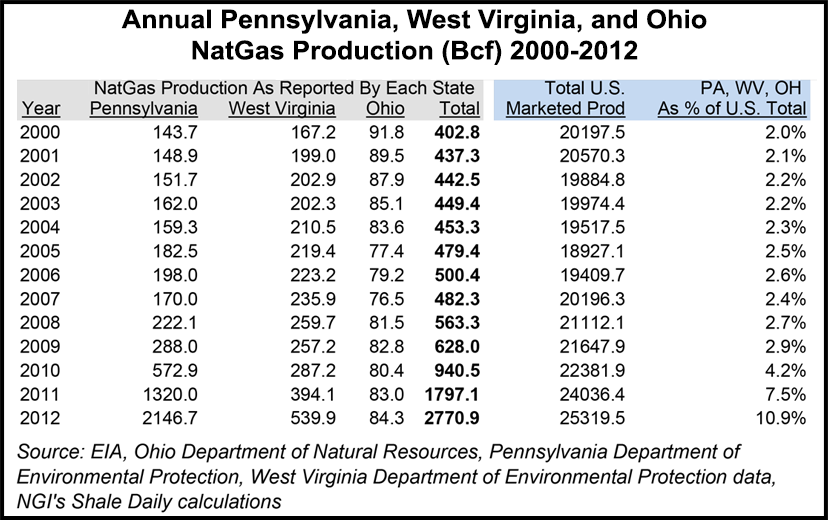

Ample supplies of natural gas from the Marcellus and Utica shale plays have flattened the Northeast-Henry Hub basis, among others, which has forced companies out of the gas marketing business due to the lack of spreads (see Shale Daily, Aug. 14). According to state reports and Energy Information Administration data, the combined gas production from Pennsylvania, Ohio and West Virginia increased from accounting for only 2% of U.S. total production in 2000 to 10.9% of the U.S. total in 2012 (see chart).

The flood of gas to the region, along with weak demand, is also creating days in the physical gas market where transportation constraints and the supply glut lead Marcellus pricing points to run counter to the rest of the market (see Daily GPI, Aug. 5).

Marc Halbritter, chief marketing officer at Blue Racer Midstream LLC, told attendees at Platts’ Appalachian Oil and Gas Conference in Pittsburgh on Tuesday that the super-rich gas areas of the Marcellus, as well as the liquids-rich areas of the Utica, are delivering superior returns, even at today’s prices.

“When you get out into the Marcellus in northeast or southwest [Pennsylvania], those areas are still roughly in the middle of the pack, with just under 30% return,” Halbritter said. “We think [drilling rigs] are going to continue to migrate into the wet portion of the play, but you’ll continue to see the northeast Pennsylvania gas offer attractive returns. A wild card out there is what’s going to happen with the Utica dry [gas]. There are some fairly encouraging results we’re hearing out of those wells; they’re very prolific.”

Halbritter said as the Northeast transitions from importing to exporting gas, production is meeting — and in some parts exceeding — demand, a phenomenon he and others have dubbed as lumpiness.

“With potential production of 20 Bcf/d by 2020, we’ve got to send gas out,” Halbritter said. “It’s going to continue to be a problem until we have adequate pipeline capacity to take gas away.

“The key for allowing production to actually occur is going to be the infrastructure that gets built. It is all aspects of infrastructure — gathering, processing, fractionation, NGL [natural gas liquids] pipelines and transportation of residue gas. Significant amounts of investment are going to be required to get us through this.”

Halbritter said 2013 has been “the year of delineation.”

“This was the time for producers to figure out exactly what it was they had in the Utica, and then develop their drilling plans going forward,” Halbritter said. “Historically, the Northeast has been an import region, where it has had about 10 Bcf/d to 20 Bcf/d of demand, with the difference being what’s required for winter versus summer.

“As we look at various [pipeline] options, our number one focus is managing gas quality. I certainly agree that ethane will be solved once the pipeline networks are in, but until that comes there are issues to manage around gas quality. Secondly, we’re trying to connect our plants to at least two, and ideally three, residue outlets so producers have a diversity of market that they can attach.

Halbritter added that Blue Racer also plans to create access to all residue lines by moving gas between its processing plants — specifically, the Berne, Lewis and Petersburg complexes in Ohio (in Monroe, Harrison and Mahoning counties, respectively) and the Natrium Complex in Marshall County, WV — to create a processing “super system” for producers (see Shale Daily, Sept. 5; Dec. 24, 2012).

“We will support the development of all the market outlets we can get,” Halbritter said. “We think that’s crucial not only for the success of the play, but also for producers to get the highest value for the their gas.”

Scott Garner, vice president for corporate development and joint venture management at MarkWest Energy Partners LP, said the company has invested $5 billion in capital expenditures (capex) in the Marcellus and Utica since 2008. According to Garner, MarkWest plans to spend nearly $1.8 billion on capex in the region this year, and exceed that figure in 2014.

This year MarkWest is on track to double its volumes and double processing capacity in the Marcellus to 2.2 Bcf/d (see Shale Daily, May 13). It also is on track to complete another 1 Bcf/d of capacity, bringing the total to 3.2 Bcf/d.

MarkWest has 22 construction projects underway in the region, Garner said. Expansions at the Majorsville, Mobley and Sherwood complexes, located in West Virginia’s Marshall, Wetzel and Doddridge counties, respectively, were scheduled to come online in 3Q2013.

“It’s been quite an experience gearing up for that level of project activity and then being able to sustain it in a way that would be considered successful in meeting our producer commitments and their desires,” Garner said.

William Moler, chairman of Rockies Express Pipeline LLC, said his company wants to move gas volumes East to West — in the opposite direction from which the pipeline originally was designed, from the Utica to the Rockies, while keeping “prices pari passu with the rest of the country” (see Shale Daily, Sept. 12).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |