Marcellus | E&P | NGI All News Access

Consol Gas Production Higher, Profits Lower

A day after Consol Energy Inc. disclosed a multi-billion deal to shift its focus to natural gas from coal, the company reported a third quarter loss on charges and higher costs.

On Monday, Consol agreed to sell five West Virginia coal mines to Murray Energy Corp. in a transaction valued at $3.5 billion to restructure investments away from coal and toward more Appalachian gas (see Shale Daily,Oct. 28). Consol posted a loss of $63.7 million (minus 28 cents/share) from a 3Q2012 loss of $11.4 million (minus 5 cents). Adjusted earnings were $243.8 million in 3Q2013 from $210.3 million in 3Q2012. Total revenue rose 6.1% to $1.23 billion. Operating costs rose 2.5% to $1.22 billion.

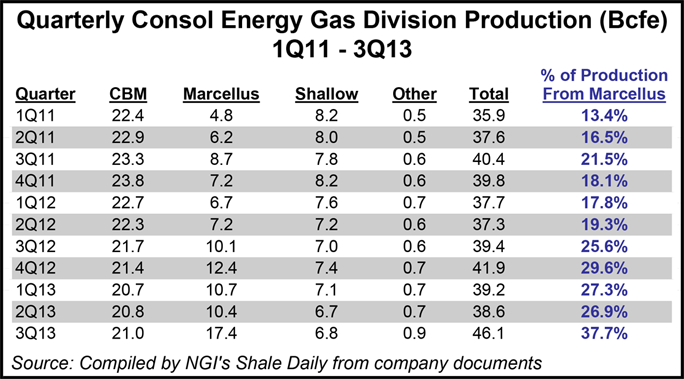

Consol, long weighted to coal, had said earlier in October that the gas division produced 46.1 Bcfe in 3Q2013 versus 39.5 Bcfe in the year-ago period (see Shale Daily,Oct. 15). Net production included 491 MMcf/d of natural gas, 397 b/d of oil/condensates and 1,340 b/d of natural gas liquids.

On Tuesday management said the division showed unit margin expansion from the second quarter as the average sales price was nearly unchanged, while unit costs were lower, mostly on higher volumes. Overall natural gas production was up 17% sequentially, aided by the 72% growth in the Marcellus Shale.

“Consol’s gas division continues to see the Marcellus Shale become a greater portion of the production mix,” said CEO J. Brett Harvey. “This is important for two main reasons: the first is the lower-cost nature of the Marcellus resulting from drilling efficiencies such as pad drilling, and the second is sales price uplift associated with a higher concentration of liquids. Consol is not only on track to meet its 2014 overall gas production guidance but is also on track to more than double its Marcellus Shale production in 2014, compared to 2013.”

Coalbed methane output in the quarter totaled 21 Bcfe, a decline of 3% year/year as Consol reduced drilling to focus on higher return projects. Marcellus production totaled 17.4 Bcf, up 72% from 10.1 Bcfe produced in 3Q2012, primarily from wells coming online. In its shallow targets, Consol produced 6.8 Bcfe, down 3% from a year ago as rigs and capital were shifted toward deeper Marcellus and Utica Shale prospects.

All-in unit costs in the Marcellus were $2.55/Mcfe in 3Q2013, a decline of 40 cents from the year-ago period. The improvement was attributed to the increase in volumes. Total gathering and transportation costs, however, were impacted negatively by 29 cents/Mcfe because of costs associated with liquids production and firm transportation, Consol said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |