Markets | NGI All News Access | NGI Data

Weak New England Leads Far-Reaching Decline; Futures Recover Early Losses

Physical natural gas for Friday delivery overall declined 4 cents as most traders elected to get their deals done prior to the release of often volatility-inducing storage figures.

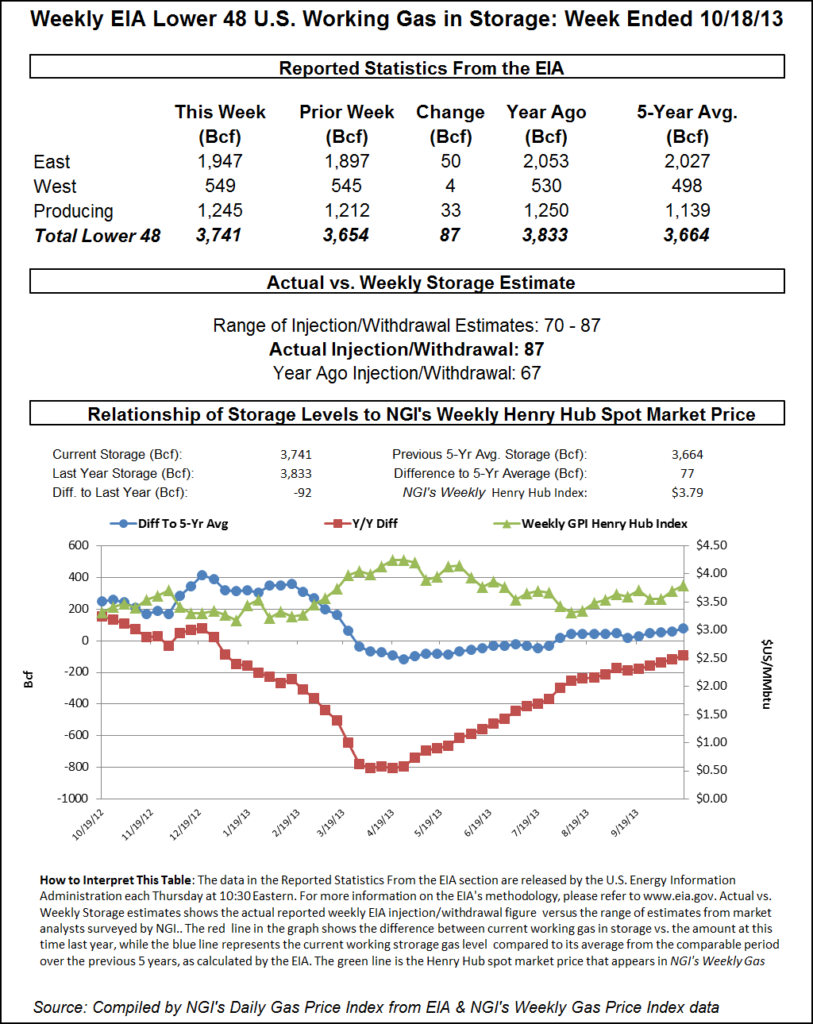

Weakness was widespread, with most points down a few pennies to a nickel. New England points were particularly weak as soft power prices did not encourage strong gas bids. Upper Great Lakes and California were both down about a nickel. The Energy Information Administration (EIA) reported a build of 87 Bcf, and November futures promptly put in the low of the day before staging a modest advance. At the close November was higher by 1.0 cents to $3.629 and December gained 1.0 cents as well to $3.743. December crude oil added 25 cents to $97.11/bbl.

Great Lakes buyers reported having to make modest purchases before considering their bidweek strategies. “We paid $3.93 and $3.88 for gas on Consumers. It’s getting close to the end of the month and we want to make sure our customers’ accounts are balanced given that we have colder weather right now,” said a Michigan buyer.

The buyer thought that the weather outlook might be somewhat warmer for November but said their initial figures indicated an aggressive bidweek posture. “The purchase has not yet been made so a change could be forthcoming,” he said.

Gas for Friday delivery at the Chicago Citygates fell four cents to $3.89, and deliveries to Michcon slipped 3 cents to $3.83. On Consumers, gas changed hands at $3.87, down 5 cents, and at Dawn Friday packages came in at $3.94, down 3 cents.

Next-day gas prices at New England locations were down by double digits as next-day power prices slumped. IntercontinentalExchange reported that peak power for Friday delivery at the New England Power Pool’s Massachusetts Hub dropped $3.75 to $41.83/MWh and gas at the PJM Interconnect’s Western Hub shed $2.10 to $41.58/MWh.

At the Algonquin Citygates, Friday packages were seen at $4.53, down 17 cents, and gas into Iroquois Waddington shed 14 cents to $4.09. On Tennessee Zone 6 200 L, gas changed hands at $4.43, down 32 cents.

Weakening California power demand along with temperate weather helped prompt lower West Coast as well as California next-day power prices. Next-day gas in turn shed upwards of a nickel at some points.

The California Independent System Operator forecast that Thursday’s peak power requirements of 29,121 MW would ease Friday to 29,015 MW.

Forecaster Wunderground.com predicted that the high in Los Angeles Thursday of 70 would hold for Friday before rising to 72 on Saturday. The seasonal high in Los Angeles is 78. Burbank’s 75 high on Thursday was expected to jump to 81 on Friday before reaching 84 on Saturday. The normal mid-October high in Burbank is 78. San Francisco’s high reading of 64 on Thursday was anticipated to hold for Friday before reaching 68 on Saturday. The normal high in San Francisco is 69.

IntercontinentalExchange reported that peak Friday-Saturday power at NP-15 fell 91 cents to $41.10/MWh and Friday-Saturday power into SP-15 dropped $1.47 to $44.01/MWh. At Mid-C, peak power shed $1.93 to $43.05, and at Four Corners Friday-Saturday power fell $1.25 to $34.00/MWh.

Gas at the PG&E Citygates was quoted at $3.94, down 2 cents, and deliveries to SoCal Citygates came in 5 cents lower at $3.93. At the SoCal Border, gas for Friday was seen at $3.80, down 3 cents, and on El Paso S Mainline next-day parcels changed hands at $3.80, down 4 cents.

Futures traders were treated to their second dose of storage data within a week. Tuesday’s report for the week ended Oct. 11 showed a build of 77 Bcf, and Thursday’s report was expected to show a slightly higher build. Tim Evans of Citi Futures Perspective calculated an 80 Bcf increase, and Kyle Cooper of IAF Advisors was looking for a build of 82 Bcf. A Reuters survey of 23 traders and analysts revealed a sample mean of 79 Bcf with a range of 70 Bcf to 87 Bcf. Bentek Energy’s flow model came as close as anyone and predicted a hefty build of 86 Bcf.

Bentek said that stout production estimates prompted its higher build. “Supply disruptions from the previous two-weeks did not roll into the current storage week, with production averaging 65.4 Bcf/d, the highest average since the July 26 storage week and 1.2 Bcf/d above the average of the previous three weeks.”

Analysts correctly predicted that risk to the consensus estimates would play out to the high side. In its weekly survey of market pundits,Energy Metro Desk expected an 83 Bcf increase, and John Sodergreen, editor, said “We see risk to the upside this week; anything between 83 and 87 Bcf should be right on the money. We note that one of our key indicators for an EIA surprise is just a whisper away from calling it. The spread between the three categories we track [financial institutions, individuals, and newswire surveys] came in this week at 2.8 Bcf, and we need a 3.0 Bcf spread to call it a proper surprise. So were EIA to come in at 85-87, it would be a modest surprise, and the bias would be right.”

Longer-term weather forecasts are in a state of flux, more so than usual. In its Thursday morning six- to 10-day outlook WSI Corp. of Andover, MA, said, “Temperatures have warmed over the Rockies and Southern Plains early in the period as the models are now slowing down the propagation of a sharp cold front a bit longer than what was originally anticipated.”

WSI said it has less than normal confidence in the forecast and admits that “The forecast could go either way here and is completely dependent on the mean progression and evolution of a digging cold trough over the Rockies early in the period. If the trough breaks and develops a cut-off low pressure system, temperatures could run warmer than forecast across the central and eastern U.S. as advertised by the deterministic models. But the ensembles continue to advise less of a risk of a cut-off to develop, and thus are promoting colder temperatures across the central and eastern U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |