E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bill Barrett Selling West Tavaputs, Cutting Debt

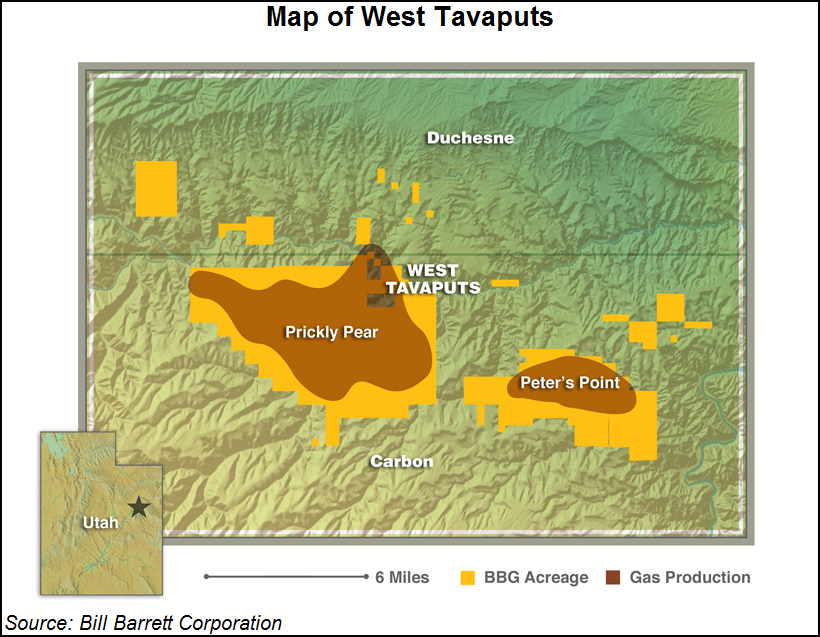

Denver-based Bill Barrett Corp. continued to increase its emphasis on oil over natural gas with an agreement to sell its West Tavaputs gas property in the Uinta Basin in Utah.

An undisclosed buyer agreed to pay $371 million, which includes $46 million to assume a lease financing obligation for compressor units on the property. The deal is expected to close by year-end.

“Completing this transaction is consistent with our objectives to partially fund our capital program through asset sales, to end 2013 with total debt less than year-end 2012 and to divest of projects where the company is not actively investing,” said CEO Scot Woodall.

Former CEO Fred Barrett said more than a year ago that the company would be increasing its emphasis on oil (see Daily GPI, Jan. 25, 2012).

The sale includes about 35,000 net acres, 300 producing wells, 265 Bcfe of net proved reserves (based on year-end 2012) and 68 MMcfe/d of net production (based on the second quarter).

Woodall said the company is getting 5.6 times cash flow for the property, based on second quarter figures, or about $5,450/Mcfe per day of flowing production. Pro forma for the sale, long-term debt as of June 30 is cut from nearly $1.25 billion to $877 million. Woodall said the company expects to end this year with oil accounting for about 40% of production.

The company’s 2013 production guidance will be adjusted based on the actual date of closing. Bill Barrett said it expects to record noncash impairment charges in the third quarter of about $200 million (pretax) associated with the sale.

“…[I]nvestors should be happy to see this on tape this morning as some were questioning whether the company could get the sale done by year-end 2013,” said Wells Fargo Securities analyst David Tameron.

Tameron said that at first glance the deal is a slight detriment to net asset value (NAV) “as we were valuing proved reserves at $1.65/Mcfe, although we did not include West Tavaputs unproved locations in our NAV estimate.” Tameron said the sale should allow investors to focus more on the company’s execution next year in the Denver-Julesburg Basin, the Uinta, and the Powder River Basin deep program.

Bill Barrett shares closed down more than 3% Wednesday at $26.36 after a day of moderately heavy trading. Over the last 52 weeks the shares have been as low as $15.50 and as high as $27.70.

Canaccord Genuity analyst Ipsit Mohanty also follows Bill Barrett and said in a note Wednesday that Ultra Petroleum Corp.’s acquisition of oil assets in the Uinta Basin bodes well for Bill Barrett’s holdings there (see Shale Daily, Oct. 22). “In our view, the valuation metrics [of the Ultra acquisition] provide very positive embedded value for BBG’s [Bill Barrett] acreage,” the analyst said.

“Much of BBG’s investment thesis now rests on Niobrara development and lower debt levels following potential gas asset divestitures. Niobrara rightfully takes priority ahead of Uinta given better rates of return, but transactions such as [Ultra’s] remind us of the valuation embedded in BBG’s Uinta acreage.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |