Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

The ‘Age of Gas’ Is Coming, GE Report Says

As an outgrowth of the North American shale revolution, natural gas increasingly will capture a bigger piece of global energy demand with a denser network offering greater flexibility and improved economics, according to a white paper released Friday by General Electric Corp. (GE).

Gas will transform from a mostly regional, marginal energy source to a focal point of global energy supply, said Peter Evans and Michael Farina, co-authors of the GE-backed report, “The Age of Gas & The Power of Networks.” Large-scale multi-billion-dollar pipeline and liquefied natural gas (LNG) projects will anchor the gas network.

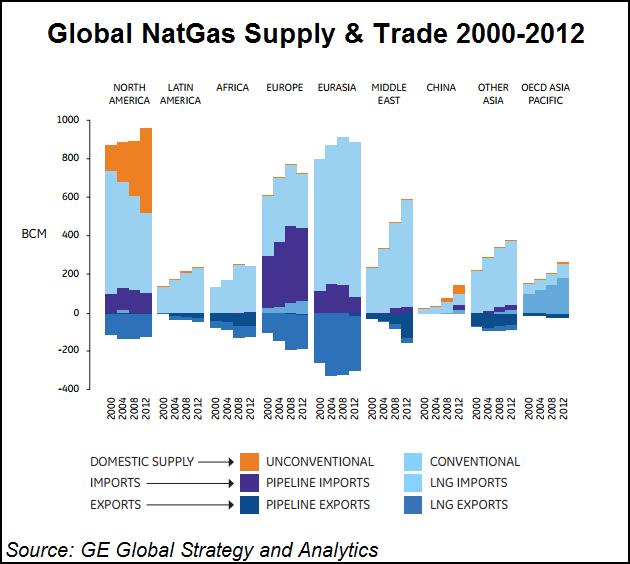

The report projects that global gas consumption will grow by 36% between now and 2025, increasing gas to 26% of global energy consumption. GE’s white paper characterizes current global gas demand at 3,500 billion cubic meters (bcm) annually, or about 70% of today’s global oil market. The projection is for gas to hit 4,800 bcm annually in 2025.

Annual global investment in natural gas will rise to nearly $400 billion over the next five years, and 30% of those investments will be for the use of gas in transportation, the GE report said.

While the paper is bullish, its authors also offer words of caution, noting that their Age of Gas outlook “is not a foregone conclusion.” They note that many “complex pieces” need to fall in place. In the end, however, the report predicts that gas will win substantial market share globally from both oil and coal.

“Gas network growth and new supply options like shale gas, coupled with technology innovation, are contributing to creating greater network density, a greater flexibility, and improved economics,” Evans and Farina concluded. “Indeed, the power of networks and the Age of Gas are closely inter-linked and will contribute to a range of valuable benefits.”

Among the benefits that they cite in the 76-page report are significantly lower environmental emissions relative to other fossil fuels, synergies with more intermittent renewables, and contributions to overall energy system resilience to disruption.

Amy Myers Jaffe, executive director of energy and sustainability at the University of California-Davis, said on her blog that the GE report outlines “the incredible synergies” that could develop from the increasing links among ship, pipeline, rail and trucking networks for natural gas, LNG, compressed natural gas and small-scale generation and fueling systems.

Jaffe said the GE white paper makes it clear that the U.S. federal government needs to embrace global energy exports as a means of fostering competitive investment and more consumer choice. “The U.S. government needs to support the reform of the electricity utilities to hasten the transition that GE is describing in its white paper,” Jaffe said.

The gas networks of technology and software, as well as the infrastructure ones, are becoming “more diverse and expanding globally,” according to GE’s report. That includes large-scale pipeline and massive new LNG projects, along with small-scale networks, including distributed and “satellite” gas applications (small power generation, microgrids and fueling stations).

Investments in gas infrastructure currently range from $250-$300 billion annually, and about a quarter of that is aimed at expanding gas transportation networks, the report noted. “Over the next five years, gas transportation network development is likely to account for nearly 30% of annual capital spending of $400 billion global gas industry,” the authors said.

Ultimately, more global investment and continued technology innovations, particularly in exploration/production activities, will be needed to realize the new gas dominance, the report said. “This means redefining what is possible in gas operations, including enabling oil substitution, improved water management, reduction of fugitive emissions and gas flaring, and other new approaches to advance efficiency and electrification.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |