Bakken Shale | E&P | NGI All News Access

North Dakota Official: Bakken ‘Changed World Markets’

In anticipating 1 million b/d of North Dakota crude oil production in the next few months, the state’s chief oil/natural gas overseer said Tuesday that the Bakken Shale has changed world energy dynamics to the point that North America soon may be a net exporter of oil.

Only long spans of bad weather or too-strict federal regulations could slow the steady growth in oil and gas production in North Dakota, said Lynn Helms, director of the Department of Mineral Resources, during a monthly webinar in which records for both oil and gas monthly production were announced for August (see Shale Daily, Oct. 16).

While reporting on a short-term setback in McKenzie County due to prolonged rainstorms that forced road closures, shutting down drilling operations in the state’s largest oil producing county, Helms said depending on how long the closures go on the million barrel per day milestone may get postponed. But that would only mean until the first quarter of 2014, he said.

Helms said the Bakken introduced shale oil to the world, and it has “changed world markets to the extent that North America could become a net oil exporter, completely self-sufficient in terms of oil and gas.

“It has changed the world dynamic of all the [energy] flows across the globe.”

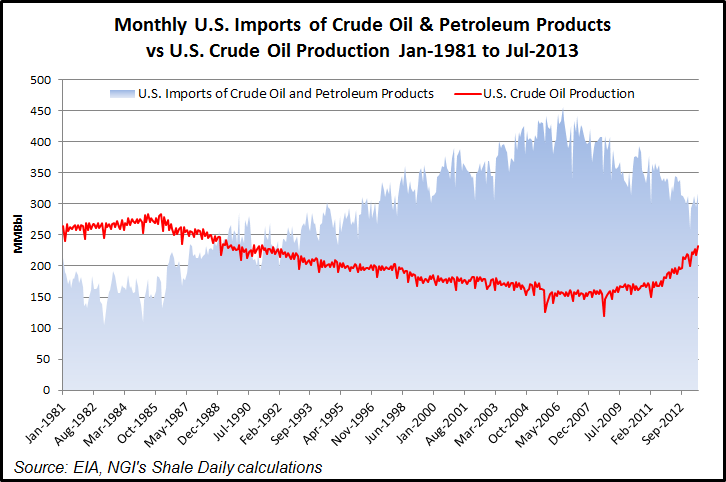

Domestic monthly crude oil production, which had been in decline since the mid-1980s, has been in the upswing for the past few years, reaching 232 million barrels in July, according to Energy Information Administration data. Meanwhile, U.S. imports of crude oil and petroleum products have been in decline, totaling 317.5 million barrels in July.

Justin Kringstad, director of the North Dakota Pipeline Authority, reported that the percentage of crude oil transported by rail continued to decline, hitting 61% in August after being more than 70% a few months earlier, but said that is likely to reverse over the rest of the year. Rail transport is more attractive when the difference between WTI and Brent global oil prices widens, and that is beginning to happen again after a few months of narrowing in the two price indexes, Kringstad said.

“The spread between the Midcontinent WTI price and the Brent price has widened since July, and as of yesterday [Oct. 14] it was $8.69[/bbl difference], so we may see some barrels begin to move back toward the rail transport,” he said. “Earlier in the summer we saw the spread tighten and barrels come off of the rail and into pipes.”

Helms said oil prices in the Bakken have “softened a little bit,” but not a great deal, and natural gas prices have stayed about the same. “The train just keeps on rollin’,” he said, although the continuing issue of flared associated gas and the more recent issue of a big drop in the number of completed wells month over month are causing some concerns.

An industry task force looking at ways to reduce flaring has identified the need for operators to stay engaged with midstream infrastructure developer/operators and to share more timely information with one another, Helms said.

“The first two meetings of the task force were all about what information do we have that should be shared and what kind of model has [the industry] been operating under. And finally, what are the barriers to getting flared gas processed and out of the state? All of those cards are on the table now,” said Helms, noting the state has given the task force about three months to come up with some recommendations.

In the meantime, while North Dakota produced more than 1 Bcf/d of natural gas in August, 29% was flared, meaning that only about 700 MMcf/d was processed and sent to market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |