NGI The Weekly Gas Market Report

NGI Archives | NGI All News Access

Canada-Asia LNG Success Keyed to High Oil Price, Contracts

Canadian hopes to export liquefied natural gas (LNG) rely on oil prices to stay high and overseas supply contracts to uphold value parity between the two energy commodities, an industry analyst said Thursday.

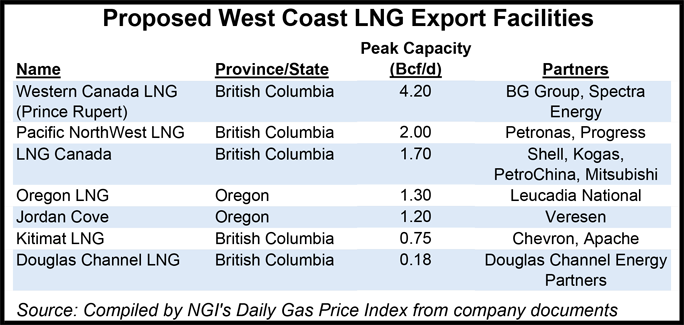

Industry analyst Paul Ziff described the formidable economic needs of LNG export plans for the northern Pacific Coast of British Columbia (BC) at a Calgary meeting of the Canadian Society for Unconventional Resources. Ziff Energy Group has done supporting supply and demand reports for six of eight LNG terminal projects lined up for gas export licenses from the National Energy Board (NEB).

The proposed Canadian-Asian trade in LNG will be no bonanza even if its price stays near energy par with oil because new facilities will be costly to build from scratch in northern BC, according to Ziff.

At a forecast average oil price of C$85.62/bbl for 2017-2012, the period when BC projects aim to begin shipments, current near-parity overseas contract indexes would value LNG at $12.54/MMBtu. The anticipated LNG price creates an arbitrage opportunity, or gain, of $7.96/MMBtu for Canadian production, which Ziff expects to fetch an average $4.58/MMBtu if it stays on glutted North American markets.

However, $6.18/MMBtu, or nearly 80%, of the gain is eaten up by costs of reaching Asia from the northern BC or Alberta shale gas deposits where LNG supplies are expected to originate. The projected LNG export expenses include 88 cents/MMBtu for tolls on jumbo new pipelines proposed to cross BC from gas-producing areas to ports at Kitimat or Prince Rupert, $4/MMBtu for multibillion-dollar terminals to liquefy the gas, and $1.20/MMBtu for tanker voyages across the Pacific.

Ziff’s sketch of the economic obstacle course faced by BC LNG export schemes drew no quarrels from the well-attended annual shale gas and oil congress in the Canadian industry capital of Calgary.

He echoed widespread consensus among gas producers, financial analysts and supporters of the Asian export campaign that it needs regulatory and political help. The hopes include brisk passage past environmental opponents of pipelines and shale development with hydraulic fracturing, and moderation of BC government ambitions to parlay LNG development into a $100 billion provincial “prosperity fund” of royalties and possibly a special export tax.

At the same time, BC supporters got a reminder that their entry is not the only contender in the gas race to Asia. A Calgary firm said it has seen interest in overseas markets for Canadian gas that would be turned into LNG and loaded onto tankers at a terminal proposed for the Pacific Coast of the United States.

Veresen Inc. (formerly Fort Chicago Energy Partners LP), which has interests in Alliance Pipeline and northern Alberta gas processing plants, reported a marketing coup by its Jordan Cove LNG export project on the Oregon coast at Coos Bay (see NGI, Sept. 23). Prospective customers headquartered in Indonesia, India and an undisclosed east-Asian country have agreed to work on negotiating 25-year supply contracts with Jordan Cove.

Veresen in September filed an application with NEB for a 25-year license to export up to 1.55 Bcf/d, or 9 million metric tons a year, from Canada to the United States initially to supply the proposed Jordan Cove project (see NGI, Sept. 16; May 27). Canada gas would reach the Jordan Cove terminal via existing pipeline and gathering networks to the Malin trading hub in southern Oregon and then be transported through the Pacific Connector, a 232-mile, 36-inch proposed pipeline owned equally by Veresen and Williams. The tentative deals with overseas customers are nonbinding heads of agreement to guide development of firm commitments. Each of the prospective customers is a large gas buyer that would take 25% or more of Jordan Cove’s proposed initial annual shipments.

Jordan Cove is the most recent entry into the lineup for NEB export licenses. The Calgary-owned, Oregon-located project has told the board that most and potentially all of its LNG will be made from Canadian-sourced gas. Veresen-Jordan Cove’s target supplies may travel most of the way to the proposed Oregon terminal on current export legs in the TransCanada Corp. and Spectra pipeline systems between BC, Alberta and the U.S. Pacific Northwest.

Total costs of the entire Jordan Cove project are forecast to be $7.5 billion, including the Coos Bay terminal and the Pacific Connector link to the established pipeline grid at Malin near the Oregon-California border. In BC, forecast costs of new pipelines alone to Prince Rupert or Kitimat alone run from $5-8 billion.

Veresen’s Jordan Cove package and the tall economic hurdles that the industry faces in BC prompted Calgary executive Jim Prentice, vice-chairman of the Canadian Imperial Bank of Commerce and a former senior federal Conservative cabinet minister, to predict recently that the first Canadian LNG to reach Asian markets could embark via a U.S. terminal.

In related news, Malaysian Prime Minister Najib Razak vowed that Petroliam Nasional Bhd (Petronas) will keep promises that secured Canadian approval of its takeover of Calgary’s Progress Energy by pressing ahead on a BC export project. He made the ceremonial pledge after Malaysian soldiers saluted, played the Canadian national anthem and flew a maple leaf flag when Prime Minister Stephen Harper arrived from Ottawa for a meeting of the Asia-Pacific Economic Council (APEC). It was the first visit to Malaysia by a Canadian head of state in nearly two decades.

“This is a very significant landmark decision,” said Razak. Harper added, “All the indications I have are that Petronas is looking at further investments,” beyond the C$5.2 billion paid for Progress last winter (see NGI, Dec. 17, 2012).

On paper, the Malaysian connection will eventually add up to the largest-ever single foreign investment in Canadian energy supplies: C$36 billion, including costs of the corporate takeover, an LNG terminal in BC at Prince Rupert, construction of an allied pipeline project by TransCanada, and production development of Progress shale gas properties in northern BC.

Canadian officials of the Petronas-Progress team said the ceremonial political support did not change the previously declared plan. No overseas contracts or customers — the missing links in all projects in the eight-entry Canadian lineup to build LNG export facilities — were announced. The Petronas-Progress project remains in the early stages of seeking export, construction and environmental permits on a schedule that calls for approvals and a commercial decision to proceed by the end of 2014 in order to start operations in 2018.

But the Malaysian affirmation of investment intentions sounded a bright political note in Canada for Harper, whose APEC trip was not expected to be rewarded by completion of a long sought, multi-nation trade agreement known as the Trans Pacific Partnership. The glad tidings about long-range LNG development were especially welcome in BC, where Harper’s Conservative government holds 21 of the province’s 36 seats in Parliament and faces fights to keep them all against lively opposition by the New Democrats (12 BC seats), Liberals (two seats) and Green Party (one seat).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 |