NGI Archives | NGI All News Access | Shale Daily

Regency, PVR In $5.6B Multi-Basin Midstream Tie-Up

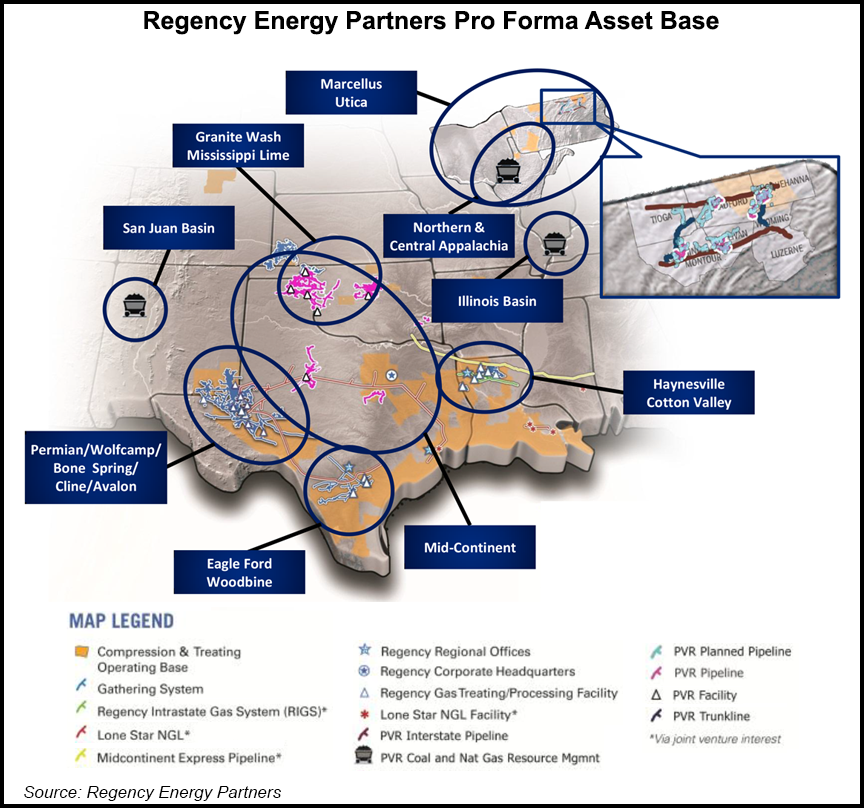

Regency Energy Partners LP plans to buy PVR Partners LP in a $5.6 billion deal (including $1.8 billion of debt) to create a natural gas gathering and processing giant with a presence in Appalachia, West Texas, South Texas, the Midcontinent and North Louisiana.

“This acquisition enhances our overall geographic diversity by providing Regency with a strategic presence in two prolific producing areas,” the Marcellus and Utica shales in the Appalachian Basin and the Granite Wash in the Midcontinent region, said Regency CEO Michael J. Bradley. “These are tremendously complementary businesses…”

During a conference call with financial analysts, Bradley noted the bulking up taking place among midstream players as more infrastructure is needed to get growing oil and natural gas production from shales to market.

Also on Thursday, Crestwood Midstream Partners LP said it is buying privately-held Arrow Midstream Holdings LLC for $750 million, expanding its focus in the Bakken Shale and building on its just-completed merger with Inergy Midstream (see related story).

In March, CenterPoint Energy Inc., OGE Energy Corp. and ArcLight Capital Partners said they were forming a midstream master limited partnership (MLP) with thousands of miles of intrastate and interstate pipelines in Oklahoma, Arkansas, Texas and Louisiana (see Shale Daily, March 18).

Regency Energy Partners is a member of the Energy Transfer family, which includes three other publicly traded partnerships: Energy Transfer Partners LP, Energy Transfer Equity LP, and Sunoco Logistics Partners LP. In 2011, Energy Transfer announced a deal to acquire Southern Union Co. (see Shale Daily, June 17, 2011). More recently, it entered the crude oil and refined products business by acquiring Sunoco Inc., including its interest in Sunoco Logistics Partners LP (see Shale Daily, May 1, 2012). Like its siblings in the Energy Transfer family, Regency Energy Partners aims to grow.

“…[I]n an industry where size and scale are becoming increasingly important, the combined company will be a top-15 MLP when measured by enterprise value…” Bradley said. “This transaction materially increases Regency’s weighting toward its core gathering and processing [G&P] business. In particular, 73% of the combined company’s growth capital expenditures in 2013 will be G&P focused and will be underpinned largely by fee-based cash flows.”

The addition of PVR’s assets in Appalachia and the Midcontinent to Regency’s footprint in the Permian Basin, South Texas and North Louisiana puts the combined company in many of the most economic, high-growth unconventional oil and gas plays in North America: the Wolfcamp, Bone Spring, Avalon and Cline shale in the Permian Basin, the Eagle Ford Shale in South Texas, the Marcellus and Utica shales in Appalachia, the Granite Wash in Oklahoma and Texas and the Haynesville Shale and Cotton Valley formation in North Louisiana, Regency said.

The transaction is to be unit-for-unit plus a one-time cash payment to PVR unitholders and is expected to close in the first quarter. The combination builds on Regency’s fee-based cash flows and is expected to be slightly dilutive to 2014 distributable cash flow (DCF), but it is not expected to affect anticipated cash distribution growth in 2014. The enhanced scale, balance sheet strength and diversification are expected to provide substantial earnings before interest, taxes, depreciation and amortization (EBITDA) and DCF growth over time, Regency said.

The acquisition better positions the combined company to capitalize on the long-term growth momentum of North American gas production through incremental, high-value expansions around its core asset base, as well as other growth and acquisition opportunities, Regency said. “The combined company will also benefit from the addition of a growing fee-based asset portfolio, with all the Marcellus and Utica margin coming from fee-based contracts.” The acquisition also provides Regency with an expanded talent base.

“We view this transaction as a merger creating a larger, more diversified operating platform that will be highly attractive to investors, customers, creditors and employees,” said PVR CEO William H. Shea, Jr. “We believe that the size and scope of the combined enterprise will be highly beneficial to our unitholders, offering added diversification and critical mass…”

Holders of PVR common units, Class B Units and Special Units will receive 1.020 common units of Regency for each PVR unit held. In addition, PVR unitholders will receive a one-time cash payment at closing estimated to be $40 million in the aggregate. The consideration to be received by PVR unitholders is valued at $28.68 per common unit based on Regency’s closing price as of last Wednesday, representing a 25.7% premium, and a 24.8% premium to the volume-weighted average closing price of PVR common units for the 10 trading days ending last Wednesday.

Regency Energy Partners units on the New York Stock Exchange closed down nearly 8% Thursday at $25.63 in heavy trading. PVR Partners units closed up nearly 13% at $25.75, also in heavy trading.

The combined company is to retain the Regency name and have its headquarters in Dallas. Bradley will continue as CEO, and Thomas E. Long will continue as executive vice president and CFO of the combined company. The transaction is subject to the approval of PVR unitholders, antitrust clearance and other customary conditions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |