E&P | NGI All News Access | Permian Basin

Permian Basin ‘Booming,’ Atmos Gas Buyer Says

The venerable Permian Basin, which has seen its share of booms and busts in its 86-year production history, is booming beyond most of the industry’s recognition, said Alan Chambers, senior gas buyer for Atmos Energy Corp. and a native of the Permian region.

Chambers was on a panel of three gas buyers at the LDC Gas Forum Rockies & West conference in Los Angeles. They agreed that the times are good for buying natural gas.

“I don’t know if it is a secret or not, but the whole place is booming right now; you can’t buy a house or find a motel room, and they keep bringing in new fracking crews and other crews every day,” said Chambers.

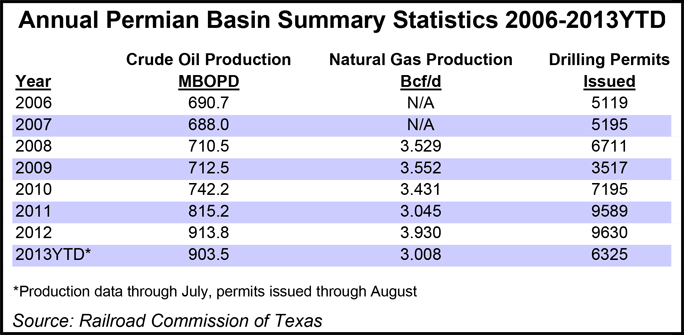

Crude oil production in the Permian has increased steadily in recent years, hitting 913,800 b/d in 2012, and was 903,500 b/d in the first seven months of this year, according to Railroad Commission of Texas data. Natural gas production over the same period has been more erratic: 3.53 Bcf/d in 2008, 3.05 Bcf/d in 2011, 3.93 Bcf/d last year and 3.01 Bcf/d so far this year.

“There is going to be plenty of gas coming from the Permian Basin and the Eagle Ford Shale plays for quite awhile, but people in the [exploration and production] business tell me that there are producing formations down below the formations they are focused on now that might be just as good as these,” Chambers said. “There is multi-level production they haven’t even tapped yet.”

Chambers, along with Southern California Gas Co. (SoCalGas) gas acquisition manager Steve Baird and Black Hills Corp.’s Henry Ono, senior manager for planning and forecasting, agreed that volatility and prices are not issues in the gas-buying world right now. Reliability and diversity are the keys, they said.

In regard to the Permian, Chambers, who began his 45-year career in the industry as a roughneck in the West Texas oil/gas fields, said the Permian is called “the gift that keeps on giving” by the local residents in the area.

“Since 1927, the Permian has been producing oil and natural gas with up and down cycles, but this current cycle seems to have a lot of legs because of the new hydraulic fracturing techniques. There also are some very profitable wells being drilled in the western part of the basin that are vertical wells, and they are cheaper to drill,” he said.

Calling it a newly discovered production area on the eastern end of the Permian, Chambers identified the Cline Shale as perhaps the next Eagle Ford. The Cline is about 140 miles long, 70 miles wide and 200-550 feet thick. It lies above the eastern shelf of the Permian Basin, and is considered the D interval of the Permian-aged Wolfcamp Shale. Occidental Petroleum Corp.’s Centurion Pipeline LP is proceeding with a new oil pipeline out of the Cline (see Shale Daily, Aug. 8).

“From the early reports of it, Cline is going to be another very good field — like the Bakken, eventually — and they have already begun producing there,” Chambers said. “Atlas Pipeline has connected up with our pipeline to deliver some of the Cline Shale gas that is only just now beginning to be developed,” Chambers said.

Chambers said there is not much public information coming out of the Cline, and he thinks that could mean there are either “some very good wells, or some very bad wells there.” He thinks most of the gas will find its way to westerly interstate pipelines, such as El Paso or Transwestern.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |