NGI Archives | NGI All News Access

Futures Up Again After Supportive Storage Data As Cash Sags

Undeterred by the formation of Tropical Storm Erin off the coast of Africa, physical natural gas prices on Thursday for Friday delivery slumped across much of the country, except for much of California, which saw individual points rise from a penny to a nickel.

In the spot market, traders took their cue from the ramping-up weather activity in the tropics as well as a smaller-than-expected 65 Bcf natural gas storage report Thursday morning. September gas lunged higher to record a two-plus week high of $3.427 before finishing the regular session at $3.419, up 7.7 cents from Wednesday’s close and up a combined 13.4 cents, or 4.1%, over the last two regular sessions.

Most declining cash points on the day dropped a few cents to just shy of a dime, while some northeastern points saw decreases of 15 cents or more as a cold front bathed much of the region in 60- and 70-degree temperatures, as opposed to summer norms in the 80s and 90s.

In the East, Algonquin Citygate deliveries were off 12 cents to average $3.29, while Dominion lightened by 12 cents to $2.98. Cooler temps also highlighted the Marcellus Shale’s supply glut once again as Transco-Leidy Line and Tennessee Zone 4 Marcellus dropped 23 cents and 37 cents, respectively, to average $2.59 and $2.25.

“Nothing really earth-shattering today to report,” a Northeast marketer told NGI. “I think it will be more interesting to see what happens Friday for the three-day delivery. We had a somewhat bullish storage report, storm activity is picking up, and near-month futures recorded back-to-back gains, each of more than a nickel. I think it will be hard for [cash] traders to ignore such strength from the screen on two consecutive days.”

Turning attention to the West, which enjoyed the day’s only price gains, Southern California Border added a nickel to average $3.51, while Socal Citygate tacked on a penny to average $3.56. However, the gains were not across the board in the Golden State as PG&E Citygate slipped 2 cents to $3.64.

Cash prices could be looking to reverse course in the coming days if the recent increase of weather activity in the tropics turns into a Gulf of Mexico infrastructure-threatening hurricane. In the National Hurricane Center’s (NHC) late afternoon report Thursday, newly-named Tropical Storm Erin was sporting 40 mph winds while moving away from the Cape Verde Islands over the tropical Atlantic in a west-northwesterly fashion at 14 mph. The NHC said it was expecting some strengthening over the succeeding 48 hours.

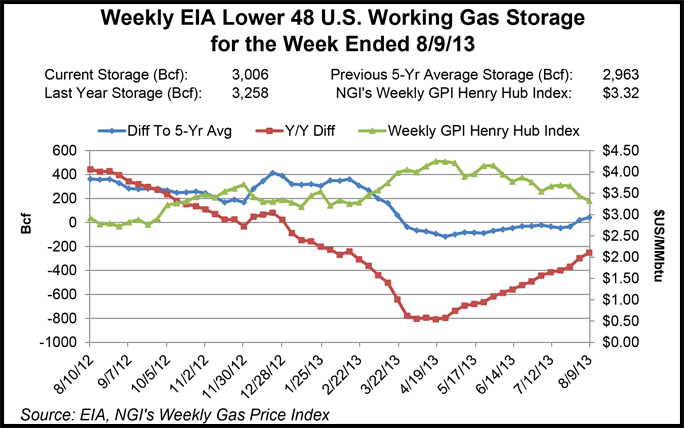

After weeks of larger-than-expected natural gas storage injections, natural gas price bulls received minor support Thursday morning when the Energy Information Administration (EIA) reported that 65 Bcf was injected into underground storage for the week ending Aug. 9. While the injection was still significantly larger than historical comparisons for the week, it came in just below most industry estimates.

As a result, natural gas futures market bulls came alive. Heading into the 10:30 a.m. EDT report, September futures were trading at $3.362, but jumped to $3.400 in the minutes immediately after it hit the street.

“We had heard as high as 72 Bcf, so this was definitely a surprise for the bulls,” a New York floor trader told NGI.

Ahead of the report, a Reuters poll of 26 analysts revealed an average 70 Bcf injection expectation with a range from 62 Bcf to 79 Bcf. Ritterbusch and Associates was looking for an increase of 68 Bcf, and Bentek Energy’s flow model calculated a 67 Bcf addition. Last year for the week a mere 20 Bcf was injected, and the five-year average was a 42 Bcf build.

As of Aug. 9, working gas in storage stood at 3,006 Bcf, according to EIA estimates. The week’s injection further eroded the current deficit to last year, while increasing the current surplus over the five-year average. Stocks are now 252 Bcf less than last year at this time and 43 Bcf above the five-year average of 2,963 Bcf.

Continuing mild summer temperatures in the East allowed the region to inject 51 Bcf into storage for the week, while the West Region chipped in 10 Bcf and the Producing Region added 4 Bcf. The Producing region salt cavern storage figure decreased for the week by 4 Bcf to 261 Bcf, while the non-salt cavern figure rose by 8 Bcf to 792 Bcf. The EIA first split Producing Region facility types in storage report footnotes in March 2012 in an effort to give analysts and industry more comprehensive information on the relationship between natural gas inventory changes and types of storage facilities.

Addison Armstrong of Tradition Energy sees the market undergoing a delicate balancing act between expectations of warmer temperatures offset by high production. “Prompt gas prices have now spent a week consolidating above a six-month low near $3.30 as traders eye the return of hot weather and potentially elevated cooling demands across the Midwest and Northeast, plus a pick-up in tropical weather activity,” he said.

“But near-record production levels of gas and the approaching start of this fall’s slack demand shoulder season is likely to provide growing resistance to rising gas prices in the coming weeks. Weather forecasts are little changed from [Wednesday], with normal to below-normal temperatures expected across the East in the next five-days followed by a shift warmer during the latter part of this month. Texas and the Southeast are expected to see normal to below-normal temperatures during the latter part of August.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |