NGI Archives | NGI All News Access

EIA Nudges Price Outlook Down; Production Unchanged

In its latest Short Term Energy Outlook (STEO), the Energy Information Administration (EIA) nudged down is Henry Hub natural gas price forecast for this year and next and predicted that coal-fired power plants will retain their recent gains over gas-fueled facilities. The gas production outlook held steady with last month’s STEO.

Natural gas spot prices averaged $3.83/MMBtu at the Henry Hub in June, down 21 cents from the previous month, it said. EIA expects that the Henry Hub price will increase to $3.76/MMBtu in 2013 and $3.91/MMBtu in 2014 from an average of $2.75/MMBtu in 2012. One month ago the agency projected a larger price increase.

In the previous STEO, EIA said it expected that the Henry Hub spot price would increase to $3.92/MMBtu this year and $4.10/MMBtu in 2014 (see Shale Daily, June 13). The change in outlook reflects a reduction of 16 cents/MMBtu and 19 cents/MMBtu for 2013 and 2014, respectively.

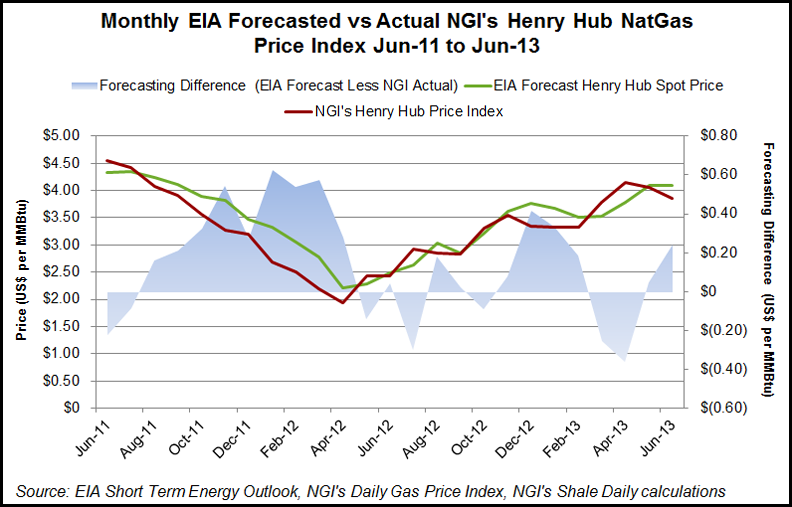

According to NGI calculations, which take into account EIA forecasts and NGI‘s Henry Hub Price Index, the EIA on average has shown a positive forecasting bias of 15 cents in its STEO over the past two years (see chart). This being the case, it might be reasonable to expect an even more pronounced drop in actual spot market prices this year, with everything else being equal.

Natural gas futures prices for October delivery (for the five-day period ending July 3) averaged $3.62/MMBtu. Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for October 2013 contracts at $2.69/MMBtu and $4.88/MMBtu, respectively, EIA said. At this time last year, the natural gas futures contract for October 2012 averaged $2.90/MMBtu, and the corresponding lower and upper limits of the 95% confidence interval were $1.74/MMBtu and $4.82/MMBtu.

While U.S. power generation overall is expected to grow by 0.8% in 2013 and by 1.0% in 2014, generators have been running their existing coal capacity at higher rates so far this year in response to the increasing cost of natural gas relative to coal, EIA said. As a result, the share of total U.S. generation fueled by coal during the first four months of 2013 averaged 39.5% compared with 35.4% during the same period in 2012. The share of generation fueled by natural gas fell from an average of 29.5% during January-April 2012 to 25.8% this year.

EIA said it expects coal-fueled power plants to continue their increased level of generation, averaging 40.1% of total generation in both 2013 and 2014. The share of U.S. generation fueled by natural gas averages 27.6% in 2013 and 27.3% in 2014.

Industrial natural gas use during the first five months of 2013 was more than 4%, or 0.9 Bcf/d, greater compared with the same period in 2012, reflecting economic gains and sustained, historically low gas prices that have provided operators of natural-gas-intensive industrial facilities a cost advantage compared with competing facilities that rely on higher-cost energy sources. Projected industrial sector gas use increases by 2.2% in 2013 and 1.3% in 2014, according to EIA.

The agency said it expects that gas consumption, which averaged 69.7 Bcf/d in 2012, will average 70.1 Bcf/d and 69.7 Bcf/d in 2013 and 2014, respectively. Colder winters forecast for 2013 and 2014 (compared with record warmth in 2012) are expected to increase the amount of gas used for residential and commercial space heating. However, the projected year-over-year increases in gas prices contribute to declines in gas used for power generation from 25.0 Bcf/d in 2012 to 22.4 Bcf/d in 2013 and 22.2 Bcf/d in 2014, although these forecast levels are still high by historical standards, EIA said.

Marketed natural gas production is projected to increase from 69.2 Bcf/d in 2012 to 70.0 Bcf/d in 2013 and to 70.4 Bcf/d in 2014, which is identical to last month’s STEO. Onshore production increases over the forecast period, while federal Gulf of Mexico production from existing fields declines as the economics of onshore drilling remain more favorable. Gross imports of gas via pipelines, which have fallen over the past five years, are projected to remain near their 2012 level over the forecast. Liquefied natural gas imports are expected to remain at minimal levels of around 0.4 Bcf/d in both 2013 and 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |