NGI Archives | NGI All News Access

Carrizo’s Eagle Ford Soars Higher

Carrizo Oil & Gas Inc. raised second quarter oil production guidance to 10,800-11,200 b/d from 9,600-10,000 b/d, increased its 2013 crude oil production growth target to 40% from 28% and raised its total 2013 production growth target to 10% from 6%, based largely on results in the Eagle Ford Shale.

Carrizo’s results in the Eagle Ford Shale have been exceeding management’s expectations, with oil production averaging roughly 9,500 b/d through the first two months of the quarter, the company said. Key drivers of the outperformance have been flatter-than-expected decline rates from new wells in a number of areas, successful results from artificial lift installations and less well downtime than expected.

“These items have given us increased confidence in our updated Eagle Ford Shale type curve and allowed us to materially increase production guidance with only a small increase in spending,” said CEO Chip Johnson.

For natural gas and NGLs, Carrizo is maintaining its prior guidance of 90-94 MMcfe/d, but it said it expects production to be near the high end of the range. Crude oil is expected to account for more than 40% of production by year-end.

The company also revised its 2013 drilling and completion capital expenditure plan to $530-540 million from $500 million. The revised plan remains based on three operated rigs in the Eagle Ford Shale, two in the Niobrara Formation and one in the Marcellus Shale.

In the Eagle Ford, Carrizo is increasing drilling activity by three wells as a result of increases in drilling efficiencies, and increasing planned completion activity by 35 net frack stages, primarily for lease management purposes.

In the Niobrara, Carrizo now expects to drill and complete 21 net wells, up from an estimate of 17-18 previously. This results from increased nonoperated drilling and completion activity coupled with a higher working interest in a number of the company’s operated wells.

In the Utica Shale, construction of drilling pads is being moved into 2013 from 2014 to avoid winter construction. This work should allow development drilling in the play to begin in the second quarter of 2014. Carrizo now plans to spud a second Utica well prior to year-end.

During the first quarter, strong results in the Eagle Ford drove production and revenue records at the company (see Shale Daily, May 9).

Wells Fargo Securities analyst David Tameron has an “outperform” rating on Carrizo and puts a net asset value on the company of $40.59/share. “As the company shifts its focus from the Barnett towards the emerging Eagle Ford, Marcellus, Niobrara and Utica plays, we believe Carrizo will see an impressive production growth profile over the next few years while changing the production mix to be more weighted towards liquids,” he said in a note Monday. “We believe this growth coupled with cash flow to cover anticipated capital needs will drive shares to outperform peers.”

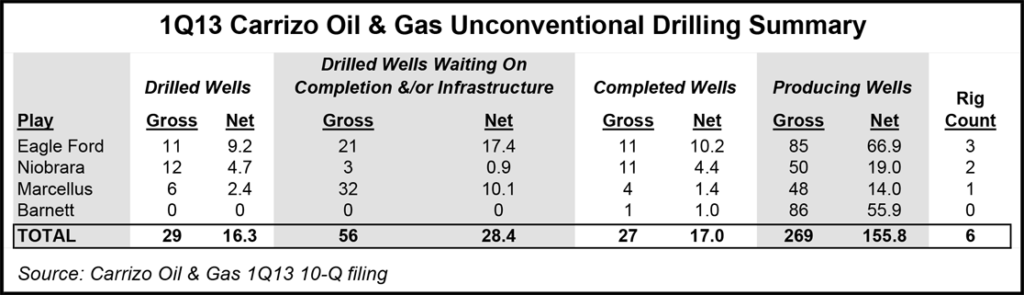

In the first three months of 2013, Carrizo had 29 drilled wells (16.3 net): 12 in the Niobrara, 11 in the Eagle Ford and six in the Marcellus. There were another 56 wells (28.4 net) drilled and waiting on completion or infrastructure, according to the company’s 1Q13 10-Q filing with the Securities and Exchange Commission. Carrizo had 27 completed wells (17 net) and 269 producing wells (155.8 net) spread across the four shale plays in the first quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |