NGI Archives | NGI All News Access

Find Fracking Solutions in ‘Water-Stressed’ U.S. Regions, Says Ceres

Energy industry efforts to reduce the amount of water used in hydraulic fracturing (fracking) through recycling and other means have to be stepped up if unconventional resources are to grow as projected, according to Ceres, which runs an influential institutional investor coalition.

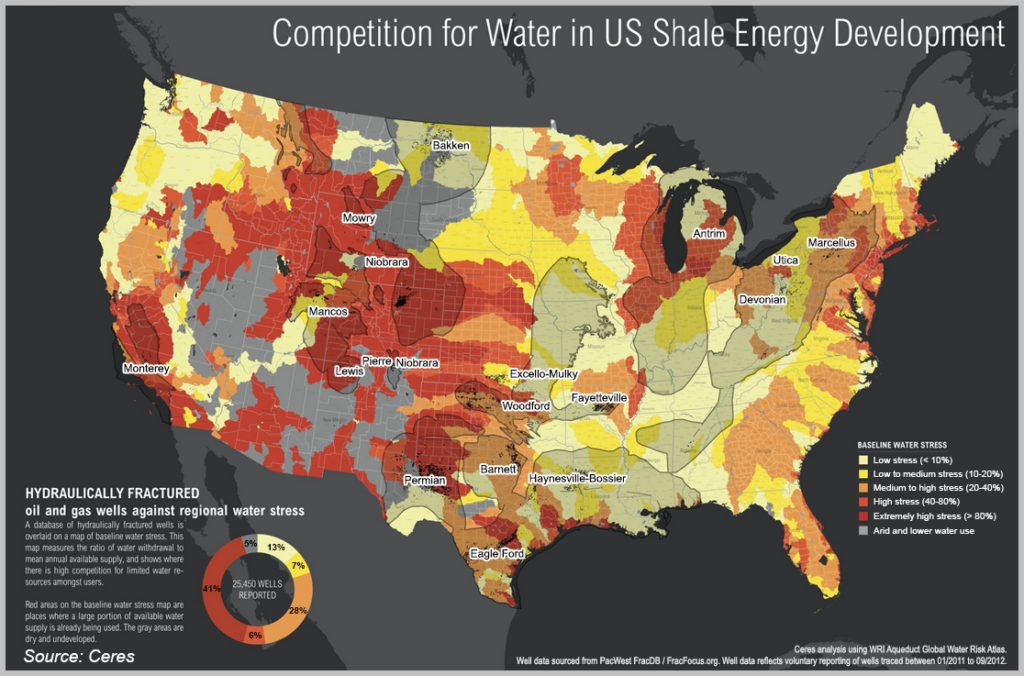

Researchers relied on well drilling and water use data from FracFocus.org on 25,450 wells in operation from January 2011 through September 2012, as well as water stress indicator maps developed by the World Resources Institute (WRI).

The data indicated that 47% of the wells developed were in water basins “with high or extremely high water stress,” with the majority in big producing basins of Texas and Colorado.

“These findings highlight emerging tensions in many U.S. regions between growing hydraulic fracturing activity and localized water supply needs,” said Ceres President Mindy Lubber.

FracFocus.org, the voluntary chemical registry, provided researchers with the location and date of each well, the chemical additives and total volume of water/well injected.

WRI’s Aqueduct Water Risk Atlas provided baseline water stress indicator maps indicating the level of competition for water in different U.S. regions by measuring total annual water withdrawals against the percentage of water available. “Extremely high water stress” indicates that more than 80% of available water already has been allocated for municipal, industrial and agricultural uses.

Ceres linked the data sets together by matching latitude and longitude coordinates to determine the extent and distribution of well production activity in regions with water competition challenges.

“Colorado and Texas showed the highest exposure to water stress,” said Ceres. “In Colorado, 92% of the wells were in extremely high water stress regions. In Texas, which accounts for nearly half of the total wells analyzed, 51% of the wells were in high or extremely high water stress regions.”

In some Texas counties, water used for fracking accounted for more than 20% of the region’s total water use, according to the report. In Pennsylvania, about 70% of the wells were in “medium to high” water stress water basins, and 2% were in high water-stress basins.

“Given projected sharp increases in shale oil and gas production in the coming years, competition over water should be a growing concern to energy companies, policymakers and investors,” because fracking use is expected to double in the coming years, said researchers. “Shale energy development cannot grow without water, but in order to do so, the industry’s water needs and impacts need to be better understood, measured and managed.”

The industry has made progress in boosting its use of recycled water and through the use of alternative water sources, the report said. Operators are beginning to use “non-freshwater alternatives” such as wastewater, saline water, seawater and acid-mine drainage. However, recycling and other sources “must increase considerably to have a significant impact,” said the report.

Ceres, which directs the Investor Network on Climate Risk, a network of 100 institutional investors with collective assets totaling more than $11 trillion, recommended that the energy industry consider working with regulators to implement:

The report is part of a study undertaken by Ceres to analyze water risks across different regional basins of North America across the entire drilling cycle, from water sourcing to water disposal. The research primarily is for investors with financial stakes in operators and that support services in these regions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |