Infrastructure | NGI All News Access

Gas-Fired Power Generation Down 14% Compared to 2012

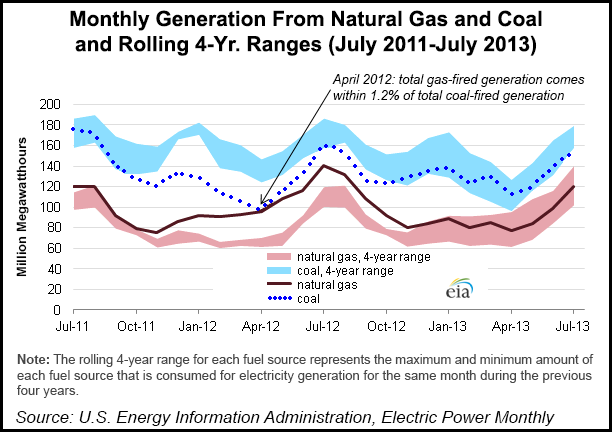

Total natural gas used for power generation in the United States was down 14% between January and July 2013 compared with the same seven month period in 2012, due primarily to higher gas prices relative to coal prices this year, according to a report issued Wednesday by the Energy Information Administration (EIA).

“High natural gas-fired generation in 2012 occurred as a result of the lowest spot natural gas prices in a decade — in fact, the two fuels contributed approximately equal shares of total generation in April 2012,” EIA said. Still, despite lower natural gas use for generation so far this year, gas use for generation remains consistently higher than levels before 2012, according to the agency.

The decline in gas used for power generation this year has generally occurred for average daily temperatures between 40 and 80 degrees, when power demand rose to levels that induced power companies to base the fuel mix of their additional generation to meet higher demand on relative fuel costs.

Trends in gas use for power vary by region, because of differences in the availability of generating plants, generating plant age and efficiency, and the relative cost of fuels to operate power plants, EIA said.

“While natural gas prices in most parts of North America are fairly uniform, the availability and cost of coal varies more by region. In addition, coal transport costs can reflect a high portion of the overall cost of delivered fuel. In some regions, such as the Southeast and Mid-Atlantic, natural gas use for power is significantly lower in 2013. This larger drop is because natural gas made greater inroads in 2012 compared to regions like Texas, where low natural gas prices in 2012 did not displace nearly as much coal-fired generation. Fuel competition is less intense in parts of the country where coal fuels a very small portion of the generation or where the delivered coal price is extremely low, resulting in relatively greater coal consumption.”

The use of natural gas for power generation in the United States has generally risen since 2008. “The increasing gas use for power is a structural change that is occurring across a wide range of temperatures and seasons,” EIA said. “Several factors underpin this trend, including moderate natural gas prices, increased shale gas production, and additions of natural gas generating capacity.”

Natural gas has pretty much won the new-build power generation game, beating coal on economics, with a predominance of gas-fired plants to be built over the next decade, according to BNP Paribas’ Teri Viswanath, director of commodity strategy (see Daily GPI, Aug. 5). In 2004, only about 25% of states burned at least 0.2 Bcf/d of gas to generate power; now nearly half of the states do.

The top five states for burning gas to generate power are Texas, Florida, California, New York and Alabama. A recent Federal Energy Regulatory Commission quarterly update of various regional efforts to coordinate natural gas and electric markets showed that the New England and Northeast generation markets will continue to be the most gas-dependent during the upcoming heating season (see Daily GPI, Sept. 20).

The Environmental Protection Agency (EPA) recently issued proposed rules for greenhouse gas (GHG) emissions for new power plants, leaving gas-fired plants mostly unaffected but making construction of new coal-fired plants problematic (see Daily GPI, Sept. 23). The proposal would come down hard on new coal-burning plants, which currently emit an average 1,768 pounds of carbon dioxide/MWh, obligating them to use carbon capture and storage technology, according to the Institute for Energy Research.

Power plants are the largest concentrated source of emissions in the United States, accounting for roughly one-third of all domestic GHG emissions, according to EPA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |