NGI Archives | NGI All News Access

Raymond James Devises Substitute for Rig Count

The move to horizontal drilling and longer laterals has made the domestic land rig count not so simple anymore, leading Raymond James & Associates Inc. on Monday to launch well and footage count forecasts.

Analysts J. Marshall Adkins and Colin Gerry also see higher capital expenditures (capex) in 2014 by domestic exploration and production (E&P) operators.

“The logic is simple: since 2013 has been a rare year of dramatic ‘underspending’ by the U.S. E&P complex, 2014 should be a ‘rebound year,’ where E&P companies spend excess cash from 2013 plus new cash generated in 2014,” wrote the analysts. U.S. E&P capex in 2014 should be stronger than ever, particularly for oil operators, with spending 5-10% higher than this year.

“In the past, we used our rig count forecast to reflect spending behavior,” wrote analysts. “The market isn’t that simple anymore. We are now initiating well count and footage count forecasts.”

Raymond James has raised its 2014 rig count forecast by 4% to an average of 1,717, almost half of an earlier prediction of a 7% hike. The well count is expected to increase “in the neighborhood of 1%,” with footage expected to be around 5% higher.

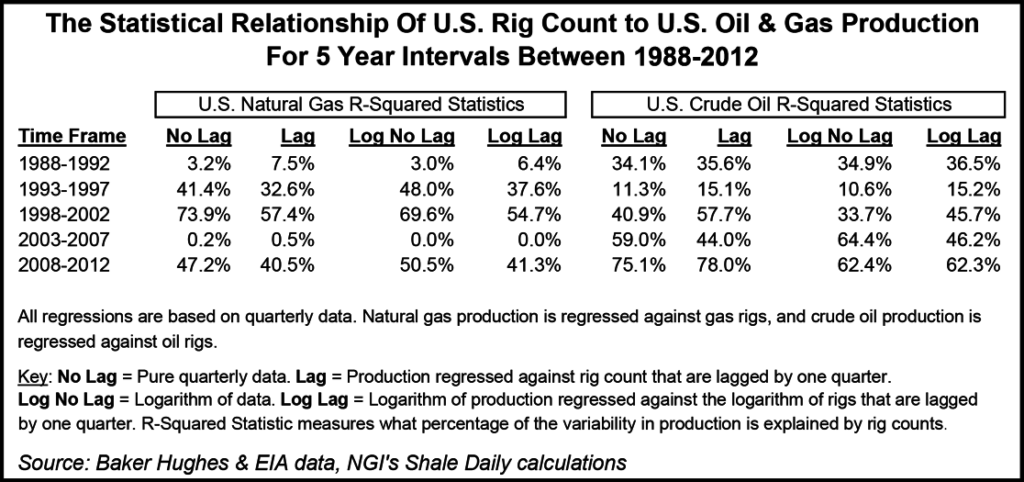

In the past, rig count forecasts had been a good proxy for E&P spending, noted Adkins. In the past several years, however, horizontal drilling and multi-stage hydraulic fracturing (fracking) has “completely blown up the rig count as the best oilfield spending metric.”

The disconnect led Raymond James to introduce a U.S. well count forecast and a footage forecast as proxies for overall oilfield spending behavior. The best correlation with domestic E&P spending now would be a combination of well footage drilled and frack stages pumped, said the analysts.

More important, the 2014 U.S. rig count should be down only 3%, the well count will trend slightly upward, and the footage drilled will jump 5%.

“In many established basins, each horizontal rig is displacing multiple vertical rigs…Because of this, the U.S. rig count has fallen over the past two years despite the highest average oil prices in history.”

Raymond James’ revised rig/well count forecasts still represent a year/year decline from 2013 but it’s more than half what analysts had forecast six months ago.

“The relative bearishness still has everything to do with efficiencies,” including pad drilling, the learning curve, and in the case of the Permian Basin, a move to horizontal from vertical drilling.

“The fact remains that drilling rigs are going to capture a smaller share of the overall E&P dollar spent as we drill more horizontal wells with longer laterals and more frack stages.”

The analysts used Spears and Associates well data to determine that 48,100 wells were drilled in 2012. However, even with a 20% surge in 2013 E&P cash flows, the domestic rig count this year is forecast to fall about 4% to 46,400 wells.

The move away from vertical to horizontal wells over the past eight years generally has meant that E&Ps are drilling fewer wells per active rig, said analysts.

“Simply put, horizontal wells have more footage and take longer to drill than vertical counterparts in the same basins. Now that the horizontal count is up to more than 60% of total rigs, however, the vertical to horizontal shift should become less of a driver while pad drilling becomes a larger driver.”

The switch to more shallow, oily wells from deeper natural gas targets won’t impact 2014 well counts as much as pad drilling, but improved drilling speeds should result in more wells per active well.

“The combination of all of these trends combined should allow the overall U.S. well count to outpace the rig count over the next several years.”

In a note Monday, Tudor, Pickering, Holt & Co.’s analysts highlighted the “choppy” domestic land rig count of late, with RigData reporting a loss of 40 rigs week/week, while Baker Hughes Inc. said there were seven fewer total rigs and over four weeks, 17 fewer.

There appears to be a “directionless rig count” even though oil prices are higher, said analysts, which indicates the “impact of efficiency gains but also an industry mindset: outside of the Permian, there’s no real momentum to accelerate.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |