NGI Archives | NGI All News Access

Cash and Futures Tread Water Before and After Storage Data

Friday deliveries of physical natural gas on average were unchanged in Thursday’s trading as most traders elected to get their deals done ahead of what can often turn into a market broadside once the Energy Information Administration (EIA) releases storage figures at 10:30 a.m. EDT.

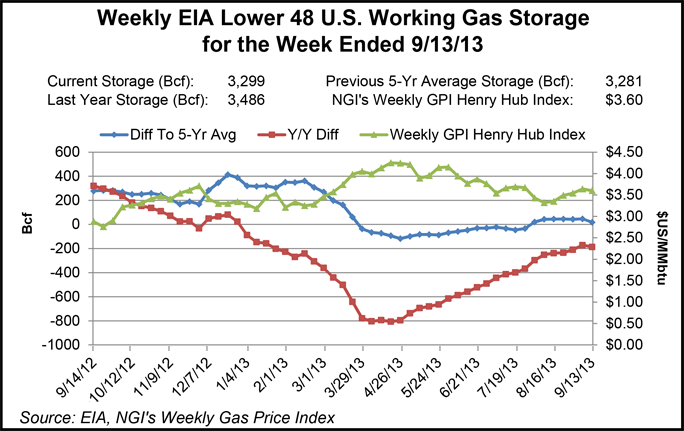

Most points traded within a few pennies of unchanged and Marcellus locations were able to post the day’s most robust gains. The EIA reported a thin 46 Bcf build, about 6 to 10 Bcf below consensus expectations, and October futures immediately reached another eight-week high of $3.820. By the time the dust had settled, though, October finished the day up a miserly 0.7 cent to $3.720, and November had added just 0.8 cent to $3.795. October crude oil fell $1.68 to $106.39/bbl.

Midwest points were off a few pennies as forecasters called for load-killing storms and thunderstorms across a vast portion of the nation’s midsection.

“The storm system that brought severe thunderstorms to parts of the Northwest on Tuesday and the northern Plains on Wednesday will move across the Midwest Thursday and Friday,” said AccuWeather.com meteorologist Mike Doll. He said “powerhouse” thunderstorms on Wednesday would rake the Dakotas and “will shift farther east and south on Thursday, reaching the Upper Midwest and central Plains.

“During Thursday night, the risk of strong thunderstorms will shift into the Great Lakes region and southwestward into the middle Mississippi and lower Ohio valleys. Chicago and Milwaukee are most likely to be hit by the storms Thursday night. Louisville, St. Louis, Indianapolis, Detroit and Cincinnati could be affected by strong thunderstorms on Friday.

“There were locally drenching showers and thunderstorms occurring well ahead of the zone of severe weather Thursday over the Midwest. These were affecting parts of Indiana and the Lower Peninsula of Michigan, to name a couple of areas.”

Chicago’s Thursday high of 83 was forecast to drop to 73 Friday and reach 66 on Sunday, according to AccuWeather.com. The normal high in Chicago is 75. Milwaukee’s Thursday high of 79 was anticipated to drop to 76 on Friday and 63 on Sunday. The seasonal high in Milwaukee is 70. Detroit’s high Thursday of 80 was expected to rise to 81 Friday and drop to 65 on Sunday. The seasonal high in the Motor City is 73.

A Midwest utility buyer downstream from Rockies production heading east reported no impact from the outages on Colorado Interstate Gas from a force majeure earlier in the week. (see related story). The buyer said their gas purchased off Northern Natural connects off of Trailblazer, which connects with CIG, but “we haven’t seen any impact. We typically use 33,000 Dth/d, but that will be going up to 40,000 Dth/d because of a liquefaction plant we are bringing on line, and then to 45,000 or 50,000 Dth/d because it will be getting colder,” he said.

Gas on Alliance fell by 3 cents to $3.84, and Friday deliveries to the Chicago Citygates was flat at $3.84. On Northern Natural Ventura, Friday packages were seen at $3.74, 3 cents lower, and at Demarcation Friday gas came in at $3.73, down 2 cents.

Gas on Consumers was unchanged at $3.98, and on Michcon next-day parcels changed hands at $3.92, also unchanged. At Dawn, gas for Friday was seen at $4.11, up three cents.

Infrastructure-challenged points in the Marcellus were the day’s big gainers. Transco-Leidy Line gas rose 47 cents to $1.80, and deliveries to Tennessee Zone 4 Marcellus added 26 cents to $1.61.

Other major market centers fluctuated around unchanged. The Henry Hub was quoted at $3.73, up two cents, and Tetco M-3 was seen down 1 cent at $3.72. El Paso non-Bondad came in 3 cents lower at $3.64, and at the SoCal Citygates Friday gas changed hands at $3.89, 2 cents higher.

The main futures price driver Thursday was the release of storage data, and last week’s storage report had analysts thinking the risk was to the high side because of the likelihood of increased builds resulting from the Labor Day weekend. The actual figure came in at 65 Bcf, generally behind expectations of a few Bcf higher. This week industry pundits saw the opposite: risk to the low side of the market consensus.

“[W]e feel similarly confident the risk is to the low side of the consensus. The survey index (average of all the big survey averages) came in at 56 Bcf and our [Energy] Metro Desk consensus was even lower at 54 Bcf (average and median),” said John Sodergreen, editor. “We note too that the spread of forecasts between the three surveys we track was just a hair below the magic 3 Bcf number; it came in at 2.9. Recall that a 3 or more Bcf spread between analyst categories typically (+80% probability) points to a surprise forecast out of EIA by 5 Bcf or more (high or low). Our broader range of forecasts is also a tad higher than normal this week at 47 to 62 Bcf. We’re not calling for a low-side surprise, but it wouldn’t surprise us.”

At first glance, the report seemed bullish, well below last year’s 61 Bcf build and the five-year average of 74 Bcf. Analysts at United ICAP forecast a 52 Bcf injection, and a Reuters survey of 24 traders and analysts revealed a 56 Bcf average with a range of 47 Bcf to 68 Bcf. Bentek Energy’s flow model calculates a 47 Bcf build.

In attempting to explain what amounted to a sizeable miss, analysts saw a wide range of factors in play. “The 46 Bcf net injection was at the lower end of the range of market expectations, possibly reflecting stronger power sector demand linked to some nuclear outages in addition to the warmer-than-normal temperatures. The data implies some tightening of the background supply-demand balance that could carry over into the weeks ahead,” said Tim Evans of Citi Futures Perspective.

Bullish or not, Addison Armstrong of Tradition Energy sees “further advances are likely to meet growing resistance from the near-record production levels of gas, the advent of the slack-demand shoulder season, and expectations for increased storage injections in the coming weeks.”

Market bulls may want to be more circumspect about the prospects for any long-term advance in natural gas prices. At the recent LDC Gas Forum Mid-Continent in Chicago Jim Duncan, ConocoPhillips chief analyst and commodity market strategist, said the natural gas market is a “smorgasbord of fragmented pieces,” and the United States is headed for a return to gas-on-gas competition among shale-dominated natural gas basins (see Daily GPI, Sept. 16).

WSI Corp. in its morning six- to 10-day outlook said, “No major changes when compared to the previous forecast.” Risks to the forecast include “temperatures [running] a few degrees cooler over the East early, whereas cooler across the central U.S. late in the period as the pattern continues to favor an increased frequency of low-pressure systems tracking across the U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |