Bakken Shale | NGI All News Access

North Dakota Aims to Accelerate Flaring Cuts

Following an upswing in the percentage of associated gas being flared in the most recent monthly oil/natural statistics, albeit due to gas processing and electric grid breakdowns, North Dakota state officials are stepping up their efforts to speed up the reduction of flaring, which again hangs at 30%. The state wants new programs or rules in place early next year.

In the long term the state needs to get back to flaring 2%-3% of associated gas, said the state’s chief regulator in the oil/gas patch, Lynn Helms, director of the Department of Mineral Resources (DMR). More near-term, the level can be higher, he indicated on a webinar with news media last Friday.

“Right now, it doesn’t look like the market gets us far enough, fast enough in reducing flaring, said Helms. At the current rate of reduction it would be well after 2020 before any sizable reductions below 10% are reached, he said. “So it is going to take some regulatory policy.”

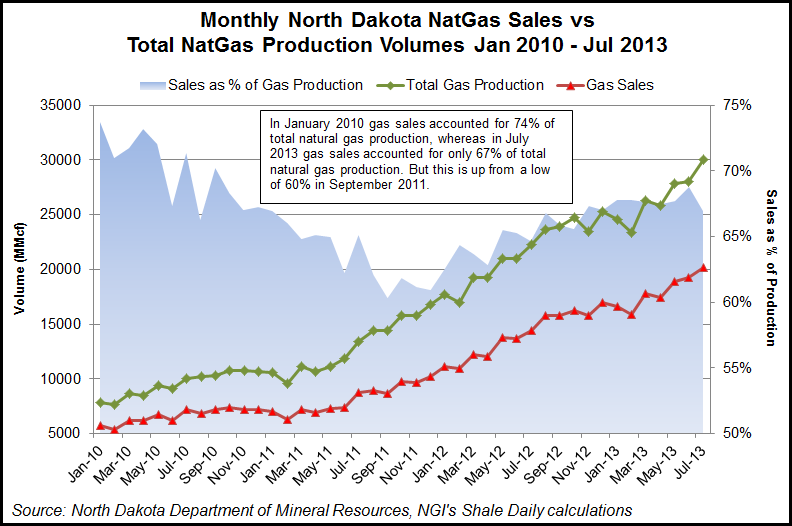

In analyzing DMR data for the last few years, the difference between gas produced and gas sold is an approximation for gas flared. In January 2010 North Dakota gas sales accounted for 74% of total natural gas production, whereas in July 2013 gas sales accounted for only 67% of total natural gas production. However, signs of improvement can be found as the July 2013 percentage is up from a low of 60% in September 2011.

The state is reviewing various options, but it has not come up with “anything great in terms of new regulatory policy,” Helms said. “What we do know is that the policy that was developed in the 80s and 90s phasing in production restrictions does not work; it doesn’t appear like it could work economically.”

Helms said that the state Industrial Commission, which oversees DMR’s operations, has given him his marching orders, and he will be making a presentation to the North Dakota Petroleum Council this week to outline what he intends to do to respond to the mandate from the three-member commission.

“There is a lot of talk ongoing at this point, but not a lot being implemented,” said Helms, adding that the state and industry cooperatively are “trying to find policy measures that could complement the state’s goals [for flaring reductions] and maintain the economics of the Bakken-Three Forks.”

Helms called the Industrial Commission’s goal “pretty simple,” aiming for reducing the amount of flaring, the number of wells doing it, and the duration of flaring when it occurs. The state is not setting a specific goal at this point, but historically, prior to the Bakken shale boom, North Dakota flared 2%-3% of its associated gas, he said.

“That was definitely acceptable to us and was driven by that fact the flare gas was so remote from the gas gathering system it was called ‘super stranded,'” Helms said.

Contributing to the continuing high flaring percentages are mechanical failures on a still-too-inadequate gas gathering and processing system, and an over-strained electrical grid that is running at maximum capacity nearly all the time, said Helms, who noted that Basin Transmission has plans to build additional power transmission capacity “and it is badly needed.”

With some major gas gathering, processing and takeaway pipeline capacity coming online by the end of this year or early next year, Helms said there are projections for decreasing flaring by 25-30%. With those possibilities, the state intends to wait until after those facilities are in operations to inject new rules covering flaring.

“These are two really big market forces that will enter the picture, and after that we can decide on the state’s new policy,” Helms said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |