NGI Archives | NGI All News Access

Weak Northeast and East Spark Broad Cash Decline; Futures Advance

Physical natural gas prices for Friday delivery fell an average 9 cents in Thursday’s trading. Physical traders will typically try to get their deals done before the release of government inventory figures, but physical prices had their own volatility to deal with in the form of sharp changes in the near-term weather picture.

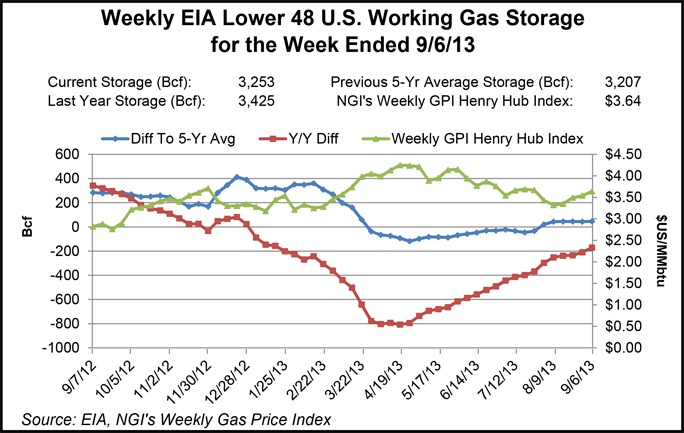

The Energy Information Administration in its Thursday morning release of storage data showed a build of 65 Bcf, only slightly less than what traders were expecting but enough to prompt futures gains. At the close of trading, October had risen 7.1 cents to $3.638 and November was up by 6.9 cents to $3.712. October crude oil rose $1.04 to $108.60/bbl.

At some Northeast locations, quotes for Friday delivery fell nearly a dollar. At the Algonquin Citygates, Friday packages were seen at $3.70, down 88 cents, and on Tennessee Zone 6 200 L next-day gas came in at $3.66, down 62 cents. Gas into Iroquois Waddington fell 13 cents to $3.97.

Farther south, declines were not quite as extreme but steeper than average. On Dominion, next-day gas fell 12 cents to $3.36, and on Tetco M-3 Friday deliveries shed 15 cents to $3.60. Gas headed for New York City on Transco Zone 6 retreated 16 cents to $3.72.

Cooler temperatures were expected to pop up all along the Eastern Seaboard as “a moderately strong cold front will begin to move through the Great Lakes and northeast Plains on Thursday, producing relatively strong thunderstorms and drawing cold air from Canada into the states. There will be about a 5- to 10-degree drop in temperatures on Thursday associated with this cold front as it moves into the Northeast. Parts of the Northeast will also experience strong to severe thunderstorms as this system continues to track northeastward on Thursday,” said Kari Kiefer, Wunderground.com meteorologist.

Temperatures were expected to drop as much as 20 degrees. Wunderground.com predicted the high in Philadelphia Thursday of 88 would fall to 75 Friday and reach 70 by Saturday. The seasonal high in Philadelphia is 76. Washington, DC, was expected to see its Friday high of 90 drop to 79 Friday and 70 by Saturday. The seasonal high in the nation’s capitol is 81. Baltimore’s steamy high of 95 Thursday was predicted to ease to 79 Friday and 73 by Saturday. The normal high in Baltimore in mid-September is 79.

Power prices also plunged across the Mid-Atlantic. IntercontinentalExchange reported that real-time power deliverable for Friday-Saturday into the PJM West terminal dropped $44.37 to $36.51/MWh.

Gulf points were also weak. Deliveries to Transco Zone 3 dropped 4 cents to $3.58 and on Florida Gas Transmission Zone 3 Friday packages were unchanged at $3.68. Henry Hub came in at $3.57, down 3 cents, and on Tennessee 500 L next-day parcels were seen at $3.57, down 4 cents. Gas on Columbia Gulf Mainline fell 4 cents as well to $3.56.

Major market hubs also endured lower pricing. Friday deliveries to the Chicago Citygates were off by 6 cents to $3.67, and gas into NGPL TX OK dropped 4 cents to $3.55. Friday gas at El Paso non-Bondad retreated 6 cents to $3.48, and at Opal gas changed hands at $3.42, down 8 cents.

Analysts are doubtful that the day’s advance can hold without help. “I am skeptical that prices can remain in this upper level without strong fundamental support,” said Dominick Chirichella, senior fellow at the New York-based Energy Management Institute. “[Thursday’s] inventory report was not very supportive. Going forward, the weekly injections are going to have to begin to underperform versus the normal five-year average for several weeks to justify prices trading at a much higher level.”

Thursday’s storage report garnered considerable attention, if for no other reason than it encompassed the Labor Day holiday and that impact is notoriously difficult to predict. Last year, a thin 27 Bcf was injected, and the five-year average stands at 62 Bcf, and the range on this week’s numbers was fairly wide. Tim Evans of Citi Futures Perspective calculated a 58 Bcf build, and Bentek Energy was looking for an increase of 74 Bcf. A Reuters survey of 27 traders and analysts revealed an average 66 Bcf with a range of 52-73 Bcf.

The main difficulty with the week’s inventory build is trying to accurately determine the effect of the Labor Day weekend, and on one level hot weather is seen offsetting the holiday. Bentek with its flow model predicted a stout 74 Bcf build and admitted to manually increasing the injections for the East and Producing regions citing historical precedent.

Others also thought the number might err on the high side. “We’re thinking that the risk is to the high side of our consensus, but our bias radar has been a little sketchy lately. Nonetheless, high-side risk seems to be a common theme among most analysts,” said John Sodergreen, editor of Energy Metro Desk before the report was released. “Were it not for the holiday, we reckon the build would have been closer to 60 Bcf this week, maybe upper 50s even. We still think EIA shorted us a little over the past few weeks, so this week they will give back a little (higher build).”

Going forward, Sodergreen sees last year’s ending inventory record of more than 3.9 Tcf within sight. “We continue to think that last year’s record is totally in view. Based on the numbers we received from 50 or so forecasters for our annual end-of-season storage tally competition, our in-house 3.912 Tcf forecast may be higher than most we received, but not by much. Several analysts are actually calling for a new record this year.”

Atlantic and Gulf hurricane activity continues. Hurricane Humberto was moving west from the Cape Verde Islands and had sustained winds of 85 mph, according to the National Hurricane Center’s (NHC) 5 p.m. EDT Thursday report. Tropical Storm Gabrielle was west of Bermuda and up to 40 mph winds.

In addition, NHC said the area of low pressure over the southern Bay of Campeche had now become Tropical Depression 10. It was moving to the west at 7 mph with 35 mph winds. Landfall in Mexico was expected Monday. An area of low pressure east of the Leeward Islands was given a 20% chance of developing in the next five days.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |