Infrastructure | NGI All News Access

Power Generation, Industrial Sectors to Expand Gas Demand, Experts Say

If U.S. natural gas supplies are going to find a market, increased gas-fired power generation on both sides of the border with Mexico and a number of forgotten heavy industries are going to have to soak up huge chunks of the additional output from shales, according to energy analysts who appeared on a supply-demand panel at the LDC Gas Forum Mid-Continent meeting Monday in Chicago.

Estimating that there will be an additional 14.3 Bcf/d of U.S. gas production over the next five year, Bentek Energy’s Jack Weixel, director of energy analysis, thinks it has to go somewhere, and one logical place is increased gas-fired electric generation to displace coal. And as part of this additional gas-fired generation market, “Mexico is the best game in town,” Weixel said.

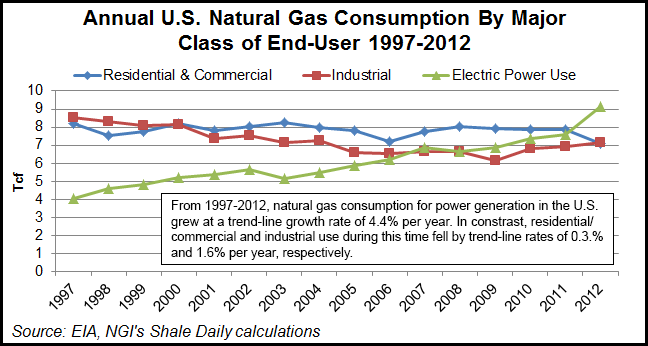

From 1997 to 2012, natural gas consumption for power generation in the United States grew at a trend-line growth rate of 4.4% per year, according to Energy Information Administration data. In contrast, residential/commercial and industrial natural gas use during this time fell by trend-line rates of 0.3.% and 1.6% per year, respectively.

While conceding that about a $1/Mcf increase in gas prices this year compared to 2012 has cut the potential volume of displaced coal-fired generation in half (from 20 Bcf/d to 10 Bcf/d), Weixel still thinks by 2017 there will be another 19.2 GWh of new gas-fired generation, and the potential additional gas loads will range from 1.7 Bcf/d to 5.9 Bcf/d, depending on developments regarding price and new projects in Mexico involving increased U.S. gas exports south of the border (see Daily GPI, Aug. 20; July 19).

Equally robust in potential new loads are the industries monitored closely worldwide by IIR Energy, a global industry energy research organization, which tracks 65,000 major industrial projects in energy-intensive industries, such as fertilizer plants, refineries, mining, steel and automotive manufacturing. IIR tracks projects planned or under construction.

“We’re tracking $10.5 billion of fertilizer plants that are slated to come online by 2018,” said John Best, IIR Energy vice president for Research and Product Development. About $200 million of that total is under construction and another $5.2 billion is in the engineering phase.

Best outlined a smorgasbord of heavy industry construction projects to develop major energy-consuming operations in mining ($2.6 billion), steel ($2.6 billion), refining ($1.7 billion) and even automotive ($4.8 billion), along with the more than $10 billion in fertilizer plants and another $9.5 billion in coal generation plant retrofits, all for projects due to come online between 2015 and 2018. However, there is a major stumbling block at this time in that there is not sufficient skilled labor to build all of these projects over the time frame of the next five years.

“I was shocked by this analysis,” Best said, adding that continuing low natural gas prices in the United States are driving many of the proposed projects. Some of the infrastructure is for energy-intensive operations, such as the pulverizing of taconite in the mining industry, he said, adding that he was shocked that there is $2.1 billion in construction projects related to this mining niche.

“Before today’s low natural gas prices, taconite was written off as being uneconomic,” Best said. “This is also a potential [energy] market that is very centered on the Midcontinent.”

Citing mostly small ($50-75 million) projects, Best is bullish on automotive industry construction being the source of increased future demand for natural gas. IIR is tracking $4.8 billion in projects, many centered on the Midcontinent region, and $3.7 billion involves projects slated for completion by the end of 2014. “Only a handful of those $3.7 million involve projects of more than a $100 million each,” he said.

In the electricity generation sector, Bentek’s Weixel sees a continuing uptick in the number of gas-fired power plants replacing coal because he is bullish about the prospects for producers through continuing efficiencies and technology innovations to push up production levels, keeping prices in the $3-4 range long term, meaning more switching of coal to gas for power generators.

While the shift may be slower than in was last year, there is going to be a steady shift back away from coal on a national basis, he said. However, in regions like he Midcontinent and Northeast, the potential for greater switching from coal to gas is more likely, Weixel said.

Helping drive the pick up in gas-fired generation in the Midcontinent will be the expected shift of up to 1.5 Bcf/d of supplies coming out of the Marcellus and Utica shales based on planned new and reversed gas pipelines in those areas, said Weixel, who added that Bentek is not concerned with monitoring rig counts because they don’t reflect where production is going. He does, however, chart what is happening with takeaway pipelines and processing capacity in places like the Marcellus and Utica.

Ultimately, he thinks the latter will allow for up to 14.3 Bcf/d of additional production of U.S. gas in the next five years. The additional production will be driven by increases in demand “primarily in the power sector” and by higher relative prices, perhaps above $4/Mcf, Weixel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |