NGI Archives | NGI All News Access

Tesoro Plans Crude Rail Project to West

In another plan for getting shale-driven domestic crude oil supplies in the central United States to the West Coast, Tesoro Corp. and Savage Companies on Monday formed a joint venture to develop and operate a new rail shipment-linked 120,000 b/d unloading and marine loading facility at Port of Vancouver, WA, across the Columbia River from Portland, OR.

The project is expected to cost $75-100 million and could be operational next year, assuming it gets the timely regulatory approvals. The facility could be expanded from 120,000 b/d to a 280,000 b/d.

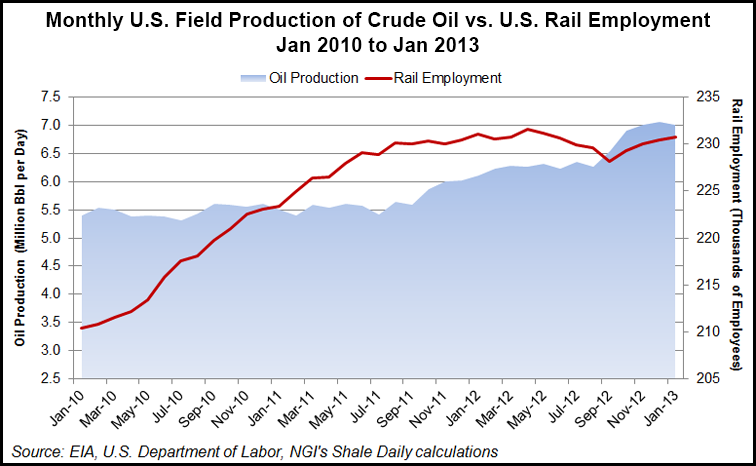

The announcement comes as industry analysts are trying to determine how big the role rail transport of booming U.S. crude production will become, particularly in the Gulf of Mexico (GOM) where an estimated 200,000 b/d of additional rail capacity is being developed, according to the latest in a series of reports by RBN Energy LLC.

“With access to rail and existing marine infrastructure, Port Vancouver is uniquely positioned to serve as a hub for the distribution of North American crude oil to West Coast refining centers,” Tesoro said.

The joint venture will involve Tesoro Refining & Marketing Co. and Savage developing and operating the new facility; the pair already have experience working closely for the last 10 years under a West Coast partnership, Tesoro said. Port Vancouver is embracing the proposal as a means of creating additional steady revenues and jobs at the harbor, which is considered an economic engine for the southwestern Washington state.

Between national railroad connections and the Columbia River outlet to the Pacific, central U.S. crude could be opened to a global marketplace, the two companies said. Tesoro CEO Greg Goff said the project will build on “the success of the rail unloading facility at our Anacortes, WA, refinery,” which has been unloading and processing mid-continent crude oil shipped by rail.

Savage COO Kirk Aubry said the Port Vancouver project will solidify his company’s position as a “leading provider of services in the crude-by-rail market to refiners, producers and marketers.”

The Tesoro-Savage joint venture will own the crude unloading and marine loading facilities and will enter into a land lease agreement with the port for an initial 10-year period. Savage will oversee the design, construction and operation of the proposed facilities.

In its latest in a series of reports on crude rail transport, RBN on Tuesday examined the logic behind the development of two new rail unloading facilities in the Houston Ship Channel (HSC) at a time when an estimated added 1.7 million b/d of pipeline capacity to the GOM is expected by the end of next year.

“Ordinarily all that pipeline capacity should trump crude-by-rail due to lower transport costs,” said RBN’s Sandy Fielden, noting the “onslaught of rail” could change the game, however. His analysis goes on to speculate that the two new HSC rail unloading facilities could be used for condensate as well as crude oil shipments.

Eventually, traders could benefit from having the GOM rail option, Fielden said, because “it seems probable that as new pipeline crude hits the Houston area in the next two years there will be inefficiencies in the distribution system that will cause price discrepancies in the production basins” that can be arbitraged.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |