NGI Archives | NGI All News Access

Energy & Exploration Expands Eaglebine Footprint

Energy & Exploration Partners Inc. (E&E) on Monday acquired 57,275 net acres and 11 producing wells in the East Texas Eaglebine formation from a subsidiary of Chesapeake Energy Corp.

In connection with the transaction, the partnership issued senior unsecured notes to Highbridge Principal Strategies and Apollo Investment Corp. E&E last September filed an initial public offering to buy the acreage from Chesapeake for $125 million (see Shale Daily, Sept. 13, 2012). Chesapeake, which is paring its portfolio, announced last April that it would sell the East Texas assets (see Shale Daily, April 10, 2012).

CEO Hunt Pettit said the partnership plans a two-rig program on the new acreage. It already owns about 14,600 net acres in the play. A 330 square-mile 3-D seismic acquisition is underway over most of the Texas acreage owned in Madison and Grimes counties.

The Eaglebine is actually a combination of the Woodbine sands formation and the northeastern end of the Eagle Ford Shale, about 100 miles northwest of Houston. The play is hundreds of miles from the core Eagle Ford Shale in South Texas, but the focus for explorers is much the same. There’s a a thick section of rock below the Austin Chalk formation and above the Buda Limestone where the edge of the Eagle Ford meets the Woodbine sands, and the fields basically butt up against each other forming the Eaglebine.

The Woodbine first was explored in the 1930s and gained fame as the reservoir where the East Texas oilfield became the most productive in the United States. Traditional, vertical wells drilled in the 20th century produced up to 200,000 boe/d. Today producers are testing unconventional drilling techniques to target oil and condensate in the sandstone. Since 2007 close to 100 horizontal wells have targeted the Woodbine sands, and producers now are finding success in the Eaglebine’s tight sands.

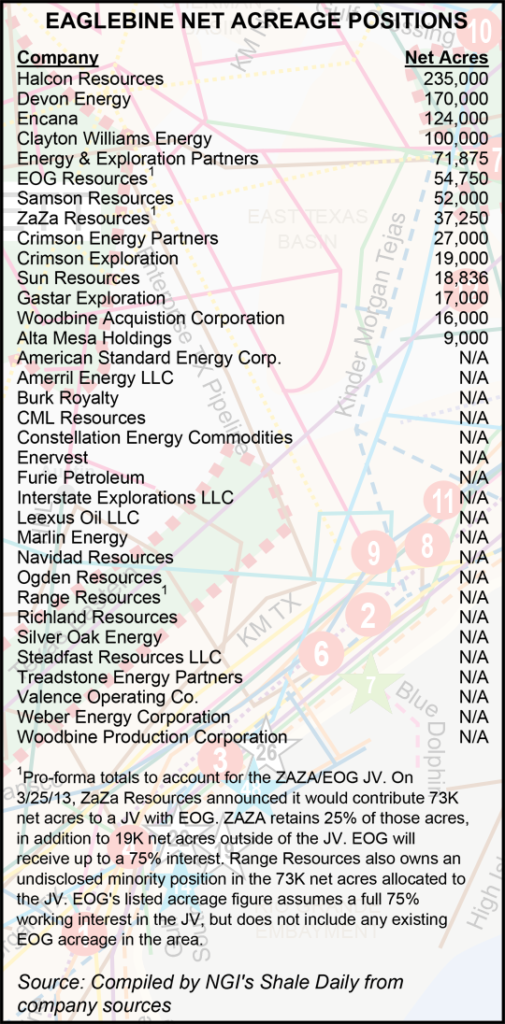

Big operators now working the play include ExxonMobil Corp. subsidiary XTO Energy Inc., EOG Resources Inc., Devon Energy Corp. and Encana Corp. (see Shale Daily, Feb. 19). Other independents include Range Resources Inc., Halcon Resources, Indigo Minerals, ZaZa Energy Corp. and Crimson Exploration Inc. (see Shale Daily, April 8; March 26; July 16, 2012).

According to company reports, Halcon Resources is the largest net acreage holder in the Eaglebine with 235,000 acres. Rounding out the top five are Devon Energy (170,000), Encana Corp. (124,000), Clayton Williams Energy (100,000), and following the Chesapeake deal, E&E is now number five with 71,875 acres.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |