NGI Archives | NGI All News Access

GMX Resources Seeks Protection Through Chapter 11 Filing

GMX Resources Inc. (GMXR) announced Monday that it has filed for Chapter 11 bankruptcy, and is looking to finalize an asset purchase agreement with holders of the company’s senior secured notes to acquire all of GMXR’s operating assets and undeveloped acreage.

The Oklahoma City-based exploration and production (E&P) company added that once the asset purchase agreement was finalized, the sale would be subject to a public auction where competing, and possibly higher and better offers, could be considered by the U.S. Bankruptcy Court for the Western District of Oklahoma. The senior secured notes are due in 2017.

“Over the past year, the company implemented various strategic initiatives to increase oil production, improve supply chain and production efficiencies, and reduce costs to increase cash flow,” GMXR said Monday. “While these operating initiatives resulted in some success, natural gas commodity prices have remained low, and the company’s oil and gas operations require ongoing additional capital expenditures.

“To meet these financial requirements, the company has actively sought financing alternatives to solve its liquidity needs…[but] has been unsuccessful in finding any viable funding solution to meet its long-term liquidity needs. Based on discussions with the company’s various creditor groups and advice from the company advisors, the company believes that the rights and protections afforded under a court-supervised reorganization process, including access to financing and a proposed sale of the company assets, will provide the company the ability to meet its immediate financial needs to preserve the value of assets and to provide for the greatest recovery to its stakeholders.”

GMXR has horizontal oil assets in the Bakken/Sanish-Three Forks Formation in the Williston Basin and the Niobrara Formation in the Denver-Julesburg (DJ) Basin (see Shale Daily, Feb. 2, 2011). The company also owns natural gas assets in the East Texas Basin — in the Haynesville/Bossier shale and the Cotton Valley Sand Formation — where most of its acreage is contiguous, with infrastructure in place and substantially all of its acreage held by production.

In July 2012, GMXR hired Global Hunter Securities to help it sell a portion of its Cotton Valley properties in East Texas (see Shale Daily, July 19, 2012). The properties were weighted toward natural gas liquids (NGL).

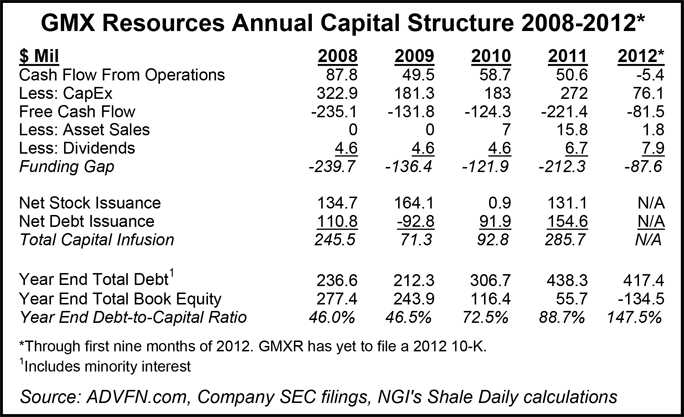

As is the case with many growth-oriented companies, GMXR has been starved for capital. Since 2008, the company has outspent its cash flow by nearly $800 million and has funded that spending gap by hitting the capital markets via debt and equity raises. Its operating losses and debt issuances have combined to sap the strength of the balance sheet, so much so that the firm now carries a negative book equity balance. Overall, its debt-to-equity ratio has ballooned from a manageable 46-47% range in 2008 and 2009 to a whopping 148% as of its latest 10-Q filing for the period ending Sept. 30.

GMXR said two of its subsidiaries, Endeavor Pipeline Inc. and Diamond Blue Drilling Co., are included in the current bankruptcy proceedings, but its joint venture in East Texas — Endeavor Gathering LLC, of which GMXR owns a 60% stake — is not. Kinder Morgan Endeavor LLC owns the remaining 40% stake in Endeavor Gathering.

The independent E&P also announced that it had obtained a commitment for debtor-in-possession financing from its principal senior secured noteholders, which would provide up to $50 million of additional capital to fund its operating expenses. “Upon approval by the bankruptcy court, the new financing and cash generated from the company’s ongoing operations will be used to support its business and the company’s efforts to negotiate and implement a sale of its assets,” GMXR said.

The company said it had also notified the New York Stock Exchange (NYSE) over its Chapter 11 filing, and said it expects the exchange will start delisting procedures, which the company said it would not oppose. Shares of GMXR were down 26 cents/share, to $2.19/share, in midday trading on the NYSE on Monday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |