NGI Archives | NGI All News Access

Marcellus NGL Pipeline Would Convert Portion of Texas Gas

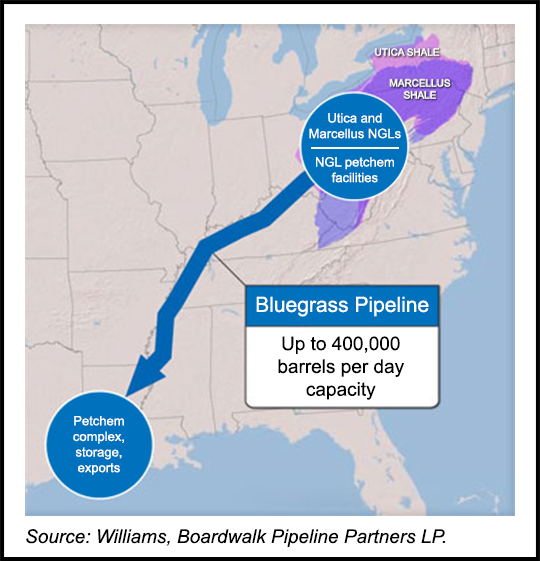

Williams and Boardwalk Pipeline Partners LP are partnering on a pipeline project to carry mixed (y-grade) natural gas liquids (NGL) from the Marcellus and Utica shales to the U.S. Gulf Coast as well as the petrochemical market in the Northeast.

On Wednesday they said the proposed Bluegrass Pipeline would have capacity to carry 200,000 b/d of NGLs from Ohio, West Virginia and Pennsylvania with the potential to expand to 400,000 b/d with the addition of pumping capacity.

The pipeline would deliver NGLs to proposed fractionation and storage facilities, which would have connectivity to petrochemical facilities and product pipelines along the coasts of Louisiana and Texas. Williams and Boardwalk are also exploring development of a new export liquefied petroleum gas (LPG) terminal and related facilities on the Gulf Coast to provide customers access to international markets.

“We are designing Bluegrass Pipeline to provide these two world-class resource plays with access to one of the largest and most dynamic petrochemical markets in the world,” said Williams CEO Alan Armstrong. “In turn, this will help producers in Ohio, Pennsylvania and West Virginia achieve an attractive value for their ethane and other liquids. The current infrastructure challenge with natural gas liquids in the Northeast is slowing drilling and isolating liquids supplies from the robust markets in the Gulf that are poised to grow substantially over the next five years.”

Last month, Williams management said the company was moving away from developing liquids fractionation in the Northeast and instead considering a Northeast NGL pipeline (see Shale Daily, Feb. 25). The company acquired a half-stake in Chesapeake Energy Corp.’s former midstream operations, now Access Midstream Partners GP (see Shale Daily, Dec. 13, 2012).

On Wednesday analysts at Tudor, Pickering, Holt & Co. wrote that the venture with Boardwalk was “good news” for Williams but would probably reduce the scope of Williams Partners LP’s infrastructure buildout in the Marcellus (see Shale Daily, Feb. 22, 2012).

Bluegrass would include:

“Given current market dynamics in the Northeast, existing liquids systems and local outlets will be overwhelmed by 2016,” Armstrong said. “Total NGL volumes in the Northeast are expected to exceed 1.2 million b/d by 2020. The proposed Bluegrass Pipeline joint venture would support Williams’ midstream assets in the region, offer an attractive return and enable Williams to become the premier NGL infrastructure provider by economically linking the Utica and Marcellus region to petrochemical complexes on the U.S. Gulf.”

Williams and Boardwalk said using existing infrastructure gives the project an advantage as it could be placed into service sooner than other options. “We believe that the unique arrangement of this planned project would create several strategic advantages, including a faster in-service date complemented by a significantly reduced construction footprint than could be achieved with a completely organic project,” said Boardwalk CEO Stan Horton.

The partners said they expect to sanction the project this year and place it in service during the second half of 2015.

Separately, Enterprise Products Partners LP previously proposed the competing Appalachia-to-Texas (Atex Express) pipeline to carry ethane from the MarkWest Liberty Midstream & Resources LLC fractionation, processing and storage complex in Houston, PA, to Enterprise’s natural gas liquids storage complex in Mont Belvieu, TX. The pipeline is expected to come online in the first quarter of 2014 (see Shale Daily, Jan. 5). Range Resources Corp. has signed on as an anchor customer (see Shale Daily, Jan. 27, 2012). About 70% of the proposed 1,230-mile route of Atex Express is expected to utilize existing pipeline, according to Enterprise.

The Williams-Boardwalk project is subject to a final joint venture agreement between Williams and Boardwalk, execution of customer contracts, board and regulatory approvals as well as antitrust clearance. Before TGT may begin converting the TGT Loop Line, it must receive abandonment authority from the Federal Energy Regulatory Commission, for which Boardwalk plans to file by May 1. Approval is expected to take nine to 12 months, the company said.

“Our pursuit of this project is also consistent with Boardwalk’s long-term growth strategy of diversifying within the midstream energy sector and leveraging our newly-acquired liquids infrastructure assets at Boardwalk Louisiana Midstream, which provide a critical footprint for the downstream fractionation and storage portion of this project,” Horton said. “Another key element is that Texas Gas would connect its natural gas customers along the length of the converted TGT Loop Line to the remaining Texas Gas lines…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |