NGI Archives | NGI All News Access

Pennsylvania Shale Gas Production Exceeded 2 Tcf in 2012

Natural gas production from unconventional sources in Pennsylvania hit a record 2.04 Tcf in 2012, as the state’s Marcellus/Utica shale gas for the first time edged ahead of the granddaddy Barnett Shale in Texas.

According to a recently released production report by the Pennsylvania Department of Environmental Protection (DEP) unconventional production totaled 1.15 Tcf from July to December of last year. By comparison, the agency reported unconventional production of 894.95 Bcf for the first six months of 2012 (see Shale Daily, Aug. 27, 2012). Both reports include production from the Marcellus and Utica shales, as well as other formations.

Gas production in the Barnett was 1.92 Tcf in 2012, down from 2.01 Tcf in 2011, which represented the play’s first year-to-year decline. (see Shale Daily, March 1).

“This certainly represents yet another significant milestone for the Marcellus, which by every measure is a world-class shale play,” Travis Windle, spokesman for the Marcellus Shale Coalition, told NGI’s Shale Daily on Tuesday. “We’re creating tens of thousands of jobs, revitalizing rural communities and our region’s manufacturing base, and producing a domestic energy source that is enhancing our environment.”

According to the DEP, the well that produced the most natural gas during the second half of 2012 was Cabot Oil & Gas Corp.’s Heitzenroder No. 3 well. Located in Susquehanna County’s Springville Township, the well produced 4.49 Bcf of natural gas. Cabot’s Heitzenroder No. 4 well recorded the second-highest production at 3.66 Bcf.

The DEP said 175 wells had production of 1.0 Bcf or more. Although the agency listed 6,166 permitted wells from July to December, only 3,552 (57.6%) recorded any production.

Operators also reported producing 1,113,907 bbl of condensate and 15,966 bbl of crude oil from July to December. Range Resources Appalachia LLC’s Kraeer 1H well produced the most condensate (16,242 bbl) during that time frame, while Chesapeake Appalachia LLC’s Guy Avolio 8H well produced the most crude oil (6,507 bbl). Both wells are in Washington County’s Independence Township.

Chesapeake was the top natural gas producer during the second half of 2012 with 250.07 Bcf, followed by Cabot at 134.20 Bcf and Range with 111.08 Bcf. Rounding out the list of top 10 operators in terms of production were Talisman Energy USA Inc. (94.84 Bcf), Anadarko E&P Co. LP (71.77), EQT Production Co. (69.32), SWEPI LP, a subsidiary of Royal Dutch Shell plc (53.87), CNX Gas Co. LLC (37.70), Chevron Appalachia LLC (28.80) and Chief Oil & Gas LLC (25.60).

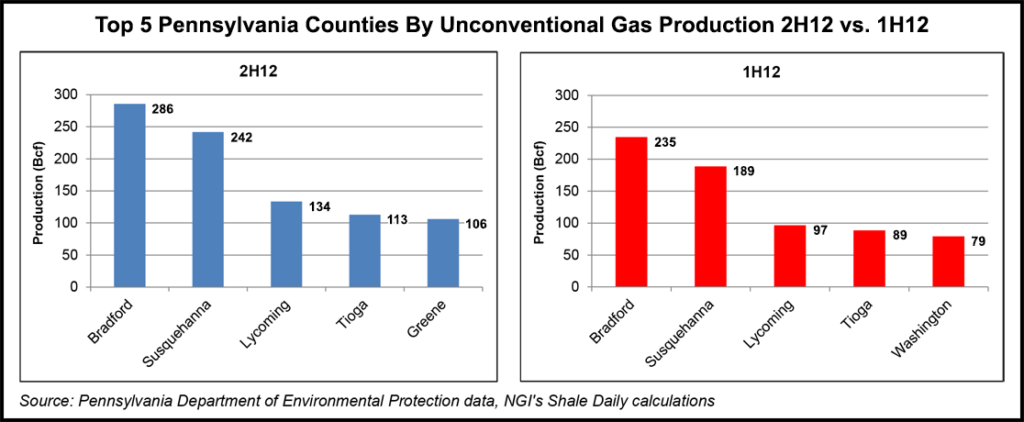

Bradford County remained atop the list of natural gas producing counties; the county produced 285.66 Bcf in 2H2012, a 21.8% increase from 234.66 Bcf produced in 1H2012. Susquehanna County followed with 242.01 Bcf in 2H2012, followed by Lycoming (133.56 Bcf), Tioga (112.71 Bcf) and Greene (106.12 Bcf) counties.

Bradford, Susquehanna, Lycoming and Tioga counties made the top five in terms of natural gas production in 1H2012, but Washington County (79.15 Bcf) slipped in just ahead of Greene County (74.36 Bcf) for fifth place.

In the DEP’s report for 1H2012, Citrus Energy Corp.’s Johnston 1H well, in Wyoming County’s Meshoppen Township, led all unconventional natural gas production with 4.54 Bcf. Citrus also had the second-most productive well, Lasco 2H in Meshoppen, which produced 2.88 Bcf. As a point of interest, Citrus and Cabot had the top 27 wells in terms of production, all in Wyoming and Susquehanna counties, respectively.

During 1H2012, 145 wells had production of 1.0 Bcf or more. There were 8,673 permitted wells on that production report, but only 2,874 (33.1%) recorded any production.

Also during 1H2012, operators produced 672,704 bbl of condensate and 49,194 bbl of crude oil. Vista Operating Inc.’s Hudson No. 2 well in Butler County’s Forward Township led in condensate (31,198 bbl), while Chesapeake’s Guy Avoilo 8H well led in crude oil (8,511 bbl).

The DEP’s Office of Oil and Gas Management has annual oil and gas production reports dating back to 2000 available for download from its website. The first Marcellus-only report covered a 12-month period from July 2009 to June 2010. Subsequently, the DEP released Marcellus-only reports that covered three six-month periods: July-December 2010, July-December 2011 and January-June 2011.

However, the fourth six-month report, which covers January-June 2012, includes all unconventional wells and is not broken down by shale/tight gas and oil plays. The DEP said the change was mandated by Act 13, the state’s omnibus Marcellus Shale law (see Shale Daily, Feb. 15, 2012).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |