NGI Archives | NGI All News Access

Wellhead Freeze-Offs Are Supply Disruption Risk — EIA

As U.S. operators move onshore from the offshore, wellhead freeze-offs are becoming a bigger risk to natural gas supplies, the Energy Information Administration (EIA) said Tuesday in the Short-Term Energy Outlook (STEO).

U.S. natural gas working inventories hit a record high in November of 3.923 Tcf, but domestic inventories ended January at an estimated 2.7 Tcf, or 0.2 Tcf below January 2012 levels, according to the STEO. The lower storage numbers were blamed in part on wellhead freeze-offs.

“Producers reported wellhead freeze-offs in the San Juan, Green River, Uinta and Piceance basins, according to recent Bentek Energy reports,” the EIA report stated. “As natural gas production in the United States shifts from offshore to inland, well freeze-offs have become a greater supply disruption risk.”

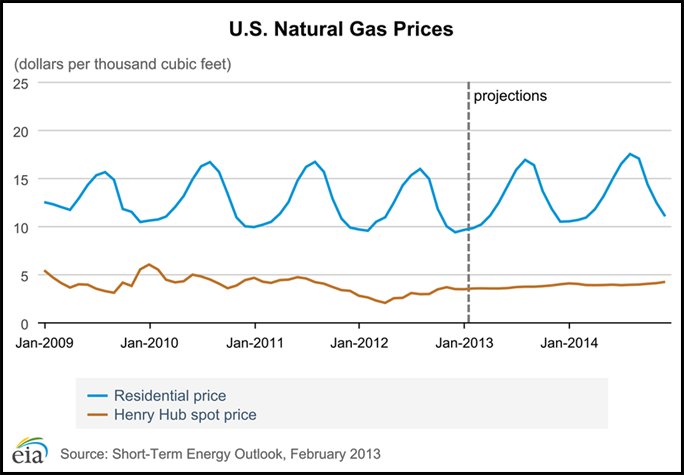

Even with less gas in storage, Henry Hub spot prices this year are expected to average $3.53/MMBtu, which is 21 cents lower than EIA predicted in January (see Shale Daily, Jan. 9). Gas prices averaged $2.75/MMBtu in 2012. Next year prices are expected to strengthen somewhat to average $3.84.

“Cold weather helped drive northeastern natural gas prices up at the end of January,” the STEO said. “The U.S. Northeast is infrastructure-constrained, and the tight supply-demand balance during extreme cold or heat often leads to price spikes. Prices at Transcontinental Pipeline’s Zone 6 delivery point, which serves New York City, and at the Algonquin Citygate, which serves Boston, both rose above $30/MMBtu on Jan. 24 and 25.”

EIA expects gas consumption to average 70.3 Bcf/d this year and fall slightly to 70 Bcf/d in 2014. The latest forecast “is a significant upward revision from last month’s expectation of 69.7 Bcf/d and 69.4 Bcf/d in 2013 and 2014, respectively.” The upward revisions in part followed changes to EIA’s historical industrial sector consumption data, which were revised higher in the recent Natural Gas Annual (see Shale Daily, Feb. 8).

In January EIA said it expected total domestic marketed gas output to increase from 69.2 Bcf/d in 2012 to 69.8 Bcf/d in 2013 and then fall slightly to 69.5 Bcf/d in 2014. Lower 48 onshore growth is being driven mostly by the Marcellus Shale and other unconventional formations, but the higher output is going to be offset by lower Gulf of Mexico production, federal officials noted.

“Forecasts for closer-to-average winter temperatures in 2013 and 2014 (compared with the record-warm temperatures in 2012) lead to increases in natural gas used for residential and commercial space heating,” the STEO said. “Despite Punxsutawney Phil’s recent forecast of an early spring this year, a 15% increase in U.S. population-weighted heating degree days from 2012 to 2013 is still projected.”

The projected increase in gas prices “contributes to a decline” in gas used for electric power generation from 25 Bcf/d in 2012. This year gas use is forecast to fall to 23.1 Bcf/d; in 2014 it’s seen falling to 22.6 Bcf/d.

“Consumption over the forecast period is less than the record-high 2012 levels but remains high by historical standards and reflects an ongoing structural shift toward using more natural gas for power generation,” EIA said.

Brent crude oil spot prices, which averaged $112/bbl in 2012 and rose to $119 in early February, are forecast to average $109/bbl this year and then fall to $101 in 2014, according to the STEO.

“The projected discount of West Texas Intermediate (WTI) crude oil to Brent, which averaged $18/bbl in 2012, averages $9.00/bbl in 2014 as planned new pipeline capacity lowers the cost of moving Midcontinent crude oil to the Gulf Coast refining centers.”

According to the STEO, U.S. total crude oil output averaged 6.4 million b/d in 2012, an increase of 0.8 million b/d from 2011. Projected output is expected to continue to rise, hitting 7.3 million b/d this year and 7.8 million b/d in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |