NGI Archives | NGI All News Access

Shale Gale Saving U.S. Households $1,200/yr, Boosting Economy, Trade, IHS Says

Domestic unconventional natural gas and oil production is increasing household incomes, boosting trade and contributing to an increase in U.S. competitiveness in the world economy, IHS Inc. said Wednesday.

“The unconventional oil and gas revolution is not only an energy story, it is also a very big economic story that flows throughout the U.S. economy in a way that is only now becoming apparent,” said IHS Vice Chairman Daniel Yergin. “In addition to significant job and economic impacts from energy production and its extensive supply chains, the growth of long-term, low-cost energy supplies is benefiting households and helping to revitalize U.S. manufacturing, creating a competitive advantage for U.S. industry and for the United States itself.”

Unconventional gas and oil activity increased disposable income by an average of $1,200 per U.S. household in 2012 as savings from lower energy costs were passed along to consumers through lower energy bills and lower costs for other goods and services. That figure is expected to grow to more than $2,000 in 2015 and more than $3,500 by 2025, according to the third volume of IHS’s study, “America’s New Energy Future: The Unconventional Oil and Gas Revolution and the Economy.” Volume 3 focuses on the manufacturing renaissance brought about by the United States’ shale gale.

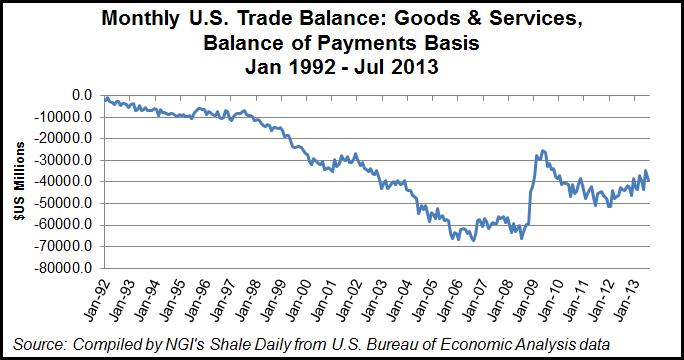

The monthly U.S. trade deficit has been improving for some time, falling from $51.4 billion in January 2012 to $39.1 billion in July 2013, according to U.S. Bureau of Economic Analysis data. The country’s trade position will continue to improve, thanks to a significant reduction in energy imports and the increased global competitiveness of U.S.-based energy intensive industries, the IHS study concludes.

“Driven by a rise in domestic production and manufacturing that will displace imports, as well as a favorable export position for these industries, the trade deficit will be reduced by more than $164 billion in 2020 — equivalent to one-third of the current U.S. trade deficit,” IHS said.

Previous IHS studies found that upstream unconventional activity supports more than 1.7 million jobs and will grow to nearly 3 million jobs by the end of the decade (see Shale Daily, Dec, 24, 2012; Oct. 24, 2012). According to the latest study, midstream and downstream unconventional energy and energy-related chemicals activity currently supports nearly 377,000 jobs throughout the economy. Total jobs supported by the entire unconventional oil and gas value chain is expected to increase from 2.1 million currently to more than 3.3 million in 2020 and nearly 3.9 million by 2025.

“Energy-related chemicals and other energy-intensive industries such as petroleum refining, aluminum, glass, cement and the food industry are some of the primary beneficiaries from secure supplies of low-cost energy from unconventional production,” IHS said. “More than 70% of the cash cost of producing energy-related chemicals — which include major commodity petrochemicals such as olefins, methanol and ammonia — is the cost of raw materials and energy feedstocks.”

The American Chemistry Council has estimated that nearly 100 shale gas-driven chemical industry projects in the United States — worth about $71.7 billion — will generate $20 billion in federal, state and local tax revenue by 2020 (see Shale Daily, May 21). The chemical manufacturing industry accounted for $198 billion in U.S. merchandise exports in 2012, a 30% increase compared with $152 billion in 2007, and that trend is expected to continue as energy-intensive industries benefit from lower energy prices, lower electricity prices and increased demand for their products, according to IHS.

Independent analysts this summer noted the revival in the domestic petrochemical industry, driven mostly by abundant natural gas reserves. BNP Paribas analyst Teri Viswanath last month said industrial gas use “was more than 3%, or 0.6 Bcf/d, greater during the first five months of 2013 compared to the same period in 2012” (see Shale Daily, Aug. 5). And Raymond James & Associates Inc. analysts said industrial sector revival would be “the most significant driver” for higher long-term natural gas prices, lifted by new ethylene crackers, ammonia plants and natural gas-to-liquids facilities that are fed by unconventional gas (see Shale Daily, June 25).

Directly or indirectly, the lower natural gas prices brought on by the shale gale are effecting a range of energy-intensive industries, including steel, aluminum and cement production and food processing. Natural gas is both a feedstock and the common fuel source for manufacturing nitrogen-based fertilizers, and the higher level of gas prices prior to the widespread development of shale gas “considerably deteriorated the profitability” of the industry, IHS said. But the shale gale has revitalized the industry.

“Lower price levels for natural gas in the United States, sustained by the development of unconventional sources, have provided increasing profitability to local fertilizer manufacturers,” according to IHS.

The flat glass manufacturing industry has been hobbled for years by the threat of cheap imports, coupled with weak nonresidential construction markets. “Given the important role that natural gas plays in heating the furnace, gas prices should provide some relief to a struggling industry,” IHS said. “However, it will not result in a sudden renaissance in U.S. based glass manufacturing.”

Glass manufacturing accounted for 1% of total industry use in the Energy Information Administration’s (EIA) most recent survey of the manufacturing sector, with natural gas accounting for 73% of fuel use and electricity another 24%. About 143 Bcf was used at glass manufacturing facilities in 2010, according to a recent EIA report.

In addition to measuring jobs supported by the full unconventional value chain, IHS quantified additional manufacturing jobs attributed to the broader macroeconomic contributions that begin with unconventional oil and natural gas. More than 460,000 combined manufacturing jobs (3.7% of all manufacturing jobs) will be supported in 2020, rising to nearly 515,000 (4.2%) in 2025, according to the report.

“The manufacturing sector will become increasingly connected to unconventional development as a primary source to create and sustain jobs over the course of the study period. Manufacturing jobs will represent one out of every eight jobs supported by unconventional oil and gas development during that time,” IHS said.

A more restrictive regulatory environment than currently exists has the potential for significant economic impacts, including 1.4 million fewer jobs supported by 2015, along with $127 billion less in value-added contributions to U.S. gross domestic product and a $94 billion reduction in benefit to the U.S. trade position, IHS said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |