NGI Archives | NGI All News Access

Despite Marcellus Surge, May U.S. NatGas Output Nearly Flat Year/Year

New wells in the Marcellus Shale kept natural gas production there on the upswing in May, but declines in several other areas kept total U.S. production to 81.84 Bcf/d, just 0.3% higher than the 81.61 Bcf/d reported in May 2012, according to the Energy Information Administration (EIA).

The Other States category, which excludes Louisiana, New Mexico, Oklahoma, Texas, Wyoming, Alaska and the federal offshore Gulf of Mexico, but includes key Marcellus state Pennsylvania, increased production to 25.62 Bcf/d in May, up 3.30 Bcf/d from 22.42 Bcf/d in May 2012, according to EIA’s latest Monthly Natural Gas Gross Production Report. The category’s increase came “as several operators reported new wells in the Marcellus Shale,” EIA said Wednesday.

Also seeing production increases compared with May 2012 were Oklahoma (5.85 Bcf/d, from 5.53 Bcf/d) and Texas (22.30 Bcf/d, from 22.15 Bcf/d). New Mexico was unchanged compared with May 2012 at 3.59 Bcf/d, EIA said.

But declines reported in five other areas in May were large enough to keep the U.S. total nearly flat. The federal offshore Gulf of Mexico produced 3.69 Bcf/d, down from 4.29 Bcf/d in May 2012; Louisiana produced 6.69 Bcf/d, down from 8.32 Bcf/d, Wyoming produced 5.63 Bcf/d, down from 6.19 Bcf/d, and Alaska produced 8.47 Bcf/d, down from 9.12 Bcf/d.

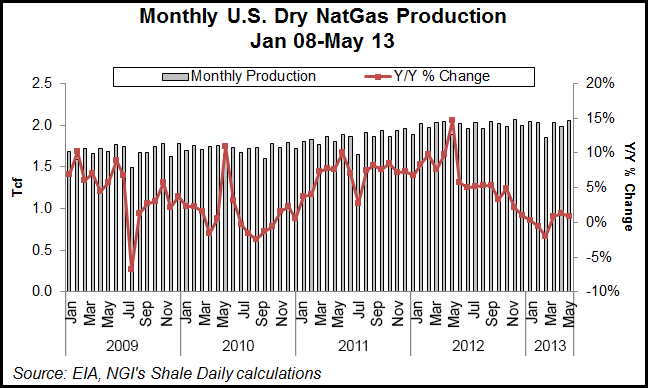

In its latest Natural Gas Monthly, also released Wednesday, EIA said dry gas production for May was 2.051 Tcf (66.2 Bcf/d), which was up marginally from 2.034 Tcf in May 2012 and the highest level since last October, when 2.063 Tcf was produced. Total consumption of natural gas for May was 1.740 Tcf, the fourth consecutive month with a sequential decline and also a decline from the 1.871 Tcf reported in May 2012, EIA said.

In mid-July EIA once again nudged down its Henry Hub natural gas price forecast for this year and next (see Shale Daily, July 11). EIA expects that the Henry Hub price will increase to $3.76/MMBtu in 2013 and $3.91/MMBtu in 2014 from an average of $2.75/MMBtu in 2012. The agency previously said it expected that the Henry Hub spot price would increase to $3.92/MMBtu this year and $4.10/MMBtu in 2014 (see Shale Daily, June 13).

EIA is considering breaking out monthly gas production data for several individual states currently lumped together into the “other” category to reveal more precisely production coming out of shale plays (see Shale Daily, April 3). The Marcellus Shale covers parts of Pennsylvania, West Virginia, Ohio and New York, and it is considered to be the most productive shale gas basin in the country. The great bulk of production from the formation is in Pennsylvania. Shale production is also booming in Texas and North Dakota.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |