NGI Archives | NGI All News Access

Denbury Closes First Phase of Bakken Sale With ExxonMobil

Denbury Resources Inc. said Monday that it has completed the first phase of its sale of 196,000 net acres in the Bakken Shale to ExxonMobil Corp. for $1.6 billion in cash and ExxonMobil’s operating interests in Webster Field in Texas, Hartzog Draw Field in Wyoming and an interest in the Carbon Dioxide (CO2) reserves in ExxonMobil’s LaBarge Field in Wyoming.

First announced in September (see Daily GPI, Sept. 21), the addition of Denbury’s entire Bakken portfolio in North Dakota and Montana will increase ExxonMobil’s stake in the play to nearly 600,000 net acres. Denbury had acquired the Bakken leasehold in late 2009 in a $4.5 billion merger with Encore Acquisition Co.

In the first phase of the two-phase deal, ExxonMobil paid cash of approximately $1.3 billion and transferred to Denbury ExxonMobil’s operating interests in Webster Field in Texas and Hartzog Draw Field in Wyoming.

For the second phase closing, which is expected to take place prior to year-end, Denbury retained approximately 17.5% of its pre-closing interest in Bakken area assets, and ExxonMobil withheld $350 million of cash consideration for such Bakken area assets. The parties continue to work to finalize an agreement and documentation pursuant to which Denbury will receive an interest in the CO2 reserves in ExxonMobil’s LaBarge Field in Wyoming in exchange for the retained Bakken interests, together with any necessary cash adjustments.

However, if for some reason this exchange does not take place in the second phase closing as expected, Denbury would sell its retained 17.5% Bakken area interest to ExxonMobil for the $350 million of cash that has been withheld.

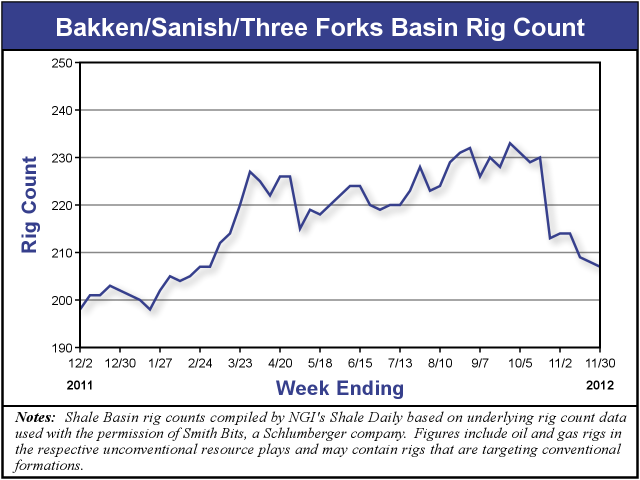

Development activity in the Bakken/Sanish/Three Forks region is continuing at a strong pace. While drilling has backed off the highs of this past fall when more than 230 rigs were actively drilling for oil and gas, there were still 207 rigs in active operation in the play for the week ending Nov. 30, according to NGI‘s Shale Daily Unconventional Rig Count. One year ago there were 198 rigs actively drilling.

As it exits the Bakken Shale, Denbury said it continues to pursue using a portion of the cash proceeds from the deal to purchase interests in additional oil fields in the Gulf Coast or Rocky Mountain regions that are well suited for CO2 enhanced oil recovery, which would qualify for like-kind exchange treatment for federal income tax purposes.

Denbury, which bills itself as “the largest combined oil and natural gas operator in both Mississippi and Montana,” also says it “owns the largest reserves of CO2 used for tertiary oil recovery east of the Mississippi River.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |