Marcellus | NGI All News Access | Utica Shale

Appalachian Midstream Venture Secures Up to $1B in Credit

Blue Racer Midstream LLC, designed to provide expanded services over the next three years in the Utica and Marcellus shales, on Thursday secured an initial five-year, $800 million credit facility that could be expanded to $1 billion.

Dominion and Caiman Energy II LLC formed the $1.5 billion joint venture (JV) late last year (seeShale Daily, Dec. 24, 2012). Caiman’s midstream operations partially are owned by Williams Partners LP, which had formed Caiman Energy II with investors EnCap Flatrock Midstream and Highstar Capital (see Shale Daily,March 20, 2012).

“The size of the credit facility is a testament to our strong relationship with the financial community, the strength of Caiman and Dominion’s track records and the tremendous response Blue Racer has received from our producer customers in the Utica Shale,” said Blue Racer CEO Jack Lafield. He also is CEO of Caiman. The company’s goal is to provide customers with the “best opportunity” to gather and process rich gas and market natural gas liquids (NGL).

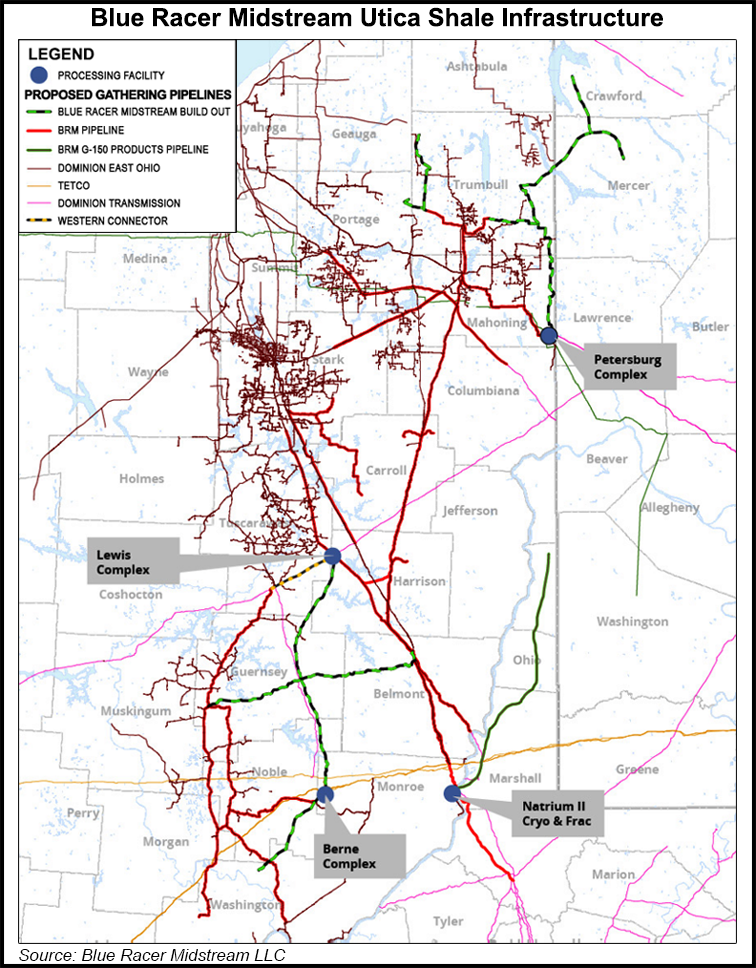

Dominion contributed existing midstream assets to the JV that include 500 miles of Dominion East Ohio gathering lines crossing the Utica Shale, as well as the Natrium Natural Gas Processing and Fractionation Plant in Marshall County, WV. Earlier this month Dominion transferred ownership of Natrium to Blue Racer.

Williams Partners, 47.5% owner of Caiman Midstream, is contributing $380 million through 2014, almost half of its $800 million commitment. EnCap, with a 35.6% stake, is expected to contribute up to $285 million, while Highstar, which holds a 11.5% stake, is contributing up to $95 million. Caiman Energy, which owns the remaining 4%, would operate the system. The fractionation system now in place is referred to as Ohio Valley Midstream.

“With cryogenic processing capacity of 200 MMcf/d already online, Natrium is the first large-scale processing plant to serve rich-gas production in the Utica Shale,” according to executives. Construction has begun for Natrium II, a second 200 MMcf/d plant, Natrium II, which would bring the facility’s total processing capacity to 400 MMcf/d by the end of March.

Additional physical assets are expected by Dominion through 2014. The partners’ plans are to install natural gas gathering, processing, fractionation and NGL transportation across the system. Energy analysts in July said new gathering lines would spur Utica production, whose true potential remains a question (see Shale Daily, July 15).

The JV faces some competition. Earlier this year, Crosstex Energy Inc. and former management of Enerven Compression Services formed E2 to provide midstream services in the Utica, an endeavor in which Crosstex has invested close to $75 million (see Shale Daily, May 16; March 7). Large pipeline projects now on the drawing board also could offer midstream services from across the region.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |