EIA Delivers on Target NatGas Storage Data, but Price Damage Already Done

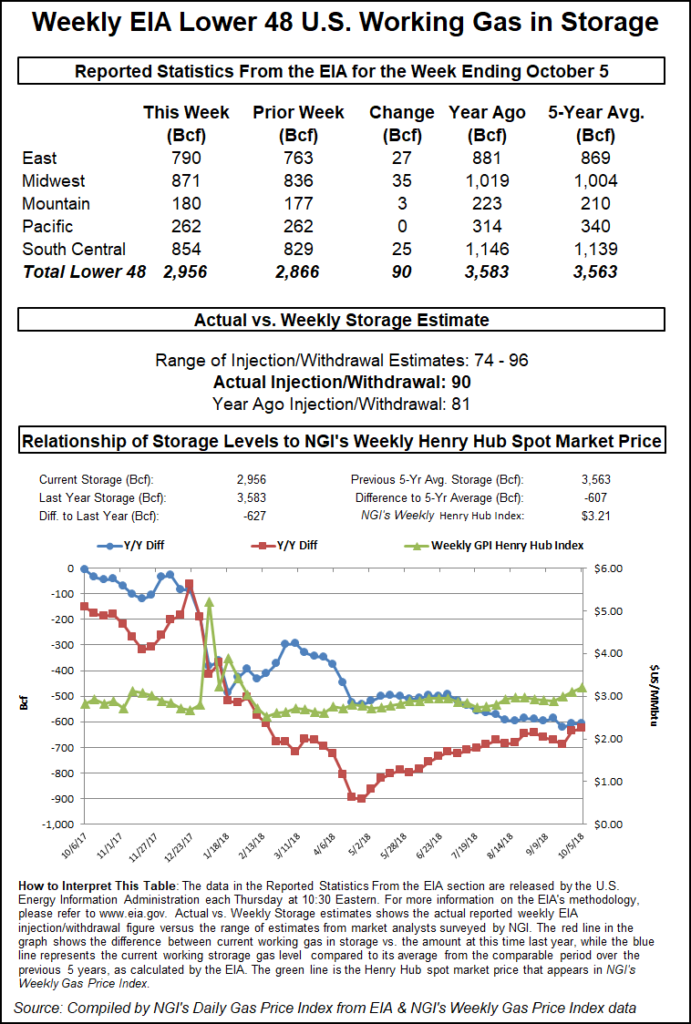

The Energy Information Administration (EIA) reported a 90 Bcf injection into natural gas storage inventories for the week ending Oct. 5, on target with market expectations that clustered around a build in the high 80s Bcf to low 90s Bcf.

After the last two wild weeks, with a low miss then a high miss canceling out, Bespoke Weather Services said it has a stronger read on balance again “as it is clear the market has loosened over the past couple weeks.

“This fits with our reading of burns loosening off a bit and production continuing to grow with Canadian imports returning last week. The print did come in just below our expectations, so we may not see as much selling initially and could bounce on any colder weather models, especially with production shut-ins from Hurricane Michael and lower Canadian imports off the British Columbia pipeline explosion, Bespoke chief meteorologist Jacob Meisel said.

Nymex futures prices were already significantly lower ahead of the report on warmer risks in long-range weather outlooks, and the storage news added slightly more pressure to the market. The November contract was trading more than 9 cents lower at $3.19 just before the EIA’s 10:30 a.m. ET release, then slipped to $3.18 immediately afterward. By 11 a.m. ET, the prompt month was trading at $3.215, down about 7 cents on the day.

“I’m still dumbfounded by lack of demand talk, all about production still,” said Corey Lefkof, CEO and meteorologist of CLWS.

But Bespoke’s Meisel said the structural growth in power burns appears more impressive than in the residential/commercial sector, which makes the demand story more impressive in summer than in winter, barring extreme winter temperatures.

Thursday’s reported 90 Bcf build lifted inventories to 2,956 Bcf, 627 Bcf below year-ago levels and 607 Bcf below the five-year average. Broken down by region, the Midwest injected 35 Bcf, the East injected 27 Bcf and the South injected 25 Bcf, including 10 Bcf into salt dome facilities and 15 Bcf into non-salt facilities.

Despite the 90 Bcf build, Mobius Risk Group said there is no guarantee there be will be further reductions before withdrawals begin in earnest. “As heating demand moves eastward, daily injection data will be closely followed by the market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |