Shale Daily | NGI All News Access | NGI Archives

U.S. Natural Gas Growth Said Shifting Supply Dynamics for Global Petrochemicals

The United States is poised to return to prominence as a low-cost region for petrochemical production thanks to the unconventional natural gas revolution, the International Energy Agency (IEA) said.

In the global energy watchdog’s 132-page report, “Future of Petrochemicals” issued last week, IEA said increasing global competition is being driven by “new supply dynamics” for chemical feedstocks.

“Today, the United States is home to around 40% of the global capacity to produce ethane-based petrochemicals,” researchers said. Saudi Arabia and Iran still help the Middle East keep its crown as the low-cost champion for key petrochemicals, however, with a host of new projects announced across the region.

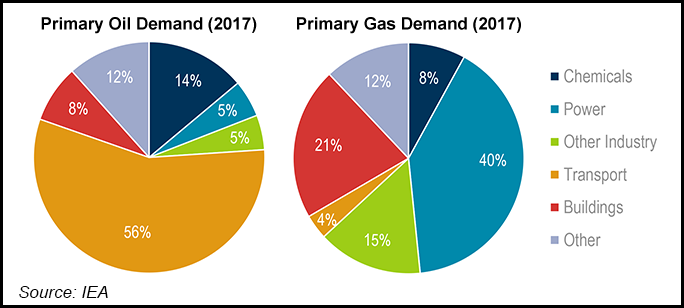

Overall, petrochemicals are poised to become the largest driver of global oil consumption and eat up another 56 bcm of natural gas by 2030, equivalent to around half of Canada’s total consumption today, IEA reported. Petrochemical demand should account for more than one-third of oil demand growth by 2030 and nearly half to 2050, eclipsing consumption by vehicles, aviation and shipping.

“Our economies are heavily dependent on petrochemicals, but the sector receives far less attention than it deserves,” IEA Executive Director Fatih Birol said. “Petrochemicals are one of the key blind spots in the global energy debate, especially given the influence they will exert on future energy trends. In fact, our analysis shows they will have a greater influence on the future of oil demand than cars, trucks and aviation.”

The United States and the China should see the largest near-term petrochemical capacity additions, with longer term growth led by Asia and the Middle East.

“The United States is expected to increase its global market share for ethylene (steam cracking) to 22% by 2025, up from 20% in 2017,” researchers said. “Along with the Middle East, the United States has a feedstock advantage in its access to low-cost ethane owing to its abundant natural gas supplies. This advantage allows both regions to gain the lion’s share of ethane-based chemical exports in the short and medium term.”

The industry’s dynamism also is “driving new trends around the world. After decades of stagnation and decline, the United States has re-emerged as a low-cost location for chemicals production thanks to the shale gas revolution, and is now home to around 40% of the global ethane-based petrochemical production capacity.”

The Middle East still remains the lowest cost center for many key petrochemicals, however, “with a host of new projects announced across the region.”

According to IEA, coal-based methanol-to-olefins capacity in China should nearly double between 2017 and 2025. In the longer run, Asia and the Middle East should increase their market share of “high-value” chemical production by 10%, while the share coming from Europe and the United States should decline.

By 2050, India, Southeast Asia and the Middle East together are expected to account for about 30% of global ammonia production.

Demand for plastics, the key driver for petrochemicals from an energy perspective, has outpaced all other bulk materials including steel, aluminium or cement, and has nearly doubled since 2000. Advanced economies currently use up to 20 times more plastic and up to 10 times more fertilizer than developing economies on a per capita basis, underscoring the huge potential for global growth.

Petrochemical products provide substantial benefits to society, including a growing number of applications in various cutting-edge, renewables technologies critical to sustainable energy systems, but their production, use and disposal “present a variety of climate, air quality and water pollution challenges that need to be addressed,” researchers said.

“While substantial increases in recycling and efforts to curb single-use plastics are underway, especially in Europe, Japan and Korea, the impact these efforts can have on demand for petrochemicals is far outweighed by sharply increasing plastic consumption in emerging economies.”

To address the challenges, IEA outlines a Clean Technology Scenario (CTS) in the report, which offers an alternative future in line with key sustainable development goals by the United Nations, such as climate action, responsible consumption and life below water, among others.

“The scenario provides an ambitious but achievable pathway to reduce the environmental impacts of petrochemicals,” researchers said. The scenario has air pollutants from primary chemicals production declining by almost 90% by 2050; direct carbon dioxide emissions reduced by nearly 60%; and water demand nearly 30% lower than in the base scenario.

IEA also emphasizes waste management improvements to rapidly increase recycling, thereby laying the groundwork to more than half cumulative, ocean-bound, plastic waste by 2050.

“In the CTS, petrochemicals become the only growing segment of global oil demand. Despite near-tripling in plastic waste collection by 2050, the limited availability of cost-effective substitutes for oil feedstock means that oil demand for petrochemicals remains resilient.”

IEA’s report was developed with input from governments, industry and other key stakeholders, with policy recommendations “to build a more sustainable and efficient petrochemicals industry.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |