NGI Data | Markets | NGI All News Access

Bullish Momentum Builds Ahead of Storage Report as November Natural Gas Rallies a Third Day

The ball remained firmly in natural gas market bulls’ court Wednesday as November prices easily breached low-end technical resistance, shooting up as high as $3.26 before taking a few steps back before the close.

The Nymex November gas futures contract rose 6.4 cents to $3.23, and some market observers eyed additional gains barring a surprise bearish storage report on Thursday. The December and January contracts each rose more than a nickel to settle at $3.297 and $3.37, respectively, while February edged up 3.7 cents to $3.252 and March climbed 2.5 cents to $3.034.

Spot gas prices followed suit as hot weather remained in the forecast for the southern United States and up through the Mid-Atlantic Coast, where daytime temperatures were forecast in the 80s to lower 90s. The NGI National Spot Gas Average rose 15.5 cents to $2.955.

While October is often referred to as a “shoulder season” month due to typically low demand and thus low gas prices, the first three trading days of the month have painted a far different picture, with the Nymex prompt month netting 22 cents and reaching heights not seen in more than a year.

Some of the recent gains have been tied to weather as near-term outlooks continue to show a cold snap occurring in mid-October. The overall impact of that weather pattern, however, would fail to drive heating degree days significantly higher than normal, several market observers noted.

Instead, continuing silence from FERC regarding approval to flow gas on both the Atlantic Sunrise and Nexus Gas Transmission pipelines is increasing perception of market risk for the winter, EBW Analytics said. Every day without official Federal Energy Regulatory Commission approval to begin flowing gas on the Appalachian takeaway projects may help support the front month, CEO Andy Weissman said.

Reasons for the delay are unclear. There has been some recent speculation that a new “unofficial FERC policy” may require restoration work to be completed before finalizing approval, but Weissman said that, in EBW’s opinion, tremendous flooding and hurricane-induced damage may be limiting line inspection and FERC wants to ensure safety before authorizing the final go-ahead. This is especially the case for Atlantic Sunrise as the eastern United States has been awash in rain for a good part of the summer.

If it emerges that FERC’s delays are intentional and may be sustained, however, the market may lack anticipated gas supplies, sharply tightening the winter outlook and justifying the recent run-up in prices, Weissman said.

“The market appears increasingly concerned with low early October flow data and FERC’s delay in approving in-service of Atlantic Sunrise and Nexus pipelines. Together, the questions about the supply side have helped bolster the case for increased winter risk premiums,” he said.

Given the current storage trajectory — the lowest in over a decade — the market “must be materially looser” this winter to offset the bullish impacts and head off price increases, according to EBW. Instead, FERC’s delay has raised questions about the timing of new supply gains in Appalachia and its impact on winter supply adequacy.

It is possible FERC will approve new pipelines in short order and the recent dip in pipeline flow production metrics will recover, likely leading to a halt of the recent rally, Weissman said. “Should pipelines be approved in timely fashion and production again rise to new all-time records, it may help reassure the market that winter supply is not at risk.”

Genscape Inc. is also watching for developments on the possible pipeline start-ups, especially as Atlantic Sunrise will allow the still-constrained northeast Pennsylvania producers a new route toward moving gas out of the region to the southeastern seaboard. “We are expecting Atlantic Sunrise to fill with a mix of gas routed from other pipelines (Tennessee Gas Pipeline in particular) and new production,” Genscape natural gas analyst Colette Breshears told NGI.

Nexus serves an area that “already has a large amount of export capacity” and is not expected to have as large of an impact to producers, “though the addition of a new route from Clarington, OH, to the Michigan market area will be welcome,” Breshears said.

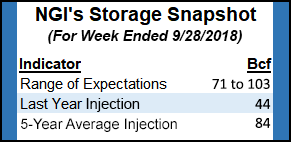

Pipeline start-ups aside, last week’s bullish storage surprise, with a build roughly 20 Bcf below market consensus, is still fresh on the minds of traders eagerly awaiting Thursday’s Energy Information Administration storage inventory report. Estimates were wide ranging for the report reflecting data for the week ending Sept. 28, from 71 Bcf to 103 Bcf. A Reuters poll of 21 market participants had a range of 71 Bcf to 99 Bcf, with a median build of 88 Bcf. Kyle Cooper of IAF Advisors projected a 92 Bcf build, while EBW estimated a build of 84 Bcf and Bespoke Weather Services estimated an 88 Bcf build.

Last year, 81 Bcf was injected into storage for the same week, while the five-year average injection stands at 90 Bcf.

“While production has repeatedly set records in 2018, the market may be waiting for easing storage deficits before surging winter contract premiums are likely to subside,” Weissman said.

Spot Gas Prices Surge in the West, Appalachia

Spot gas prices across most of the United States continued to soar Wednesday, with some of the strongest gains occurring in the West despite numerous weather systems that were expected to bring showers to the region through the next week. Temperatures were forecast to be mostly mild to slightly cool, while heavy rains were also expected across the Southwest as tropical moisture from Rosa streams through, according to NatGasWeather.

The southern United States and up the Mid-Atlantic Coast were forecast to remain “very warm” with daytime highs reaching the 80s to lower 90s. The Great Lakes and Northeast, however, were in store for mostly mild to warm conditions with highs forecast in the 60s to lower 80s due to strong high pressure. There were some cooler exceptions near the Canadian border with weather systems expected to provide glancing blows to those areas, the forecaster said.

Out West, SoCal Citygate next-day gas jumped more than 50 cents to $4.42, while Malin shot up 45 cents to $2.915. Interestingly, PG&E Citygate was relatively flat at $3.495 despite storage inventory levels at Pacific Gas & Electric Company (PG&E) remaining noticeably low less than a month before the start of winter. The total inventory available to PG&E in both core and non-core facilities is roughly 138 Bcf, only about 73% of the five-year average at the beginning of October, according to Genscape.

PG&E’s core storage, which consists of the McDonald Island, Pleasant Creek and Los Medanos fields, currently contains around 76 Bcf, which is 82% of the five-year average, Genscape natural gas analyst Joe Bernardi said. The four non-core storage facilities — Lodi, Wild Goose, Central Valley and Gill Ranch — are at 64% of their five-year average with 62 Bcf.

In the Rockies, White River Hub posted a region-leading gain of 39 cents to $2.875, while increases of more than 30 cents were common. The Rocky Mtns. Regional Avg. was up 34 cents to $2.565.

Spot gas in Appalachia continued to bounce back from recent lows, with the most substantial day/day increases seen at Texas Eastern M-3, Delivery, which shot up more than $1 to $2.65. Dominion South surged 70 cents to $2.085, while Tennessee Zn 4 Marcellus jumped nearly 60 cents to $1.92.

On the pipeline front, Tennessee Gas Pipeline had an emergent repair issue at Station 317 that began on Sept. 29, which then escalated to a force majeure event as of the Oct. 2 gas day. Though the repair issue is at Station 317, the scheduling constraint is through Segment 315, which will continue to be impacted until Oct. 19, according to Genscape.

Segment 315 scheduled capacity, taken at “Sta 315 to MLV 316,” didn’t change immediately with the emergent repair notice, though operational capacity decreased 250 MMcf/d, Genscape natural gas analyst Vanessa Witte said. Nominations began to decline on Oct. 1, however, showing a 105 MMcf/d day/day change and have remained low despite operational capacity being increased by 176 MMcf/d for the Oct. 2 gas day.

“Segment 315 has been nearly 100% utilized in the past, therefore it is likely nominations will be revised for gas day Oct. 3 and moving forward,” Witte said.

Elsewhere, Permian Basin pricing remained depressed, with key pricing hubs in the region barely holding onto $1 handles.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |