Markets | NGI All News Access | NGI Data

Appalachian Basis Diffs Widen as Weekly NatGas Spot Market Closes Book on September

As storage concerns came to the forefront in the natural gas futures market during the week ended Sept. 28, shoulder season temperatures produced a mix of changes in the spot market; the NGI Weekly National Spot Gas Average fell a penny to $2.66/MMBtu.

Weekly spot prices — traded for the first four days of the week for delivery through the end of September — saw steep declines in Appalachia as shoulder season conditions set in for the region, with a fall-off in cooling demand also pressuring points further downstream.

Dominion South saw some of its weakest day-ahead basis differentials in almost a year, coinciding with various reports of maintenance constraints impacting the region just as recent hot temperatures moderated in the East. Weekly prices at the Appalachian point tumbled 54 cents to $1.96.

Transco Zone 6 New York dropped 30 cents on the week to $2.65, while further north Algonquin Citygate added 21 cents to $3.13 amid maintenance related import constraints on the Algonquin Gas Transmission system.

In the West, SoCal Citygate fell 29 cents to $3.70. During the week Southern California Gas announced that it would stop accepting injection nominations on its system as it nears its maximum storage capacity, potentially bearish news for West Texas producers looking to find a home for their associated gas. Waha added a penny on the week to average $1.16, still well behind Henry Hub, which gained a dime to average $3.09.

Turning to the futures, the November Nymex contract fell 4.8 cents Friday but managed to end the week just above the psychologically important $3 barrier, settling at $3.008. December settled 4.4 cents lower at $3.091, while January fell 4.5 cents to $3.169.

Week/week (w/w) the November contract added a little more than 3 cents from the previous Friday’s settlement (Sept. 21) after some ups and downs as the market priced in milder trending October forecasts and an extremely tight Energy Information Administration (EIA) storage report.

NatGasWeather noted some colder trends in the midday data Friday focused on a weather system expected to move into the northern United States Oct. 6-8.

“The overall pattern for October is still expected to be a rather warm one, especially across the southern and eastern U.S.,” NatGasWeather said. “There’s still expected to be cool shots into the northern U.S., but mainly over the Rockies and Plains,” though the Oct. 6-8 pattern could trend cooler over the weekend by impacting more of the Midwest and Great Lakes.

“We see the coming pattern leading to the three largest builds of the fall season, but still only near to slightly larger than five-year averages,” the firm said. “This should keep deficits above 600 Bcf through most of October and the background state bullish.”

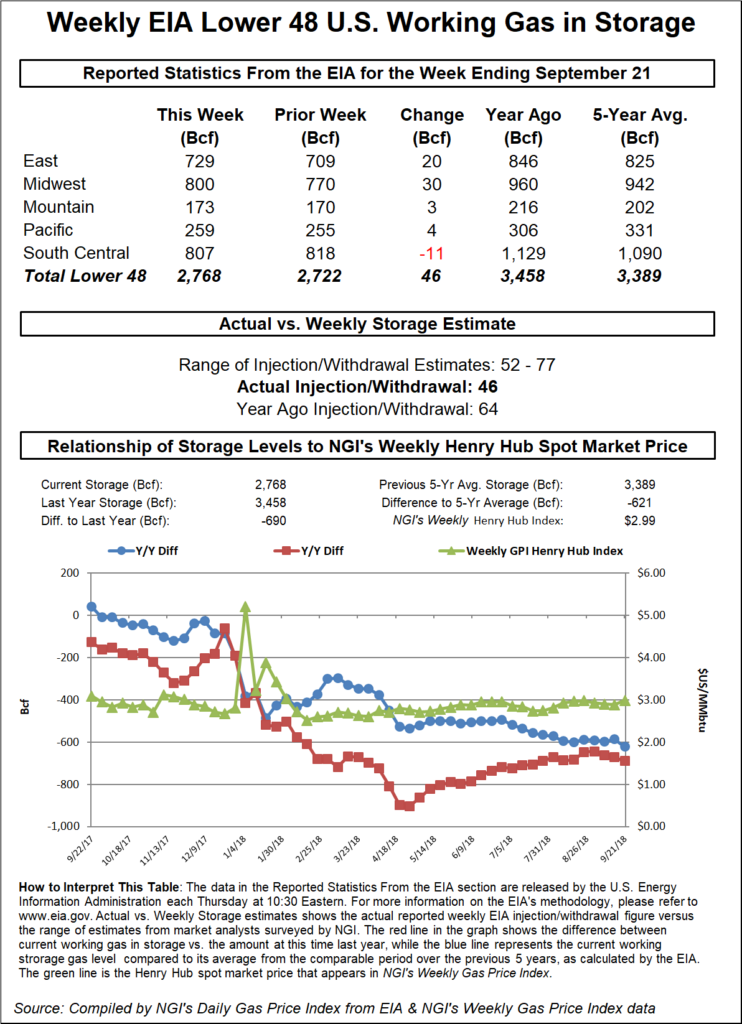

EIA reported a 46 Bcf build into Lower 48 gas stocks Thursday that came in well below consensus and widened the yawning year-on-five-average deficit, helping the November contract to promptly reverse the prior session’s losses.

The 46 Bcf injection for the week ended Sept. 21 compares to a five-year average build of 81 Bcf and a 64 Bcf build recorded a year ago.

Traders may have had suspicions that EIA’s 10:30 a.m. ET report would surprise to the low side, as prompt month futures had been gaining steadily in the lead-up to the report, picking up momentum around 9 a.m. ET. As soon as the number crossed trading desks, the November contract jumped close to a nickel to trade up around $3.065/MMBtu.

By 11 a.m. ET, November was trading around $3.050, up 7.0 cents from Wednesday’s settle and a near-perfect mirror of the prior session’s 7.8 cent sell-off.

Prior to the report, the median from a Bloomberg survey of traders and analysts had keyed in on a build of 61 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled Wednesday at an injection of 52 Bcf.

The bullish miss featured an 11 Bcf pull from salt stockpiles in the South Central region. The report period saw strong spot prices in the Gulf Coast and Southeast coinciding with hot temperatures and reports of above-average nuclear outages in the aftermath of Hurricane Florence.

Last week the average day-ahead price at Transco Zone 5 climbed as high as $3.38, while Henry Hub crested the $3 mark by mid-week (Sept. 19 trade date), Daily GPI historical data show.

“We had seen very impressive power burns last week that rallied the market, and clearly the market had not” priced in the full extent of the tighter burns, Bespoke Weather Services said. “Nuclear outages helped spike burns, and demand destruction from Hurricane Florence was far less than expected. We view the tightening in this print as a relatively one-off event; next week’s print is expected to be solidly looser as we have seen burns ease off,” along with a decline in liquefied natural gas exports and higher Canadian imports.

“Still, this print is bullish enough to emphasize storage shortages and keep a bid under prices; a reversal off $3.07-$3.10 seems most likely.”

Total working gas in underground storage as of Sept. 21 stood at 2,768 Bcf, putting inventories 621 Bcf (18.3%) below the five-year average with only a few weeks left in injection season. Year-ago inventories stood at 3,458 Bcf, according to EIA.

The Midwest recorded the largest weekly net injection among regions at 30 Bcf, followed by the East at 20 Bcf. The Pacific injected 4 Bcf, while the Mountain region injected 3 Bcf for the week, according to EIA.

“Compared to degree days and normal seasonality, the 46 Bcf injection is about 2.2 Bcf/d tight versus the five-year average,” Genscape Inc. analyst Margaret Jones said. “The tightness in this week’s stat is being driven by an unseasonably strong power burn. A late summer heat wave coincided with a large week-on-week decrease in nuclear gen…Given the necessary increase in thermal gen, coal also picked up a smaller than expected share week-on-week.

“…Relative to the previous week, total power generation was up almost 28 average GWh. Collectively, nuclear and renewable gen were down about 7 average GWH w/w as wind gen was up about 1 average GWh and nuclear generation was down about 8 average GWh w/w. Coal was up around 6 average GWh w/w, and gas generation was up almost 28 average GWh for an estimated 5.5 Bcf/d more gas burn w/w.”

The factors driving up gas demand during this week’s storage report period aren’t likely to continue as cooling degree days decrease and unplanned nuclear outages return to service, according to Jones.

Analysts with Tudor, Pickering, Holt & Co. (TPH) viewed the week’s “paltry” injection as indicating a market roughly 4.0 Bcf/d undersupplied.

“Increased power generation continues to drive the undersupply as coal retirements, warmer-than-normal temperatures, and declining nuclear plant utilizations have caused power gen demand to increased roughly 3.6 Bcf/d year/year (for September),” the TPH analysts said. “Forecasts also pulled an about face with warmer-than-normal temperatures now expected over the short-term.

“Coupled with only seven weeks left of injection season, the data points are undoubtedly a bullish print (reflected in the commodity). However, the lid is still being kept on pricing as long-term indicators remain neutral,” including the possibility of a mild El Nino winter and “ramping record supply” in the neighborhood of 84.3 Bcf/d, 0.4 Bcf/d higher on the week.

In the spot market Friday (the first trade date to reflect NGI’s increased decimal point precision for its indexes), prices rebounded in the Northeast as Appalachian basis differentials remained weak; the NGI National Spot Gas Average added 1.0 cents to $2.520/MMBtu.

After deals for delivery over the last days of September at Transco Zone 6 NY on average were discounted more than $1 Thursday, prices there gained back 58.0 cents on Friday (for Oct. 1 delivery) to average $2.380. Algonquin Citygate added 47.0 cents to $3.360 Friday as Algonquin Gas Transmission remained subject to import constraints because of planned maintenance between its Stony Point and Oxford compressor stations.

“High pressure will dominate the West and Southeast with highs of 80s and 90s, although becoming wet over the Southwest from tropical moisture,” NatGasWeather said in its one- to seven-day outlook Friday. “A cool front extends from the east-central U.S. to the South with heavy showers. A stronger cool front will push across the Midwest the next few days with lows of 30s and 40s, locally 20s.

“Much of the U.S. will return to above normal temperatures” for the first week of October, with “highs of 80s to lower 90s over the southern U.S. and 60s to lower 80s across the northern U.S. Cooler exceptions will be near the Canadian border.”

Recent price weakness in Appalachia continued amid maintenance-related constraints and soft shoulder season demand in the region. Millennium East Pool gained back 16.5 cents to average a still heavily discounted $1.025 Friday as Millennium Pipeline Co. was conducting maintenance restricting volumes through its Wagoner East segment, according to the operator’s electronic bulletin board. Dominion South, meanwhile, fell in line with Henry Hub, giving up 7.5 cents to $1.315.

Dominion South’s cash basis differential, often used as a bellwether for the takeaway constraints that have long dogged the prolific Marcellus/Utica shale region, weakened considerably in the past week, echoing the depressed shoulder season prices observed at the location a year ago despite new pipeline capacity added since then.

As of Friday, Dominion South was trading $1.68 back of Henry Hub on average, its widest negative basis differential since last November. Around this time last year, in the lead-up to the 2017/18 heating season, average day-ahead prices at Dominion South traded as much as $2.60 back of Henry.

Bidweek traders don’t appear to expect the recent weakness in the day-ahead market to extend into October, as Dominion South was trading at an average basis of minus 59 cents after Day 5, roughly a $1 above Friday’s spot price average, according to NGI’s Bidweek Alert.

Also potentially impacting Appalachian spot prices, Tennessee Gas Pipeline (TGP) notified shippers Friday of an “emergent repair” at its “STA 317” location near Troy, PA. TGP said the station would need to go offline for repairs, impacting up to 250,000 Dth of flows, with nominated volumes potentially at risk starting with Saturday’s gas day (Sept. 29). As of Friday’s notice, TGP did not provide an estimated end date for the repairs.

Elsewhere, Texas Gas Transmission was expected to conduct maintenance starting Tuesday (Oct. 2) and lasting until Oct. 6 that would restrict 220 MMcf/d of southwestward flows through its Harrison compressor station in Hamilton, OH, according to Genscape analyst Dominic Eggerman.

In the West, average prices for Monday delivery were mixed, coinciding with reports of constraints on north-to-south flows into the PG&E market.

PG&E Citygate added a penny to $3.260, while further north Malin fell 12.5 cents to $1.925.

PG&E maintenance scheduled to start over the weekend was expected to cut around 550 MMcf/d of flows along the pipeline’s Redwood Path over a five-day period, according to Genscape analyst Joe Bernardi.

“Maintenance at the Delevan Station will require operating capacity to fall from around 2,120 MMcf/d to 1,525 MMcf/d beginning Saturday, Sept. 29, and this operating capacity limit will remain in place through and including Wednesday, Oct. 3,” Bernardi said. “The 30-day average Redwood Path scheduled capacity is currently 2,079 MMcf/d, meaning this maintenance puts 554 MMcf/d at risk.

“Comparable maintenance events have corresponded with upward pressure on PG&E Citygate basis prices and increased withdrawals from storage to compensate for the reduced imports” from Gas Transmission Northwest and Ruby out of Malin, OR, the analyst said. “Genscape meteorologists are forecasting very mild weather for Northern California for the duration of this work.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |