Infrastructure | E&P | NGI All News Access

U.S Natural Gas Drilling Count Flat as Oil Activity Grows

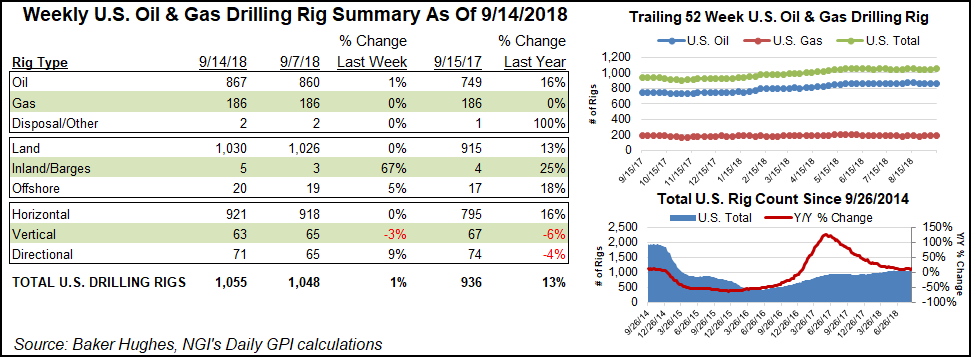

The domestic natural gas drilling count held flat for the week ended Sept. 14, but an uptick in oil-directed drilling drove the total number of active U.S. rigs to 1,055, according to data Friday from Baker Hughes, a GE Company (BHGE).

The United States netted seven oil rigs, including gains in Louisiana, Colorado and Oklahoma, leaving the domestic count up almost 120 units from the 936 rigs running at this time last year.

Six directional units and three horizontal units were added, offsetting the loss of two vertical units on the week. Four rigs returned to action on land, while two went to work in inland waters, along with one in the Gulf of Mexico.

Canada’s rig count jumped 22 units to finish the week at 226 (212 a year ago), driven by the addition of 15 oil-directed units. The combined North American rig count finished the week at 1,281, up from 1,148 rigs in the year-ago period.

Among plays, the Denver Julesburg Basin-Niobrara formation and the Marcellus Shale were the biggest movers on the week, picking up two rigs each. The Mississippian Lime and Williston Basin each added one rig, while the Permian Basin saw one net rig pack up shop for the week, according to BHGE.

Among states, Louisiana and Pennsylvania each saw three rigs return to action, while two each went back to work in Colorado and Oklahoma. Alaska and North Dakota each added a rig to their respective tallies.

Texas posted the largest decline among states at three, dropping its total to 525, which still far outpaces the 452 rigs running in the Lone Star State at this time last year.

In what could signal doubts about 2019 target dates for key pipeline takeaway projects, oil and gas producers working in the Permian increased their 2020 oil basis hedge positions by 431% during the second quarter, Wood Mackenzie analysts said earlier in the week.

“It was an anomalously high trading volume” for 2020 Midland-Cushing (Mid-Cush) basis swaps during the quarter, said corporate research analyst Andrew McConn. “The only reasonable conclusion one can draw from this surge is that Permian producers are concerned that key pipeline projects won’t be completed on schedule.”

With oil production forecast to grow on average in the Permian by more than 400,000 b/d year/year through 2022, output has been overwhelming takeaway capacity and causing oil and gas to sell inside the basin at steep discounts to national indexes.

As recently as 2015, pipeline capacity constraints caused the Mid-Cush West Texas Intermediate discount to widen to $20/bbl, according to Wood Mackenzie researchers. “This has prompted many Permian operators to use derivatives to hedge against the risk of price differentials growing wider.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |