Regulatory | Mexico | NGI All News Access | NGI Mexico GPI

Analysts Say López Obrador’s Harsh Criticism Ignores Important Mexico Energy Reform Advances

Mexican President-Elect Andrés Manuel López Obrador’s criticism of the country’s 2013-14 energy reform overlooks major advances made under the legislative overhaul, according to experts.

López Obrador last Saturday called the constitutional reform, which de-nationalized the oil sector, a “vile ruse” and a “failure,” and he lambasted the current government for slashing the exploration and production (E&P) budget of national oil company Petróleos Mexicanos (Pemex), whose crude output has dropped to below 1.9 million b/d from a peak of 3.4 million b/d in 2004.

However, this assessment omits several important facts, according to Pulso Energético’s Pablo Zarate, director of information for the think tank.

For one thing, Zarate said Monday during his weekly broadcast with Manuel Molano of the Instituto Mexicano para la Competitividad, the cuts to Pemex’s budget, while indeed large, were largely in line with the rest of the global oil industry following the commodities crash that began in mid-2014.

To blame the regime of President Enrique Peña Nieto, who took office in 2012, for the production decline is also somewhat disingenuous, Zarate said, citing the fact that Pemex’s output fell by about 1 million b/d between 2004 and 2012.

López Obrador also failed to mention five upstream projects awarded through the reforms that are expected to contribute more than 400,000 boe of hydrocarbon production by 2021-2022.

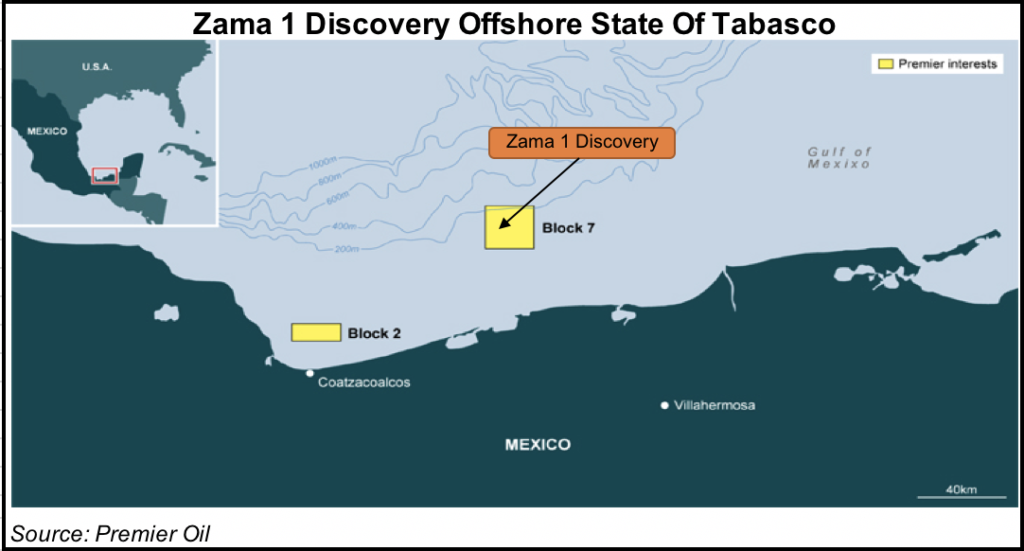

These comprise Eni SpA’s Area 1 offshore block in Campeche bay; the Hokchi shallow water joint venture between E&P Hidrocarburos and Pan American Energy; the Zama offshore discovery made by the consortium of Sierra Oil & Gas, Talos Energy Inc. and Premier Oil; the Ichalkil and Pokoch shallow water fields under development by Fieldwood Energy and Petrobal; and Pemex’s Ixachi field.

Mexico’s Comisión Nacional de Hidrocarburos (CNH) awarded the first four projects through a series of bid rounds, and assigned Ixachi to Pemex through the Round Zero process. Pemex is likely to seek a private sector partner to develop Ixachi, Pulso Energético said Monday.

The Zama discovery, which is thought to contain 1.4-2 billion bbl of mostly light oil, was named “discovery of the year” for 2017 by the Association of International Petroleum Negotiators.

In a recent presentation, CNH’s Oscar Roldan, head of the Centro Nacional de Información de Hidocarburos (CNIH), highlighted that the amount of acreage being explored in the Mexican Gulf of Mexico has more than tripled as a result of the 12 bid rounds conducted so far, through which 107 contracts have been awarded.

At the same event, Talos CEO Tim Duncan said that as a result of the rounds, Royal Dutch Shell plc now holds more acreage in the Mexican Gulf of Mexico than in the U.S. portion.

López Obrador’s Pemex-centered energy proposals, which include construction of an $8 billion refinery in his home state of Tabasco and legislative changes to give the state company more freedom to choose its joint venture partners, could prove disastrous for the heavily indebted state oil company, which is on the verge of losing its investment grade credit rating, according to Moody’s Investors Service Senior Vice President Nymia Almeida.

“If everything in [López Obrador’s] plan is executed…Pemex’s situation in four to six years will be worse,” Almeida told Zarate and Molano last week.

Molano said this week that although López Obrador may view Pemex as a proverbial bag of gold with abundant discretionary resources, the reality is “exactly the opposite. Pemex is a very sick patient in the eyes of international markets.”

López Obrador confirmed last weekend that Pemex will launch tenders in early December for drilling services contracts, and priority will be given to Mexico-based companies.

Zarate warned, however, that since providers are paid a flat rate under the services contract model, they do not have the same incentive to produce timely or successful exploration results as companies with operating or working interest in a given block.

Despite concerns over López Obrador’s statist energy rhetoric, private sector oil and gas activity in the country is nonetheless poised to ramp up as a result of the current regime’s 2013 liberalization of the sector.

And while the president-elect’s top energy advisers have been critical of the business-friendly reform, they have nonetheless made clear that they will take advantage of its provisions, namely the ability of Pemex to form joint ventures with private sector partners.

Energy Minister Pedro JoaquÃn Coldwell has said that, depending on the exploration success of the winners, the contracts awarded through the bid rounds so far could result in $160 billion of investment.

López Obrador’s team is currently fulfilling a campaign pledge to review the awarded contracts for irregularities, and the president-elect has warned that he will suspend future CNH bid rounds until the review is complete.

However, drillers that have won contracts through the rounds do not appear concerned.

“We had meetings with people very close to the top of the AMLO administration,” Premier’s Robin Allan said during the UK-based driller’s second-quarter earnings call in August. “These are sophisticated, clever people. They’re well attuned to the concept of international business and the need for international oil companies to participate in their sector.”

Premier holds a 25% equity interest in offshore Block 7, which was the site of the Zama discovery in 2017. Allan, who is the head of exploration for Premier, said “it’s a political change for sure, but business is carrying on uninterrupted and we don’t foresee any interruption.”

The Block 7 consortium expects to begin appraisal drilling at Zama in 4Q2018 and reach a final investment decision by 2021.

Despite the warnings from López Obrador’s camp about the awarded contracts under review, the contracts are “perfectly valid and could only be rescinded for the reasons laid out in the contracts themselves and only if there is a decision by the CNH,” according to a report by news media outlet Milenio, paraphrasing comments made by CNH Commissioner Sergio Pimentel.

Pimentel was quoted as saying, “there is no official, formal signal” that the next scheduled rounds “will be suspended.”

The next two tenders for onshore acreage, as well as a tender for farm-out stakes in Pemex-operated licenses, are slated for February.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |