Volatile Day for October Natural Gas as Market Fixated on Florence, Storage Data

October natural gas appeared ready to stage a third day of solid gains as the prompt month rose 4 cents Wednesday morning but then retreated throughout the remainder of the session as traders began to consider the potentially devastating effect Hurricane Florence could have on natural gas demand in the coming weeks. The Nymex October futures contract ultimately settled at $2.829, up just one-tenth of a cent on the day. November and December slipped less than a penny to $2.82 and $2.91.

Spot gas prices, however, were mixed despite mostly warm to hot conditions across the country. The NGI National Spot Gas Avg. rose a penny to $2.63.

Meanwhile, all eyes were on Hurricane Florence, which as of 2 p.m. ET, had been downgraded to a Category 3 storm as maximum sustained winds decreased to near 125 mph. Florence was moving toward the northwest near 16 mph and this general motion, accompanied by a gradual decrease in forward speed, was expected through Saturday.

On the forecast track, the center of Florence was expected to move over the southwestern Atlantic Ocean between Bermuda and the Bahamas Wednesday, and then approach the coast of North Carolina or South Carolina in the hurricane warning area on Thursday and Friday and move slowly near the coastline through Saturday.

“Demand wise, Florence will play out primarily bearish from rain, cooling and power outages,” NatGasWeather said.

EBW Analytics agreed that Florence will likely bring a major loss of demand due to widespread, extended power outages, but said that some hedge funds believe that the massive nuclear fleet in the Carolinas could be shut down due to flooding, “causing power sector gas demand to soar after transmission service is restored.”

Duke Energy owns six nuclear generation facilities in the Carolinas that together produce nearly 11,000 MW of electricity. While the nuclear facilities are designed to withstand significant winds and rain, the company will shut down each plant on a case-by-case basis before sustained inland winds are greater than 73 mph, spokeswoman Mary Katherine Green told NGI.

In the event of a shutdown, Duke will decide when to restart the facilities following the storm based on the damage sustained to area transmission lines. “We can’t put power out on the grid if there’s no one to send it to.”

Energy Ventures Analysis Inc. senior analyst June Yu said only Florida Power & Light Co.’s Turkey Point nuclear facility shut down ahead of 2017’s Hurricane Irma, which hit the Florida Keys as a Category 4 storm. The two-unit, 1,600-MW plant remained shut for five days.

Irma sent power demand in the Southeast down by around 2.5 Bcf/d from peak to trough (mostly in Florida), and total demand destruction in the power sector from Irma was about 10 Bcf over a seven-day period, according to Genscape Inc.

“At this point, we would expect demand destruction from Florence to be a bit less than that of Irma, as Florida has a larger population and a more gas-intensive power stack than the Carolinas,” Genscape natural gas analyst Eric Fell said.

Meanwhile, Dominion Energy activated its Severe Weather Plan as it pledged to keep staffing adequate and the Cove Point liquefied natural gas (LNG) facility safe as it continues to track Florence. Dominion said it would provide additional updates as the forecast takes shape over the next few days, and more information is known.

The company’s Carolina Gas Transmission unit, meanwhile, issued a notice on Wednesday encouraging shippers to schedule the volumes of gas they expect to consume each day during this time. It urged customers to reduce delivery point nominations to zero if they planned to shut down operations.

Elsewhere, there was also a weak tropical system steering into the western Gulf of Mexico with a track towards the Texas/Mexico border, according to NatGasWeather, “but again, primary impact would be bearish impacts unless it were to strengthen and then stall with heavy rains and flooding.”

Regarding the pattern for the rest of the United States, slight hotter trends have held for next week in a mostly warmer-than-normal pattern, but still with a weak cool shot late in the week across the far northern United States. “After Sept. 20 continues to look quite comfortable for most regions, just a bit warm over the southern U.S. with highs of 80s to lower 90s, and where a majority of the nation’s temperature-driven demand will occur,” NatGasWeather said.

The northern United States, meanwhile, is expected to see a mix of weak heating and cooling needs while waiting on more impressive cold blasts to arrive out of Canada.

“We must expect daily changes in the forecast models as they struggle to resolve where numerous tropical systems over the Gulf of Mexico and Atlantic will track in the coming weeks. This should lead to wildly different solutions between all models and ensembles, but overall should be mostly comfortable to a touch warmer than normal across most regions the next two weeks apart from portions of the far northern U.S.,” the forecaster said.

Hefty Storage Deficits to Remain One More Week

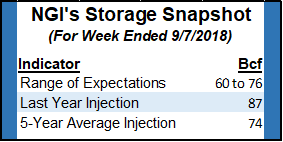

With uncertainties looming on Florence’s potential impacts, traders set their sights on Thursday’s Energy Information Administration (EIA) storage inventory report. A Bloomberg survey had a range of 59-76 Bcf, with a median of 65 Bcf. A Reuters survey of estimates ranged from 60-76 Bcf with a median of 68 Bcf. Bespoke Weather Services projected a 68 Bcf build, Kyle Cooper of IAF Advisors expected a 64 Bcf build, and EBW Analytics forecast a 69 Bcf build. Intercontinental Exchange settled at a 65 Bcf injection.

Last year, 87 Bcf was injected into Lower 48 gas stocks, while the five-year average stands at 74 Bcf. As of Aug. 31, inventories stood at 2,568 Bcf, 20% below last year and about 19% below the five-year average, according to the Energy Information Administration.

Thursday’s EIA report will be the first to publish estimates based on a new sample selected for the Weekly Natural Gas Storage Report (WNGSR). On Sept. 10, EIA planned to revise estimates for the eight weeks covering July 13-Aug. 31 to gradually phase in the estimates from the new sample.

Although the established sampling and estimation methodologies for the WNGSR have not changed, estimates produced from the sample are to reflect the most recent version of the EIA-912 form, which requires storage operators in the South Central region to separately report the volume of working natural gas held in salt facilities and nonsalt facilities, EIA said.

With most estimates pointing to an injection that is under the five-year average, deficits are expected to be near or greater than 590 Bcf for one more week, NatGasWeather said. Deficits are likely to finally begin easing after the EIA’s Sept. 20 report, in which a larger than five-year average build is expected.

Meanwhile, as the tropics are expected to begin settling down by mid- to late September, the market will enter the throes of the shoulder season with seasonally low demand and liquefied natural gas (LNG) outages, according to EBW. Power sector demand is expected to fall 5.0 Bcf/d during the next four weeks, while a planned outage at Dominion’s Cove Point may slash LNG exports by 0.7 Bcf/d for as long as a month, the firm said.

A notice on the Cove Point website, however, showed the two planned outages for September were for a total of three days.

As the market increasingly looks ahead to fall weather, “warm anomalies and a slow start to the heating season remain the most likely scenario. Currently, the October forecast favors a warm start to the heating season, limiting any early-season space heating demand,” EBW CEO Andy Weissman said. Together, October and November are currently forecast at 38 heating degree days below normal, potentially reducing demand by as much as 50 Bcf.

Spot Gas Mixed Despite Heat

Spot gas prices were mixed Wednesday as weather systems were expected to stall in the South, while the Northwest was expected to see a cool front move into the region. In the Southwest, heat prevailed, while warm high pressure was also expected to strengthen over the northern half of the country to close out the week, with daytime temperatures in the 80s becoming widespread outside of the Northwest, according to NatGasWeather.

Western spot gas markets were a sea of red, with Southern California markets posting the largest day/day declines. SoCal Citygate plunged 24 cents to $3.55, while Malin slipped just 3 cents to $2.34. At the Cheyenne Hub in the Rockies, spot gas fell a nickel to $2.24, and CIG dropped 9 cents to $2.17.

Kingsgate, meanwhile, moved against the pack as next-day gas jumped 47 cents to $1.53 as Gas Transmission Northwest (GTN) lifted the force majeure that had been in place since Sept. 6 related to the repairs at the Eastport Compressor Station 3. The operationally available capacity for the flow past Kingsgate has been increased to 2,390 MMcf/d, GTN said in a website posting.

Northeast points also softened despite the incoming heat in the region. Algonquin Citygate dropped a dime to $2.75, while Transco Zone 6 NY shed a nickel to reach $2.91. In Appalachia, Dominion South slid 7 cents to $2.23, and Texas Eastern M-3 Delivery dropped 9 cents to $2.28.

For those markets that ended Wednesday in the black, gains were limited to less than a nickel at most pricing hubs. Some exceptions were in the Midwest, where Chicago Citygate climbed 7 cents to $2.72, and NGPL-Amarillo Mainline rose 9 cents to $2.54.

As for pipeline maintenance, a force majeure that took effect Tuesday on Columbia Gulf Transmission (CGT) in southern Louisiana is cutting roughly 50 MMcf/d, according to Genscape. Immediate repairs on CGT’s East Lateral/Line 100 required an operating capacity drop at two points: to 97 MMcf/d at the Houma-SEG throughput meter and to zero at the Crosstex-Gibson intrastate interconnect with Crosstex LIG.

The throughput meter’s nominations have needed to decrease by roughly 10 MMcf/d as a result; the LIG interconnect had averaged 38 MMcf/d in the past two weeks before dropping to zero, Genscape natural gas analyst Joe Bernardi said. The end date for the work remains to be determined.

As the last phase of the LEX pigging maintenance that began on Sept. 5, Columbia Gas Transmission will restrict capacity through LXPSEG MA41 to 450 MMcf/d on Sept. 13. Westbound flow through LXPSEG has a 30-day average of 1.34 Bcf/d, representing an anticipated decrease of around 900 MMcf/d, Genscape natural gas analyst Vanessa Witte said. Nominations through LXPSEG comparably decreased to 670 MMcf/d, a 560 MMcf/d day/day drop, on Sept. 5 when the maintenance began, she said. Southbound flow through Crawford South and onto CGT showed a related decrease.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |