Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Plethora of U.S. Chemical Investments Linked to Shale, Tight Natural Gas Reserves

The overflowing basket of investments since 2010 by the U.S. chemical and plastics industry now surpasses $200 billion, nearly all of it tied to plentiful natural gas and natural gas liquids (NGL) supply, the American Chemistry Council (ACC) said Tuesday.

In the past eight years, 333 projects, including new or expanded facilities, have been launched that are cumulatively valued at $202.4 billion. More than half (53%) are completed or under construction and 41% are in the planning phase. More than two-thirds (68%) is foreign-direct investment or includes a foreign partner, ACC said.

The industry council linked the growth in projects to onshore gas supply.

“This is an exciting milestone for American chemistry and further evidence that shale gas is a powerful engine of manufacturing growth,” said CEO Cal Dooley. “The U.S. remains the most attractive place in the world to invest in chemical manufacturing,” which in turn creates more jobs.

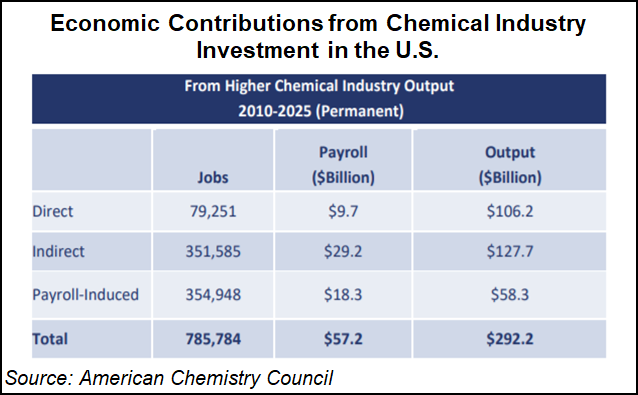

The analysis indicated that $202.4 billion in capital spending could lead to $292 billion a year in new chemical and plastics industry output, which in turn would support up to 786,000 jobs by 2025.

Investments of that magnitude could lead to 79,000 chemical industry jobs, 352,000 jobs in supplier industries and 355,000 jobs in U.S. communities.

Robust supplies of NGLs, particularly ethane, are considered key to the domestic chemical industry resurgence. NGLs are the main feedstock for basic U.S. petrochemicals and plastics, while companies overseas mostly use naphtha, which is oil-based. Since feedstock comprises about 75% of the cost of ethylene production, lower prices favor U.S. chemical makers in global markets.

There was a note of caution, however.

Because U.S. manufacturers often rely on inputs that are not domestically available or manufactured, the ACC said “protectionist trade policies such as tariffs and quotas unnecessarily raise the costs of those inputs, deter innovation and economic growth, and could ultimately weaken our country’s competitive advantage.”

The Trump administration in March imposed a 25% tariff on steel imports and a 10% tax on aluminum imports, which the oil and gas industry, as well as its allies, has opposed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |