Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

North Dakota Geologists Dig Into Mysteries of Fracking Sand

Acknowledging that it is somewhat of a long shot, North Dakota energy and geologic officials are re-evaluating whether sands in the state could be used in hydraulic fracturing (fracking), which has fueled the oil and natural gas boom in the Bakken Shale.

As oil and gas operators continue to advance various drilling efficiencies, the role of fracking keeps evolving, including the use of ever-greater volumes of sand in the proppant for the process — now about 5,000 tons per frack job. In turn, operators are looking for new and more local sources of sand.

“It has been estimated that demand for proppants will be in the millions of tons and potentially billions of dollars in order to fully develop all of the Bakken/Three Forks reservoirs,” state officials concluded.

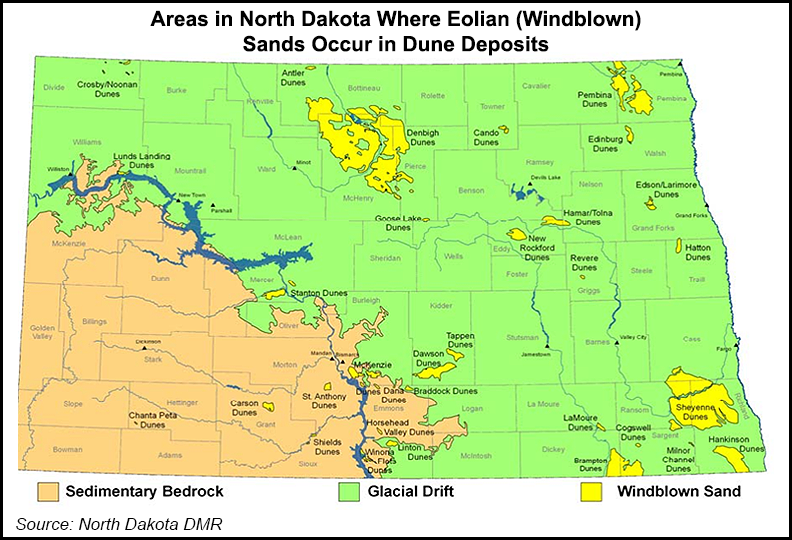

In North Dakota, the state Geological Survey is studying various potential sources in the state for “Eolian” (i.e. windblown) sand. Fred Anderson, a state geologist, has been re-evaluating studies conducted in 2011 that concluded if local sand were used “it would likely require several mechanical processing and chemical refinement steps.”

After completing some of the current re-evaluation work in response to requests from North Dakota Petroleum Council (NDPC) members, Anderson told NGI‘s Shale Daily that it is “likely that the equation to make this work in North Dakota will include the need for an adequate sized sand deposit that is close to the heart of the Bakken activity.”

Anderson said local sand would have to be “processed to produce viable quantities of quartz and sand proppant…significant process and material refinement are likely to be needed in order to make [North Dakota’s] deposits work.” The 2011 studies confirmed that quartz percentages in the North Dakota sand supplies range from 45-68% — not high enough for good proppant.

NDPC President Ron Ness told local news media that the council’s operators are serious about finding an in-state source of sand to save on transportation costs. Current supplies from Illinois, Minnesota and Wisconsin have the spherical and close-to-pure quartz supplies the industry needs. But as the demand for sand continues to grow, the industry has indicated willingness to accept lesser quality supplies than they would have a decade earlier.

Part of the state geologists’ analysis has been to study gradations of samples from 20 selected sand areas in western, north-central and eastern North Dakota. The samples have been 91% sand, with the remainder silt (5%) and clay (4%), Anderson noted in his latest report for the Department of Mineral Resources (DMR).

If a viable sand source were identified in the state, DMR would regulate the mining operations under its subsurface minerals program, according to state geologist Edward Murphy.

Samples have been tested against three recommended standards for proppant sand — International Organization for Standards, American National Standards Institute, and the American Petroleum Institute (API). The standards look at grain size distribution determinations, crush resistance, HCL-HF acid solubility, density and apparent (specific gravity) densities.

In 2014, the South Dakota Department of Environment and Natural Resources said a study completed by the University of South Dakota found the state’s grains did not meet API specifications for proppant sand. South Dakota officials had been hoping to cash in on the oil and natural gas boom in the Williston Basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |